China is exploring plans to convert retiring coal-fired plants into nuclear power stations. The move targets the nation’s vast coal capacity, which is enough to power the entire United States.

Driven by decarbonisation goals and land scarcity, the “Coal to Nuclear” (C2N) strategy aims to use retiring plants’ grid and water access for compact, meltdown-proof reactors. This could offer a faster route to clean energy than building new nuclear sites.

China could be the only country capable of this. Its high-temperature gas-cooled reactors and molten salt thorium reactors generate hotter steam than ordinary reactors. That allows them to power coal-fired turbines efficiently.

Coal-to-nuclear shift

These fourth-generation reactors may also meet safety requirements more easily and gain public acceptance, researchers say. China has over 1.19 terawatts of coal-fired power, with roughly 100 gigawatts set to retire by 2030.

According to SCMP, the C2N initiative, proposed by China Energy Engineering Group Co (CEEC), provides a direct path to decarbonisation while preserving infrastructure, especially in coastal areas. It is drawing attention from policymakers, engineers, and environmental analysts amid China’s dual goals of clean energy and carbon neutrality by 2060.

Globally, coal-fired plants produce about 30% of energy-related carbon dioxide emissions. In China, coal still generates over half of electricity, making it the single largest greenhouse gas source. Nuclear power produces near-zero emissions during operation, with life-cycle emissions comparable to wind energy. China has the world’s largest number of nuclear reactors in use, under construction, or planned.

“Given China’s vast coal-fired power capacity and the long construction timeline for nuclear plants, the C2N transition could span several decades,” wrote the project team led by senior engineer Li Xiaoyu with CEEC’s China Power Engineering Consulting Group.

“During this period, if breakthroughs occur in nuclear fusion technology, the future transformation of coal plants might shift from converting them into fission reactors to repurposing them for fusion power plants,” Li added.

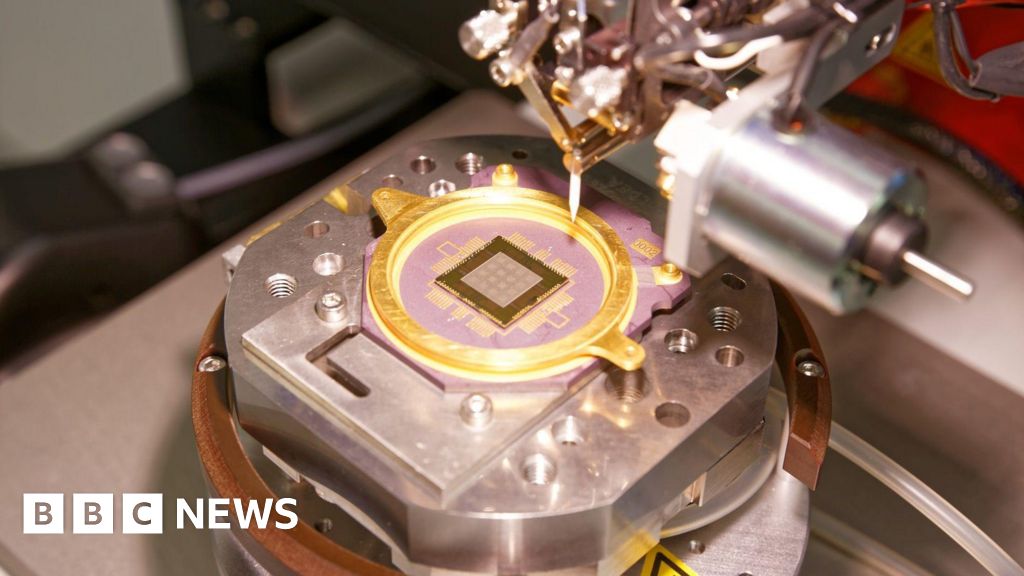

Leveraging advanced reactor designs

The idea is not new. The United States included provisions in the 2022 Chips and Science Act to support converting retiring coal plants to nuclear sites. TerraPower, backed by Bill Gates, plans a sodium-cooled fast reactor at a retired Wyoming coal plant.

China builds seven to eight reactors each year, far faster than the US. With its dense eastern coast, high electricity demand, and scarce land, C2N is both feasible and strategic.

Challenges remain. Traditional nuclear plants need strict safety zones and abundant water, which most inland coal plants lack. High-temperature gas-cooled reactors (HTGRs) require smaller zones, less water, and align with coal plant steam systems.

A 600-megawatt HTGR can fit on a coal site with minimal land expansion. Its safety features, like meltdown resistance without active cooling, reduce the need for emergency planning. China already operates a demonstration HTGR at Shidao Bay.

Molten salt thorium reactors, needing no water, suit inland sites. One experimental reactor runs in the Gobi Desert, with a larger electricity-generating version under construction.

Costs and public perception remain hurdles. “Social factors have become one of the key influences on infrastructure development in China. Public acceptance of nuclear energy and concerns about its safety directly affect decision-making by governments and enterprises,” Li’s team wrote.