Copyright ZeroHedge

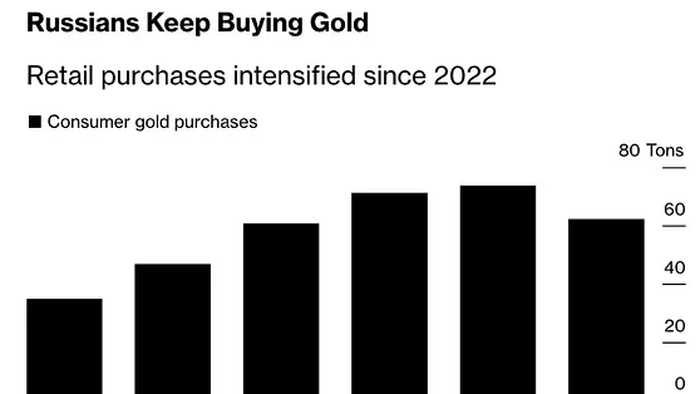

Introduction: The New Domestic Gold Standard Authored by GoldFix Russian citizens are quietly accumulating a vast reserve of gold that now rivals the official holdings of mid-sized European nations. The move represents a structural shift in the country’s household savings behavior following years of sanctions, currency restrictions, and loss of access to traditional financial instruments. In a story by Bloomberg, retail gold purchases in Russia are projected to reach 62.2 tons in 2025, bringing total household accumulation since 2022 to 282 tons. The study, published by Al Banyan Tree Research, highlights how Russian savers have increasingly turned to gold bars, coins, and jewelry as alternatives to foreign currencies. “Gold has emerged as their preferred safe haven.” A Sanctions-Driven Shift in Household Portfolios According to Moscow-based BCS Global Markets analyst Dmitry Kazakov, the behavioral change is rooted in sanctions-related restrictions that have made access to foreign currencies inconvenient and risky. “Individuals have historically preferred to invest in real estate and foreign currency, but after the sanctions-related restrictions, currency became a less convenient way to preserve savings, and since 2022, demand for gold has increased.” Lenders in Russia have since phased out deposits in euros and dollars, while cross-border transactions have grown cumbersome. Analysts suggest that some privately held gold assets may have been moved abroad as an informal means of capital transfer, although no reliable data exists to confirm this. Policy Engineering and the Birth of a Domestic Gold Market Russia, the world’s second-largest gold producer, mines more than 300 tons annually. However, since the London Bullion Market Association barred Russian bullion in 2022, the government has sought ways to redirect this production toward domestic buyers. The Kremlin eliminated value-added tax (VAT) on retail gold purchases to boost internal demand, effectively linking consumer savings policy to the health of the mining industry. Without these internal buyers, Russian miners (cut off from Western markets) would have faced severe liquidity constraints. Meanwhile, the Central Bank of Russia has kept its reserves steady at about 75 million troy ounces since 2020, despite a temporary reopening of its gold-buying window in 2022. Rise of AI Analytics in Commodity Tracking Al Banyan Tree Research, the Hong Kong-based quantitative firm behind the estimates, combines econometric models with AI-based analytics to decode patterns in commodity data. The firm’s analysis shows that Russian lenders held about 57.6 tons of gold as of August 2025, reflecting how the metal has permeated the domestic banking system as both collateral and savings. The firm’s modeling also indicates a corresponding decline in exports as domestic demand absorbed more supply. “Gold exports have declined, according to Al Banyan Tree Research.” To further cement autonomy from Western benchmarks, Russia launched physical gold trading on the St. Petersburg Exchange this month. The resulting hoard, equal to Spain’s official gold reserves, underscores how deeply geopolitical fractures have altered the psychology of wealth preservation. For many Russian households, gold is no longer a speculative asset; it has become a financial lifeline.