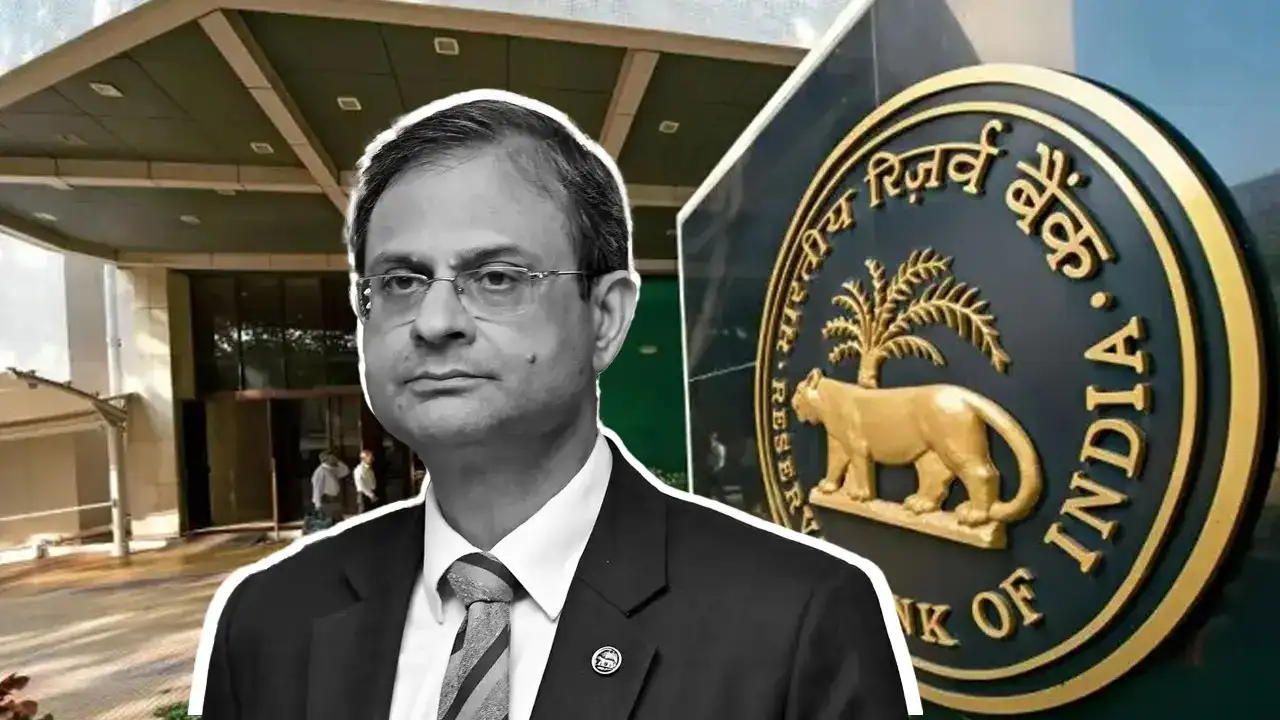

By Samannay Biswas

Copyright timesnownews

The Reserve Bank of India (RBI) on Wednesday unveiled its fourth bi-monthly monetary policy of FY26, taking a series of steps to enhance the flow of credit, strengthen the banking sector, and support economic growth, while keeping interest rates unchanged amid ongoing global uncertainties. Key Announcements 1. Lending Against Shares and IPO Financing In a major move to boost consumer and market credit, RBI announced a fivefold increase in bank lending limits against equities, raising the ceiling from Rs 20 lakh to Rs 1 crore per borrower. In addition, the loan limit for IPO financing has been increased from Rs 10 lakh to Rs 25 lakh per person. Governor Sanjay Malhotra said, “These measures are aimed at improving the accessibility of credit for individuals and businesses, while aligning our regulatory framework with international standards adapted to national conditions.” 2. Loans Against Debt Securities RBI also proposed the removal of the regulatory ceiling on loans against listed debt securities, allowing banks greater flexibility to extend credit to corporates and high-net-worth individuals. These steps are part of a broader five-pronged strategy to enhance credit flow, complemented by 22 additional measures focused on: Strengthening the resilience and competitiveness of banksSimplifying foreign exchange managementEnhancing consumer satisfactionPromoting ease of doing businessSupporting the internationalisation of the Indian rupee Monetary Policy: Repo Rate Unchanged The RBI kept the repo rate steady at 5.50%, maintaining a neutral policy stance for the second consecutive time. The short-term lending facility (STF) rate remains at 5.25%, while the marginal standing facility (MSF) rate and bank rate continue at 5.75%. This decision follows three rate cuts earlier in the year — 25 basis points in February, 25 basis points in April, and 50 basis points in June — which lowered the repo rate from 6.5% to 5.5% to support economic activity. Governor Malhotra emphasized that the RBI will continue to monitor inflation and growth trends closely, retaining the flexibility to act if significant changes occur in the economic environment. GDP and Inflation Outlook The RBI raised India’s GDP growth forecast for FY26 to 6.8%, up from its previous estimate of 6.5%, reflecting optimism about domestic demand, investment activity, and stable monetary conditions. On inflation, the RBI lowered its FY26 retail inflation projection to 2.6%, down from 3.1%, as food prices remain subdued. Core inflation is expected to hover around 4%, while FY27 could see a gradual increase as food price trends normalise. The central bank continues to aim for a Consumer Price Index (CPI)-based retail inflation target of 4%, with a tolerance range of ±2%. Retail inflation has remained below 4% since February, reaching a six-year low of 2.07% in August 2025, providing the RBI flexibility in managing rates without stoking price pressures. Global and Domestic Factors RBI noted that global developments, including US tariffs, H-1B visa fee hikes, and geopolitical uncertainties, could impact India’s exports, job market, and remittances, thereby influencing future monetary policy decisions. Governor Malhotra also highlighted the recent GST rate rationalisation, which is expected to lower inflation and encourage consumer spending, though tariff-related developments may moderate economic expansion in the second half of FY26. Banking Sector and Credit Flow The RBI’s measures to increase lending limits and remove ceilings aim to strengthen the capital adequacy framework for banks and All India Financial Institutions (AIFIs), while improving credit access for: Retail investors seeking loans against equities or IPO subscriptionsBusinesses leveraging debt securities for capital needsThe 22 additional initiatives announced alongside these measures are expected to enhance banking sector efficiency, facilitate internationalisation of the rupee, and improve ease of doing business, contributing to long-term financial stability and economic growth. Market and Economic Implications Analysts suggest that the RBI’s neutral stance combined with higher GDP forecasts is likely to: Provide stability to financial markets, encouraging investmentsIncrease liquidity and borrowing capacity for corporates and retail investorsBoost confidence in consumption and investment trends, particularly in the equities and IPO segments With retail inflation at multi-year lows and growth projections revised upwards, businesses and consumers can plan spending and investment decisions around a predictable interest rate environment. The RBI’s latest monetary policy reflects a delicate balancing act: supporting economic growth, maintaining price stability, and enhancing credit flow, while remaining cautious about global headwinds and domestic fiscal factors. By raising GDP projections, lowering inflation estimates, and increasing credit limits, the central bank has signaled confidence in India’s economic resilience, while providing tools for financial institutions and investors to participate in growth opportunities. As Governor Malhotra noted, the RBI remains ready to act if inflation or growth dynamics shift, ensuring a prudent and proactive approach to maintaining financial stability in an uncertain global environment.