Copyright Newsweek

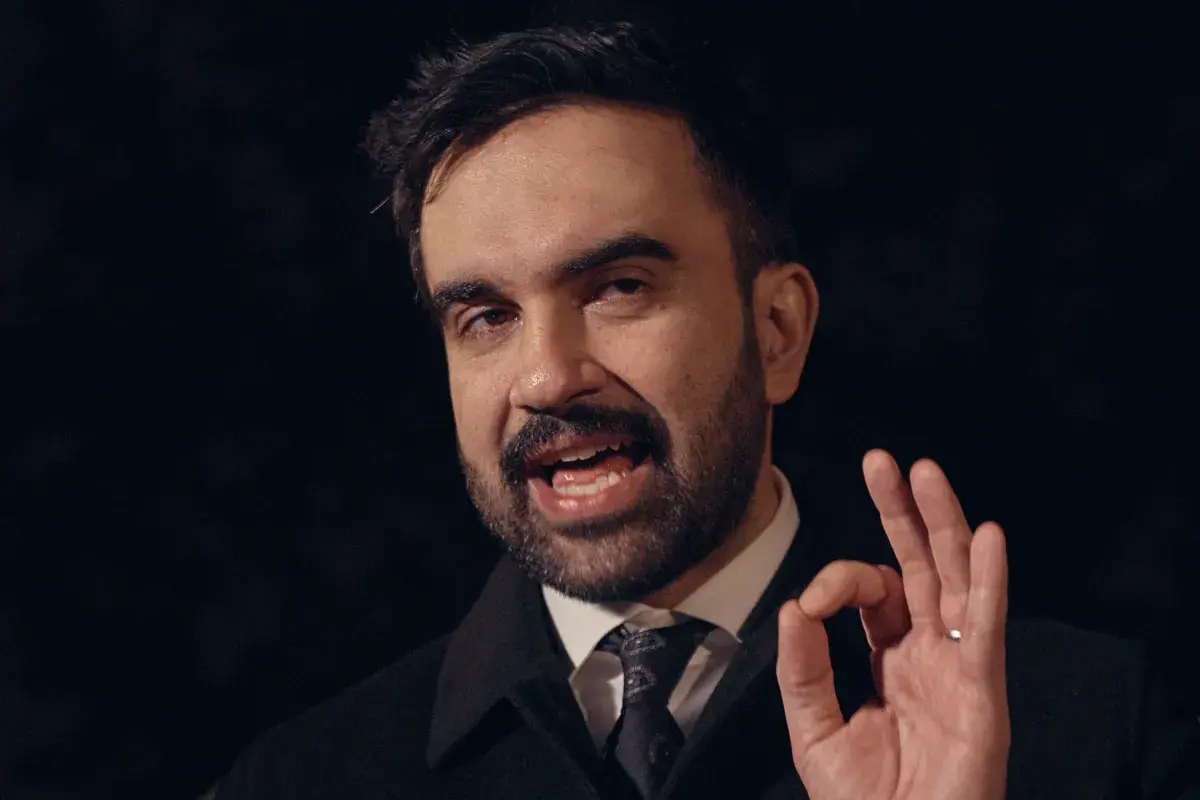

Republicans are stepping up efforts to court New York’s business community following Zohran Mamdani’s victory in the city’s mayoral race. Mamdani, a 34-year-old democratic socialist, defeated President Donald Trump-backed independent Andrew Cuomo in an election defined by record youth turnout and strong support from renters and working-class voters. Newsweek reached out to Mamdani's campaign for comment via email. Why It Matters The GOP’s outreach to New York’s business community signals a strategic attempt to regain influence in one of the country’s most liberal cities and to counter the growing power of the left. Mamdani’s victory underscored how progressive economic policies are resonating with younger and working-class voters, but it also rattled corporate leaders worried about higher taxes and stricter regulations. What To Know Since Mamdani's win, some Republican governors have sought to attract New York-based businesses to their state. New Hampshire Governor Kelly Ayotte said on X: "Live from New York — it’s New Hampshire! We have a message for NYC businesses looking to flee Mayor Mamdani’s higher taxes: Come to the Granite State!" Tennessee Governor Bill Lee said on X: "If you’re a New York business owner who doesn’t like the direction your city is headed, we have a message for you: Tennessee is open for business. Strong economy. Low taxes. Government won’t get in your way. TN is the place for people who value opportunity, security & freedom." Oklahoma Governor Kevin Stitt wrote on X: "Government doesn’t create prosperity, and residents from NYC are about to learn that the hard way. If you want to experience freedom and you want to watch your business grow, get to OK as soon as you can." Mamdani has made higher taxes on the wealthy and corporations a central pillar of his economic agenda. He has argued that New York City’s current tax system favors the rich and well-connected while placing an unfair burden on working-class residents. As part of his campaign platform, Mamdani proposed raising the city’s corporate tax rate to 11.5 percent—matching nearby New Jersey—and increasing income taxes by 2 percent on those earning over $1 million a year. According to his estimates, those changes could generate around $5 billion annually for housing, transit, and affordability programs. However, business leaders and the city’s corporate community have expressed serious concerns about the potential economic impact of these proposals. Some warn of capital flight and weakening New York’s competitiveness if taxes rise on high earners and companies. In interviews and campaign materials, Mamdani has defended his approach by emphasizing the link between affordability and economic vitality. He has argued that making New York City livable for working-age and younger residents is critical to retaining talent and supporting business growth. “We are going to make this city more affordable, so the workers who want to work at those companies can actually be able to do so,” he said in an interview with Business Insider. What Happens Next Mamdani takes office on January 1, 2026.