Copyright indiatimes

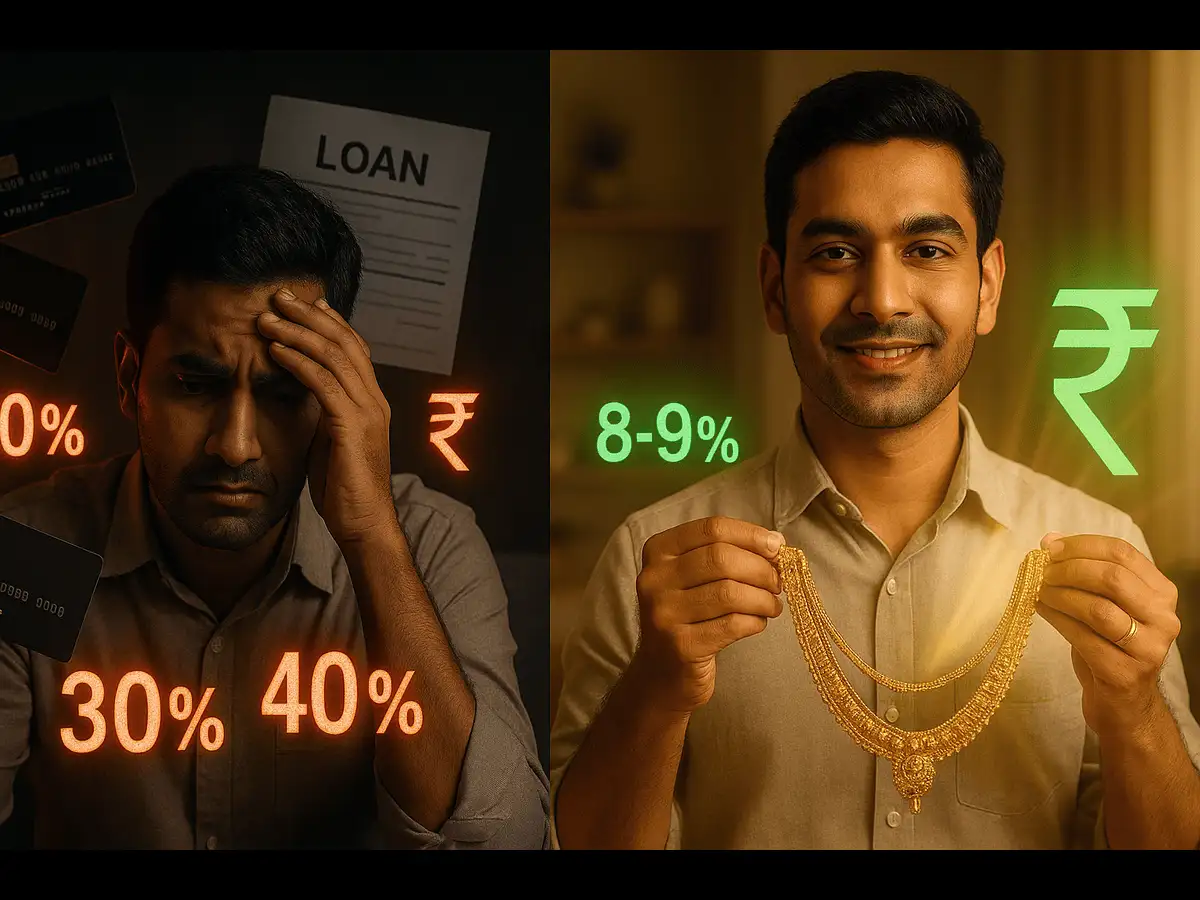

Emergencies, in all shapes and sizes, can bring even the most financially savvy among us to our knees. We often find ourselves running to relatives, friends, acquaintances or financial institutions to secure funds. Income Tax GuideIncome Tax Slabs FY 2025-26Income Tax Calculator 2025New Income Tax Bill 2025These days, it is easier to get a personal loan, but it often comes with high interest rates and unfavourable terms, especially if sourced from unregulated lenders. Even when you go through regulated financial entities like banks and NBFCs, the process can be lengthy, involving credit and background checks.Not knowing about other options, borrowers often feel pressured and end up taking these personal loans or using their credit cards. However, if you are considering these expensive alternatives despite having idle gold, then it’s time to rethink your strategy. This is where a gold loan comes into play, bridging the gap by providing funds for emergencies without putting the borrower in a tough spot financially. It allows you to activate an asset that's typically sitting idle. Lenders accept gold jewellery with purity ranging from 18 to 24 karats, and even bank-minted coins are eligible.By pledging your gold, the loan becomes secured which means it costs much less than unsecured credit options like personal loan and credit cards. Plus, the significant rise in gold prices in last few years has also boosted the borrowing potential with the same amount of gold.While personal loans and credit cards dominate often steal the spotlight in financial discussions, gold loans are steadily emerging as India's go-to emergency credit option. With quick disbursal, lenient terms, relatively low interest rates and innovative schemes, gold loans are becoming a top choice for borrowers. Save big on interest outgo through gold loanGold loans have seen explosive growth, with outstanding loans surging 122% year-on-year to Rs 2.94 lakh crore by September 2025.Gold loan rates in India typically range between 8.75% and 22% per annum, with major banks like Punjab National Bank offering rates as low as 8.35%. In comparison, personal loans charge 10-25% interest and credit cards can hit you with a crushing 36-40% annual interest on unpaid balances. Depending on your credit profile, there’s a good chance that you will get a much cheaper gold loan option than what lenders are offering for personal loans.Let’s do the math using the typical interest rate ranges found in the market for a Rs 3,00,000 loan over a 12-month period. We are assuming simplified interest calculations for comparison, though actual costs will vary depending on the repayment structure (EMI vs. lump sum interest payments). Here’s what you could be saving:Compared to personal loan: Opting for a gold loan at 9.5% instead of a personal loan at 14% means the borrower saves around Rs 13,500 in interest over 12 months (Rs 42,000 – Rs 28,500).Compared to credit card debt: By choosing a gold loan instead of funding the Rs 3 lakh through a credit card balance at 30%, the borrower saves approximately Rs 61,500 in interest over 12 months (Rs 90,000 – Rs 28,500)."The fundamental takeaway is that because gold loans are secured, they are significantly cheaper. The difference in monthly payments and overall debt burden is dramatic, especially when comparing it to high-interest revolving credit card debt,” says Kshitiz Jain, Senior Vice President, Shriram Finance.When and who should take a gold loan?1. You need money urgentlyWhen an emergency hits, the last thing you want is to be stuck waiting for background checks, assessments or approvals. Gold loans are processed in hours, sometimes minutes. Once you hand over your gold jewellery for valuation, you can walk out with cash or get money credited to your account in moments or within 24-48 hours.Personal loans, even "instant" ones, typically take 2-7 days. If you are looking for a credit card limit increase, you might be waiting even longer.2. Your credit score isn't perfectLoans are sanctioned depending on the borrower's creditworthiness and their ability to repay the loan. However, with gold loans, you don’t need a credit history because the gold itself serves as collateral. Even new borrowers, young professionals, homemakers with no credit history, or someone recovering from past financial difficulties, can secure gold loans.“Because the lender holds a physical asset (the gold), their risk is much lower compared to unsecured options like personal loans or credit cards. This reduction in risk translates directly into a lower borrowing cost for you.” Says Kshitiz Jain, Senior Vice President, Shriram Finance.3. You're borrowing for a short periodGold loans are ideal if you need funds to plug in short-term liquidity needs. Wedding season expenses, minor home renovations, or rushed business working capital needs are some common situations where a gold loan can be a convenient lifeline.Short-term gold loans range anywhere from 3 to 36 months while long-term gold loan tenures go only as far as 5 years.4. You want to avoid excessive documentationThe process of availing a gold loan is quick and accessible. There is no need for the usual KYC documentation of submitting ITR, bank statements, business registration proof, list of assets etc. Gold loans do not need too many documents to be submitted; usually just identity proof and ownership proof of the gold are enough.However, the easy access and low rates shouldn’t be considered as a no-strings-attached cash flow. Usually transparent, gold loans also come with several other caveats that can inflate the total cost. These include:•Processing & valuation fees: Lenders often charge setup fees (up to 5% of your loan) plus appraisal costs to verify your gold's value. To avoid surprises, always request a detailed breakdown of all charges before signing up.•Late payment charges: Missing a payment deadline comes with penalty charges that can significantly bump up your total costs, potentially making the loan much more expensive than anticipated.•Early repayment fees: Check if there's a foreclosure charge first, some lenders let you prepay without any charges, and others don’t. This is especially important if you need the funds temporarily and want the flexibility to repay quickly without penalties.•Loan-to-Value ratio: This determines the amount of cash you'll get for your gold. “It is capped at 75% by RBI for loans above Rs 5 lakh but new customers are offered no more than 60-65% by lenders. A higher LTV means more cash in hand to the borrower for the same amount of gold pledged by her., says Abhijit Talukdar, Founder, Attainix Consulting.•Fixed vs. floating rates: Understanding your interest rate type is crucial. Fixed rates stay the same while floating rates can change with the market, meaning lower costs now but with the potential of going up later.Current gold loan rates at top banks Bank Name Interest Rate Loan Amount State Bank of India 8.75% p.a. onwards Rs 20,000 - Rs 50 lakh Bank of Maharashtra 8.75% p.a. onwards Rs 20,000 - Rs 1 crore Canara Bank 8.90% (RLLR (8.25%) + 0.65%) 6 months from the date of sanction Bank of Baroda 9.00% p.a. onwards Up to Rs 50 lakh HDFC Bank 9.30% p.a. - 17.86% p.a. Rs 25,000 onwards Kotak Mahindra 10.56% p.a. onwards Rs 20,000 - Rs 1.5 crore IndusInd Bank 10.50% p.a. - 15.50% p.a. Up to Rs 20 lakh Axis Bank Up to 17% p.a. onwards Rs 25,001 - Rs 4 lakh Punjab National Bank Contact the Bank Rs 25,000 - Rs 25 lakh Source: Bank Bazaar (updated as of 03 Oct 2025)Gold loans are emerging as one of India's smartest financial hacks for handling emergencies without breaking the bank. It’s important to be mindful of extra fees and grasp the terms, but the numbers speak for themselves: opting for a gold loan instead of high-interest alternatives can save you tens of thousands of rupees. In a world where financial emergencies strike without warning, your gold jewellery could be your best safety net, not because of its sentimental value, but due to its ability to help you stay financially secure when you need it the most.