Copyright Benzinga

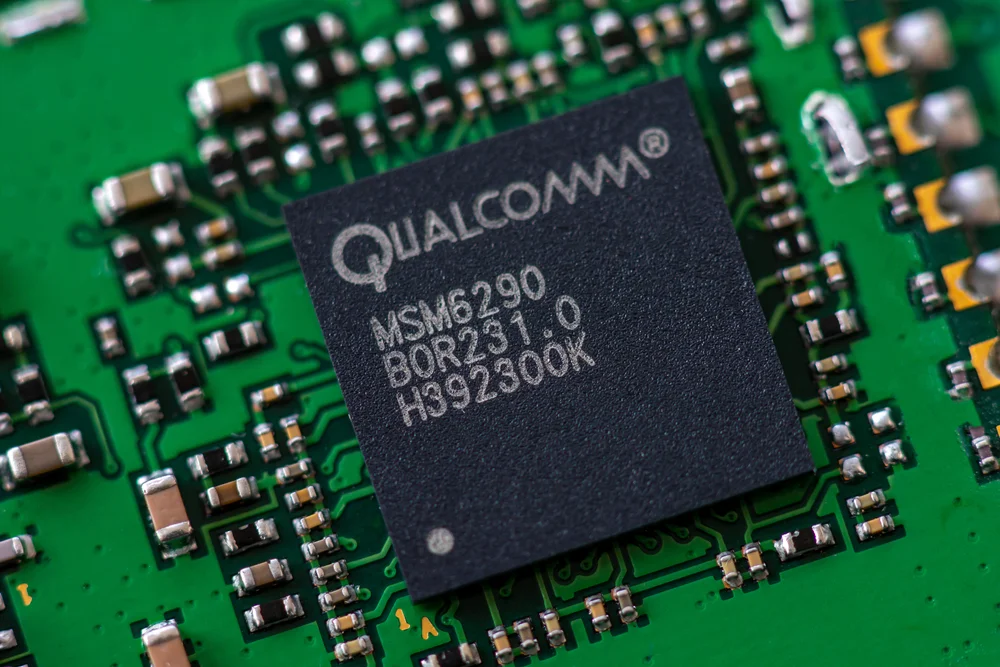

Qualcomm Inc (NASDAQ:QCOM) delivered a strong quarter, driven by double-digit growth across its core chip business signaling continued demand in premium Android devices and emerging artificial intelligence-driven technologies. • QCOM is feeling the pressure from bearish momentum. Get the scoop here. The company's expanding footprint in automotive, IoT and edge AI is fueling a new phase of growth. BofA Securities analyst Tal Liani reiterated Qualcomm with a Buy rating and raised the price target from $200 to $215. Rosenblatt analyst Kevin Cassidy maintained Qualcomm with a Buy rating with a $225 price target. Also Read: Qualcomm Set To Supply 90% Of iPhone 17 Modems, Analyst Says Bank of America Securities: Liani said Qualcomm delivered a strong quarter with revenue up 10% year-over-year, outpacing Wall Street's 5.1% forecast. Growth was led by the Qualcomm CDMA Technology segment, which rose 13.2% versus the Street's 7.7% estimate. Within QCT, the handset, automotive and IoT sales climbed 14.2%, 17.1%, and 7.4%, respectively — all above expectations. The analyst noted that while operating margins of 33.8% came in slightly below forecasts, strong top-line performance drove a 12-cent earnings beat. According to Liani, Qualcomm's stock performance — up roughly 17% year-to-date but still trailing the Nasdaq’s 22% gain—reflects both its near-term strength and medium-term risks. The company benefited from solid handset sales in China, driven by the timing of local holidays and a wave of high-end Android device launches. He noted that while these trends supported short-term revenue growth, they may prove cyclical and temporary, as the smartphone semiconductor segment remains a mature, low-growth industry still accounting for about 71% of QCT's total revenue. Liani highlighted that Qualcomm faces potential headwinds from customer concentration and industry shifts. Chinese vendors represent nearly 68% of handset-related QCT revenue, and there are early signs of self-developed chips from Xiaomi Corp (OTC:XIACY) that could reduce Qualcomm's share. He also expects Samsung Electronics Co, Ltd’s (OTC:SSNLF) contribution to decline from 100% to 75% by the fiscal second quarter of 2026, while the Apple Inc (NASDAQ:AAPL) contract is set to expire within a year. The analyst added that automotive and IoT growth should remain steady, supported by rising demand for digital chassis and smart glasses adoption, while data centers offer a compelling multi-billion-dollar opportunity in the coming years. Still, he warned that handset weakness could reemerge in the second and third quarters of 2026, even as Qualcomm's diversification into autos, IoT and AI-driven data centers supports long-term multiple expansion. Liani projected first-quarter revenue of $12.2 billion and adjusted EPS of $3.45. Rosenblatt: Cassidy said Qualcomm's strategy to diversify revenue while maintaining smartphone leadership continues to outperform expectations. He pointed to strong fourth-quarter results driven by premium Android demand, record automotive revenue, and solid industrial IoT performance. The analyst noted Qualcomm's data center AI inference rack-scale products underscore its growing capabilities and mark a key step toward capturing future AI opportunities, even if near-term revenue impact remains limited. He said Qualcomm is well-positioned to lead in AI at the network edge, an area he called the next major growth phase in the AI era. Cassidy highlighted that QCT revenue rose 13% year-over-year to $9.82 billion, supported by a 14% jump in handset sales, 7% IoT growth and a 17% increase in automotive revenue, which surpassed $1 billion for the first time. For fiscal 2025, revenue grew 13% to $44.1 billion, and adjusted EPS climbed 18% to $12.03, both exceeding forecasts. The analyst added that Qualcomm's automotive business is scaling rapidly, with adoption of the Snapdragon Digital Chassis platform driving a 36% annual increase. He also emphasized Qualcomm's growing edge in AI-enabled devices, such as smart glasses and the Snapdragon X2 Elite laptop platforms, as well as expanding partnerships with Meta Platforms Inc (NASDAQ:META) and Samsung. Looking ahead, Cassidy said Qualcomm's first-quarter 2026 outlook — calling for record handset and QCT revenue — signals continued strength despite seasonal IoT softness. The analyst maintained that Qualcomm's diversification across automotive, IoT and edge AI positions the company for long-term growth as it transitions beyond smartphones into broader AI-driven markets. Cassidy projected first-quarter revenue of $12.2 billion (up from prior forecast of $11.7 billion) and adjusted EPS of $3.45 (up from prior forecast of $3.39). QCOM Price Action: Qualcomm shares were down 4.42% at $171.78 at the time of publication on Thursday. Read Next: Ferrari CEO Confirms Electric Car Plans, Raises Full-Year Outlook Photo: Shutterstock