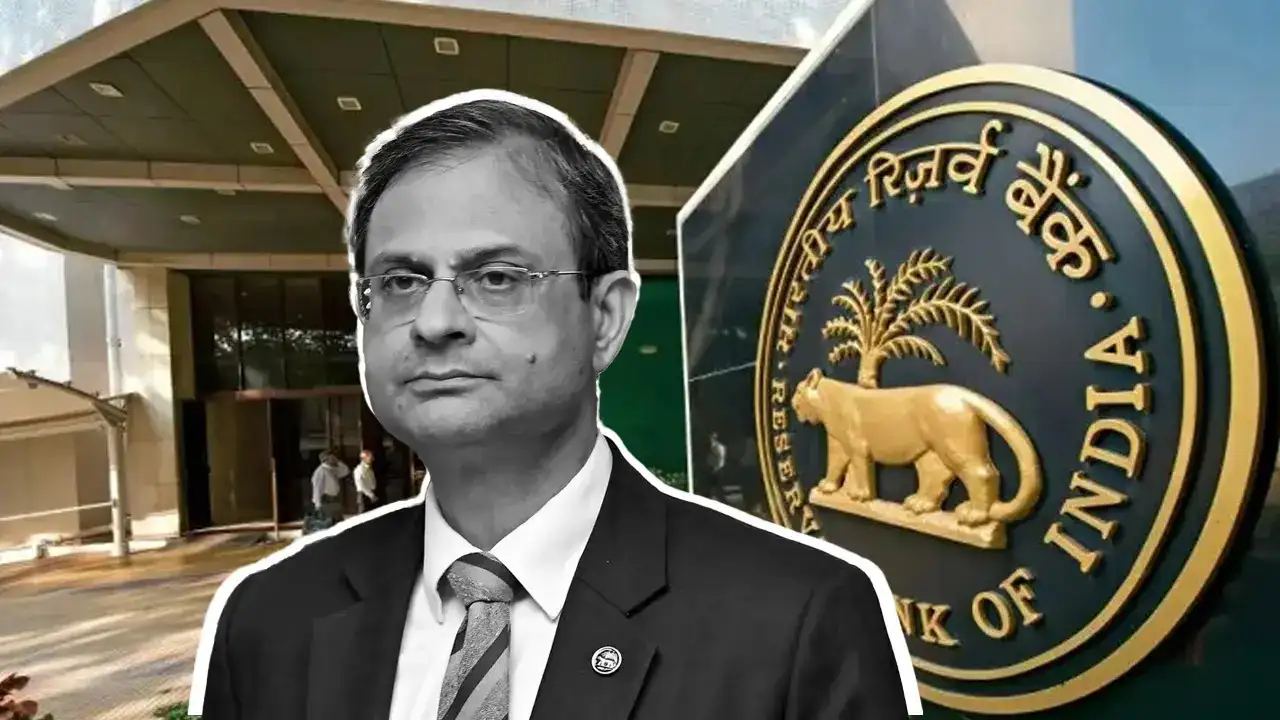

RBI Governor’s MPC Announcement Highlights: What You Need To Know About Repo Rates, Inflation, And Growth

By Priya Raghuvanshi

Copyright timesnownews

The Reserve Bank of India’s Monetary Policy Committee (MPC) began its three-day meeting on Monday and concluded with a unanimous decision to maintain the repo rate at 5.5 per cent on Wednesday. Headed by Governor Sanjay Malhotra, the six-member panel opted for a pause on interest rate changes, continuing its neutral stance in response to both domestic stability and global unpredictability. The central bank’s decision comes against the backdrop of elevated US tariffs, global geopolitical tensions, and commodity price volatility. Sunil Kumar Jain – Chairman, ONE Group, said, “With the RBI keeping the repo rate steady at 5.5 per cent, homebuyers can now look forward to stable home loan costs, a key factor supporting affordability and boosting confidence in property purchases. This stability comes at a time when demand for luxury residential properties is rising not just in metros but also in Tier-2 cities, where high-quality developments are increasingly matching the lifestyle offerings of larger urban centres. For developers, predictable borrowing costs provide the clarity to plan projects that align with evolving buyer expectations. Overall, the steady repo rate reinforces both demand and investment sentiment, further fueling the growth of luxury housing across India’s emerging and established markets.” Key Highlights From The Announcements The repo rate was held at 5.5 per cent, with no adjustments to the Bank Rate (5.75 per cent), Marginal Standing Facility (5.75 per cent), Standing Deposit Facility (5.25 per cent), or Liquidity Adjustment Facility (5.25 per cent). The MPC also noted that the current account deficit has narrowed to 0.2 per cent of GDP, a sign of strengthening macroeconomic fundamentals. Uddhav Poddar, CMD, Bhumika Group, opined, “The RBI’s decision to hold the repo rate at 5.50 per cent reflects a measured and pragmatic approach, keeping the policy stance unchanged and the real estate sector stable. With inflation easing to multi-year lows and monetary transmission showing improvement, the central bank has rightly chosen to evaluate the cumulative impact of past rate cuts. By maintaining a neutral stance, the RBI retains the flexibility to respond to evolving conditions. For businesses like ours in the real estate sector, this stability provides confidence, particularly as we head into the festive quarter, supporting planning and sustained growth.” 22 Policy Measures Rolled Out While refraining from a rate cut, the RBI unveiled 22 policy initiatives aimed at improving the financial ecosystem. These include: Introducing a risk-based deposit insurance premium structure. Proposals for easing lending norms, including higher limits for loans against shares and IPO financing. Making the Expected Credit Loss (ECL) provisioning framework mandatory for most banks from April 2027. Publishing a discussion paper on licensing new Urban Cooperative Banks. Enhancements to the capital adequacy framework under Basel III norms. These reforms target credit flow improvement, banking sector resilience, and regulatory modernisation. GDP Growth Outlook The RBI retained its real GDP growth forecast for FY26 at 6.8 per cent, with quarterly projections as follows: Q1: 7.8 per cent Q2: 7 per cent Q3: 6.4 per cent Q4: 6.2 per cent Malhotra commented, “Growth outlook remains resilient, supported by domestic drivers despite weak demand.” However, he also cautioned that “ongoing tariff and trade policy uncertainties will impact external demand.” Inflation Projections On inflation, the RBI projected CPI inflation at 2.6 per cent for FY26, though it anticipates inflation to rise above 4 per cent by Q4 due to base effects and demand-side pressures. The projected quarterly inflation rates include: Q2: 1.8 per cent Q3: 1.8 per cent Q4: 4 per cent Q1 FY27: 4.5 per cent India’s forex India’s forex reserves reach $700.2 billion, enough to cover 11 months of imports as of September 26, 2025, says RBI Governor.