Copyright keenesentinel

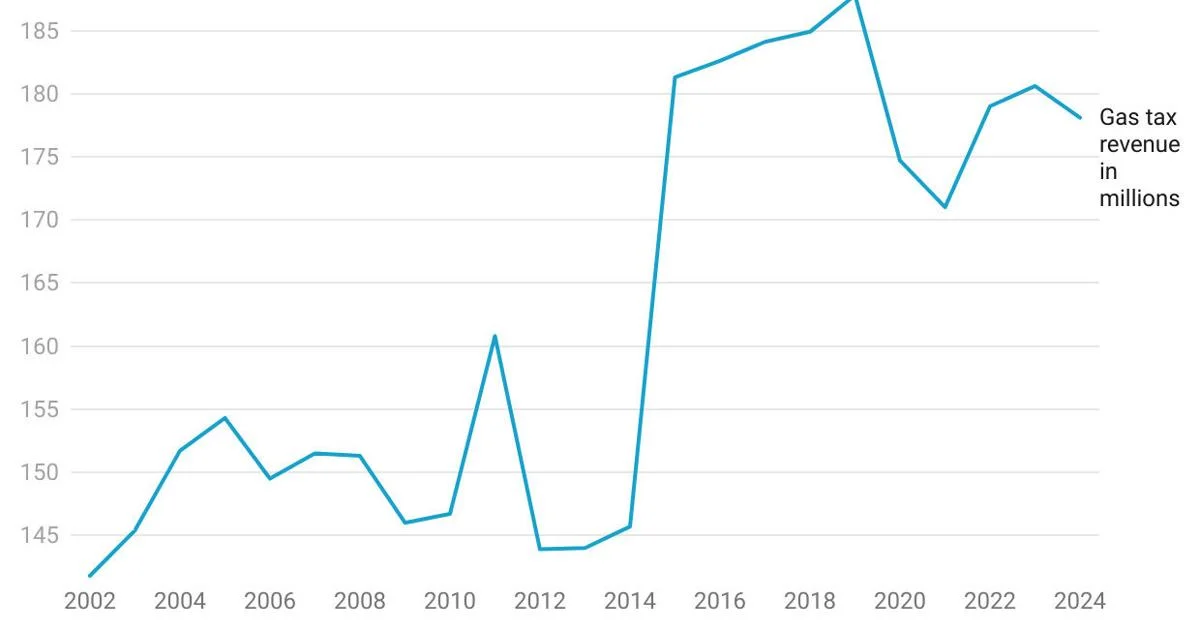

New Hampshire’s gasoline tax of nearly 24 cents per gallon ranks below what most states charge and hasn’t been increased in a decade. Meanwhile, the tax, which pays for increasingly expensive highway repair and construction projects, is taking in less revenue than it once did because vehicles have become more fuel efficient. This has forced the state Department of Transportation to cut about $400 million from its 10-year infrastructure plan. Department officials have been holding a series of meetings across the state on that spending proposal. State figures indicate that the gas tax took in $184.9 million in 2018, compared to $178.1 million last year. The nonprofit Tax Foundation says on its website that New Hampshire ranks 39th nationally in this tax rate, which is lower than any other state in the Northeast. The price of gas in the state is also fairly low. On Thursday, the average price for a gallon of regular gas in New Hampshire was $2.94, 13 cents lower than the national average, according to an AAA listing of fuel prices. Any increase in the gas tax would have to be approved by the Republican-controlled N.H. Legislature, which has been in a mode of cutting, not raising, taxes in recent years. An example of the GOP’s sentiment on taxes came this week after an attempt was made in the N.H. House Rules Committee to reintroduce a tax-increase bill that had little support in this year’s session. House Bill 503 would not have affected the gas tax, but would have increased the rates of the business profits tax, business enterprise tax, and meals and rooms tax, and reestablished the interest and dividends tax. The money would have gone to public education, which New Hampshire courts have found the state is not adequately funding. Republicans have cut business taxes in recent years and eliminated the interest and dividends tax, effective the end of this year. HB 503 failed in the N.H. House on March 6, 345-27. On Tuesday, the House Rules Committee, which includes Republicans and Democrats, decided unanimously not to move forward with a request by Rep. Thomas Oppel, D-Canaan, to allow HB 503 to be reintroduced for next year’s legislative session. Republican Gov. Kelly Ayotte and N.H. GOP Chairman Jim MacEachern issued news releases that day, criticizing Democrats over the proposal. “We’re not going to MASS up our great state with higher taxes,” Ayotte said. MacEachern said, “Democrats never met a tax they didn’t like.” Rep. Lucy Weber, D-Walpole, said Thursday that Republicans are trying to deflect from their own record of not allowing the state to collect enough revenue to provide critical services that people depend upon. “An ordinary citizen just needs to lose one muffler to a pothole and they are literally in the hole, rather than being ahead of the game,” she said. While chances for increasing the state’s gas tax would appear to be a long shot, Rep. Charlie St. Clair, D-Laconia, who is on the House Transportation Committee, said Thursday lawmakers should at least consider it. St. Clair said competitive factors go into setting gas prices, so it’s not clear that if the state raised its gas tax by a couple cents that this would immediately transfer to an increased per-gallon price. Lawmakers are still drafting bills for next year’s session, but none of the proposals made so far includes an attempt to increase the gas tax. N.H. Executive Councilor Karen Liot Hill, D-Lebanon, said Wednesday that while any increase in the gas tax would be up to the Legislature, the Executive Council could consider on its own increasing turnpike tolls. These tolls support the turnpike system and can’t be used for other purposes. One possibility, she said, would be to boost tolls, but target the increase to out-of-state motorists, rather than state residents.