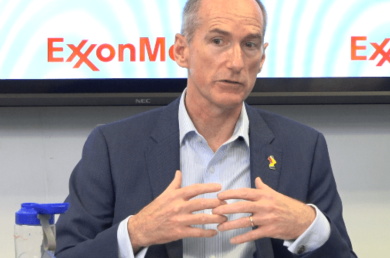

Securities and Exchange Commission (SEC) Paul Atkins said Tuesday that the Trump administration’s plan to open 401(k) retirement accounts to private market investments would give ordinary Americans safe access to opportunities that are currently restricted.

Atkins said that the SEC will work with the Labor Department to broaden access to investments in private funds for ordinary investors who currently wouldn’t meet regulatory thresholds that would provide them access.

“Individual investors need to be diversified and the private markets have developed so much because there’s a lot of capital available in the private markets,” Atkins said Tuesday on FOX Business Network’s “Mornings with Maria.”

“And frankly, it’s uncool to be a public company, or it has become so, and I want to make IPOs great again,” Atkins said. “Thirty or so years ago, when I was a young lawyer starting out in New York, companies like Apple and Microsoft – they had to go public to get capital to build their companies and new products.”

TRUMP SIGNS ORDER TO OPEN 401(K)S TO PRIVATE MARKETS: WHAT IT MEANS FOR YOUR RETIREMENT

“Today it’s [the] opposite. Companies can stay private longer, and there being so many issues in the public markets between litigation and the short-termism that we were talking about before, the weight of the regulatory apparatus on reporting and that sort of thing, compliance,” Atkins said.

“Then finally, the weaponization of corporate governance, so those issues have really decreased the attractiveness of being a public company,” he said. “We aim to make that better again.”

Currently, investments in private companies are limited to people who satisfy the “accredited investor” threshold. The rule aims to protect unsophisticated investors from financial risks associated with investments in private companies, which can be illiquid and aren’t subject to public financial reporting requirements.

SENATE CONFIRMS TRUMP’S SEC CHAIR PICK PAUL ATKINS

The rule stipulates that qualified accredited investors must have a net worth over $1 million excluding their primary residence, or income over $200,000 individually (or $300,000 as a couple) in each of the past two years, with the reasonable expectation of the same in the current year.

It also includes professional criteria to satisfy the rule, including investment professionals with Series 7, Series 65, or Series 82 licenses, executives of the company selling the security, or family clients of family offices and knowledgeable employees of a private fund they want to invest in.

Atkins explained that private market investments can help investors diversify their portfolios as public markets become more concentrated, noting the rise of the so-called “Magnificent Seven” stocks that have driven much of the market’s gains in recent years.

LABOR SECRETARY UNVEILS UNPRECEDENTED PLAN TO SLASH 63 ‘OUTDATED AND BURDENSOME’ RULES

“We only have half the number of public companies as we had 30 years ago, and if you look at the S&P 500 it’s rather top-heavy with respect to the ‘Magnificent Seven,'” Atkins said. “What industry are they in? IT basically, technology, and we saw what has happened in the past when the market gets too concentrated.”

The SEC chairman noted that work remains to be done in putting up regulatory guardrails for opening private market investments to retail investors before they will be available as options in their retirement plans or other investment accounts.

“The key word here is diversification, and so we have to put in guardrails for retail investors to have exposure to these sorts of investments because they can be illiquid, the valuations can be off,” Atkins said. “There are a whole host of things – where the retail investor fits in the capital stack of the company, and then finally what the liquidity is of the investment.”

GET FOX BUSINESS ON THE GO BY CLICKING HERE

“We have to put guardrails around them, have ‘most favored nation status’ for those sorts of investments. Their advisors will obviously have fiduciary duty and that sort of thing. So we’ll put the protections in to make sure that we guard against bad outcomes to the extent that we can,” Atkins said.