Copyright scmp

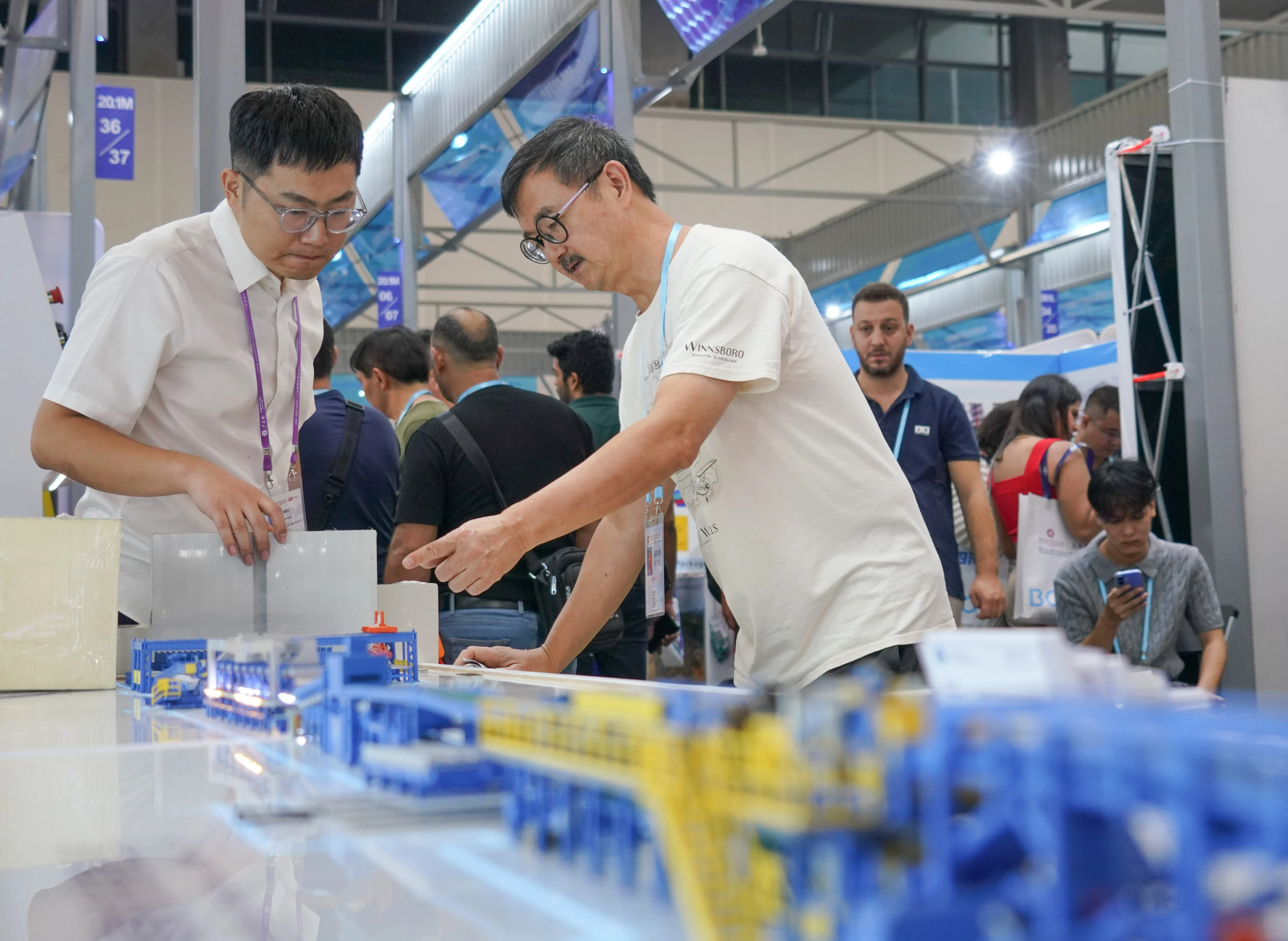

At the ongoing autumn session of the Canton Fair, China’s largest and longest-running trade exhibition, many Chinese exporters say that overseas buyers’ demands for extended payment terms are becoming one of their biggest challenges in maintaining profits. The pressure on small and medium-sized enterprises (SMEs) – across a range of industries – is particularly acute. “A regular client suddenly demanded 90-day post-shipment payment because other suppliers offer longer terms,” said Kevin Huang, a lighting exporter at the fair in Guangzhou. “If we don’t comply, we risk losing the order. “SMEs have to front-load material, production and shipping costs. If cash is tied up for three months or more, orders could easily turn into a possible loss.” The trend stems from the combined effects of tighter overseas liquidity and rising inventory pressures in a more complex global macroeconomic environment for Chinese exporters – a sector that remains a key driver of the world’s second-largest economy. Despite rising global trade tensions and protectionism, China’s foreign trade has demonstrated its resilience, growing 6 per cent year on year in the third quarter, according to official data. Huang said many traditional manufacturing exporters had accepted payment terms of up to six months or more, but cash flow pressure and the risk to profits meant that 90 days was “really unaffordable” for his firm. Large exporters are feeling similar strains. “Clients, especially those from emerging markets, often request longer payment terms, and this has been a big challenge we’ve faced in recent years,” said Wang Lilin, sales director at Keypower, an exporter of diesel generators. “Previously, terms maxed out at 60 days; now they are typically 90 or up to 120 days.” Wang said her company needed to extend terms to help distributors sell more products, meaning it was sharing their cash flow burden in exchange for more orders. Chinese exporters at the fair said that in the past, shorter payment cycles from foreign buyers gave exporters a clear profitability edge over companies focused on domestic sales. European and American orders typically settled within 45 days and Southeast Asian ones in around 60 days, while domestic clients often required 90 to 120 days. Now, that advantage was fading, as delayed payments from overseas buyers put companies’ liquidity under increasing strain. Last month, in its 2025 China Overseas Business Risk Report, corporate credit agency Dun & Bradstreet highlighted two major risks for Chinese companies in overseas markets: global corporate bankruptcies and delayed payments. The more orders, the greater the risk Dave Cheng, export trader “Among the monitored sample, average payment terms in many markets have lengthened by 10 to 20 per cent,” Louis Lu, a data expert at the agency, said at the launch of the report. “Additionally, the number of bankruptcies among major European and American economies increased by 20 to 30 per cent year on year in 2024. “The timeliness of payments from overseas companies is generally declining, and the phenomenon of extended payment terms is becoming increasingly evident. “High interest rates, inventory pressures and tight cash flow have forced overseas buyers to delay payments. Once a buyer faces bankruptcy or operational difficulties, the bad debt risk for Chinese suppliers rises sharply.” Also speaking at the report’s launch, Shi Yonghong, vice-president of the China Chamber of Commerce for Import and Export of Machinery and Electronic Products, warned that competitive pressures were forcing some Chinese exporters to accept longer payment terms when they expanded into emerging markets. “This may help secure orders in the short term, but it creates cash flow risks in the medium to long term,” Shi said. “For SMEs, the impact can be severe.” Dave Cheng, a veteran export trader, said many traditional manufacturers in China operated on gross margins of just 5 to 10 per cent. “For a company with annual revenue of 10 million yuan (US$1.4 million), if the payment term extends from the original 30 days to 90 days, it requires an additional 2 million yuan in cash flow,” he said at the fair. “This added cost alone can push factories into losses – and the more orders, the greater the risk.”