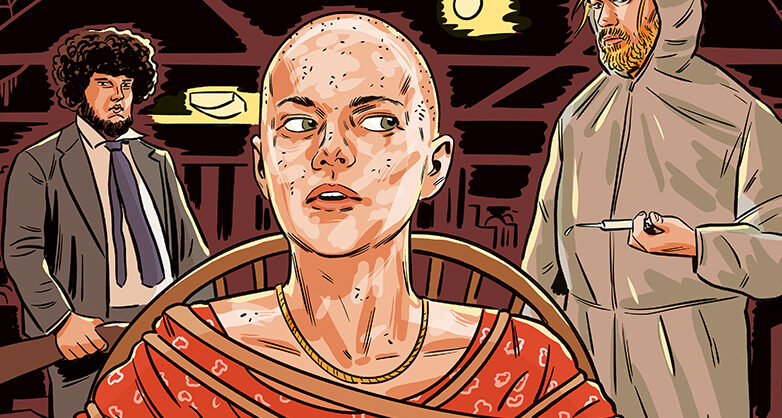

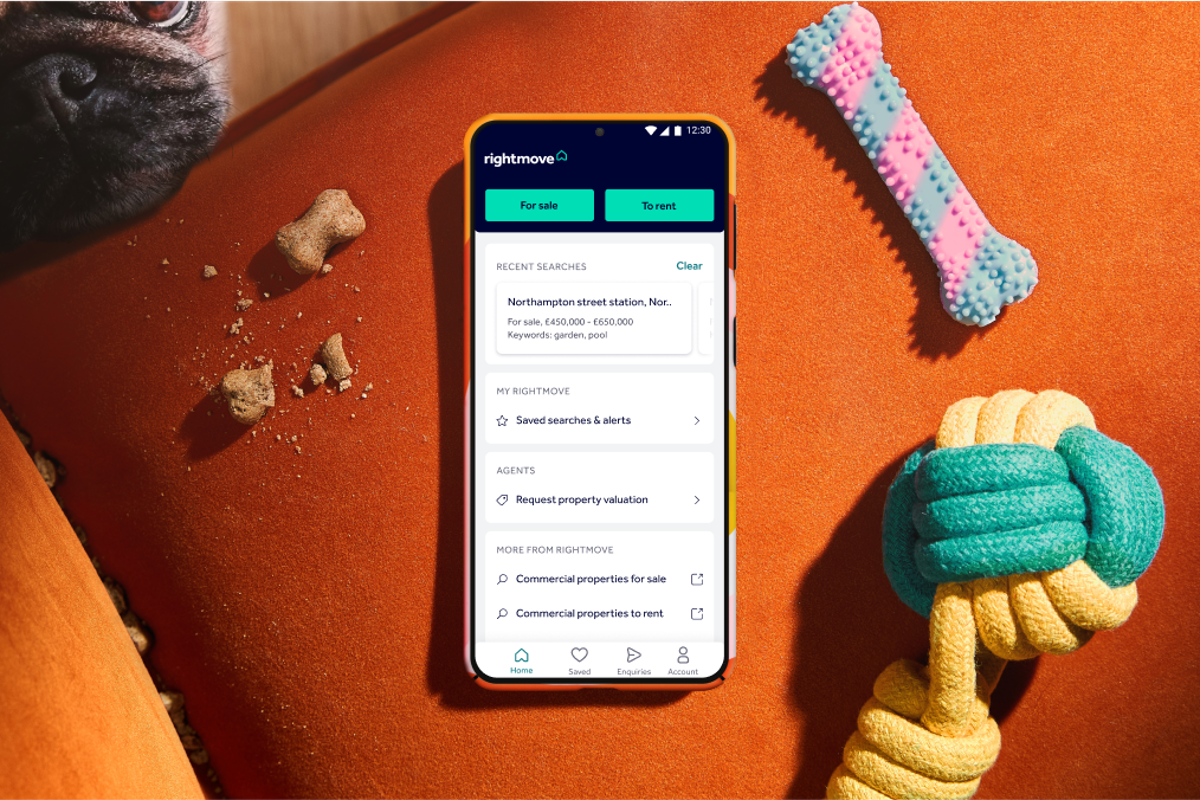

Copyright cityam

Shares in Rightmove nosedived on Friday morning after the property titan revealed a major-shakeup centred on upping AI spending. The group said it would invest £60m over the next three years, with a focus on leaning into new tech. The FTSE 100 firm slashed its short-term profitability targets amid the new plans. Company boss Johan Svanstrom said: “AI is now becoming absolutely central to how we run our business and plan for the future.” The UK’s top property portal has partnered with Google Cloud in a multi-year deal to integrate cutting-edge AI, including Gemini and Vertex AI, into its entire platform. “The market did not like Rightmove’s latest update one bit as it warned of slower profit growth in 2026,” said AJ Bell investment director Russ Mould. “This is a function of a big increase in investment, largely in artificial intelligence. Investing for future growth is not a bad thing but the scale of the market’s negative reaction implies real scepticism about its decision to put so much money into AI.” Still, Rightmove reaffirmed its 2025 targets for stable revenue growth of approximately nine per cent and a 70 per cent operating margin. Markets turn sour on AI It comes amid global jitters towards AI after market titans warned a sharp correction in stock prices. Following the Bank of England’s interest rate decision on Thursday, Andrew Bailey sent an ominous warning on a possible AI bubble, saying the Bank was looking “very carefully” at prices across stock markets. He said that, while AI returns could be productive, it was “possible” that a bubble could burst and stock prices tank. “It is, of course, perfectly possible and perfectly consistent that AI could be the next big mover in terms of productivity. “The market could overprice the returns, but the returns could still be substantial, so we’ll see.” A hedge fund manager famed for predicting the Global Financial Crisis also sent shivers through US tech stocks on Tuesday after revealing he had taken out a billion-dollar bet against some of the world’s largest artificial intelligence companies. Michael Burry, the star stock picker whose decision to short the property market was depicted in the blockbuster ‘Big Short’ film, disclosed a similar $1.1bn (£843m) wager on Palantir and Nvidia shares falling, highlighting parallel between today’s AI boom and the dot com bubble of 2000.