Copyright Barchart

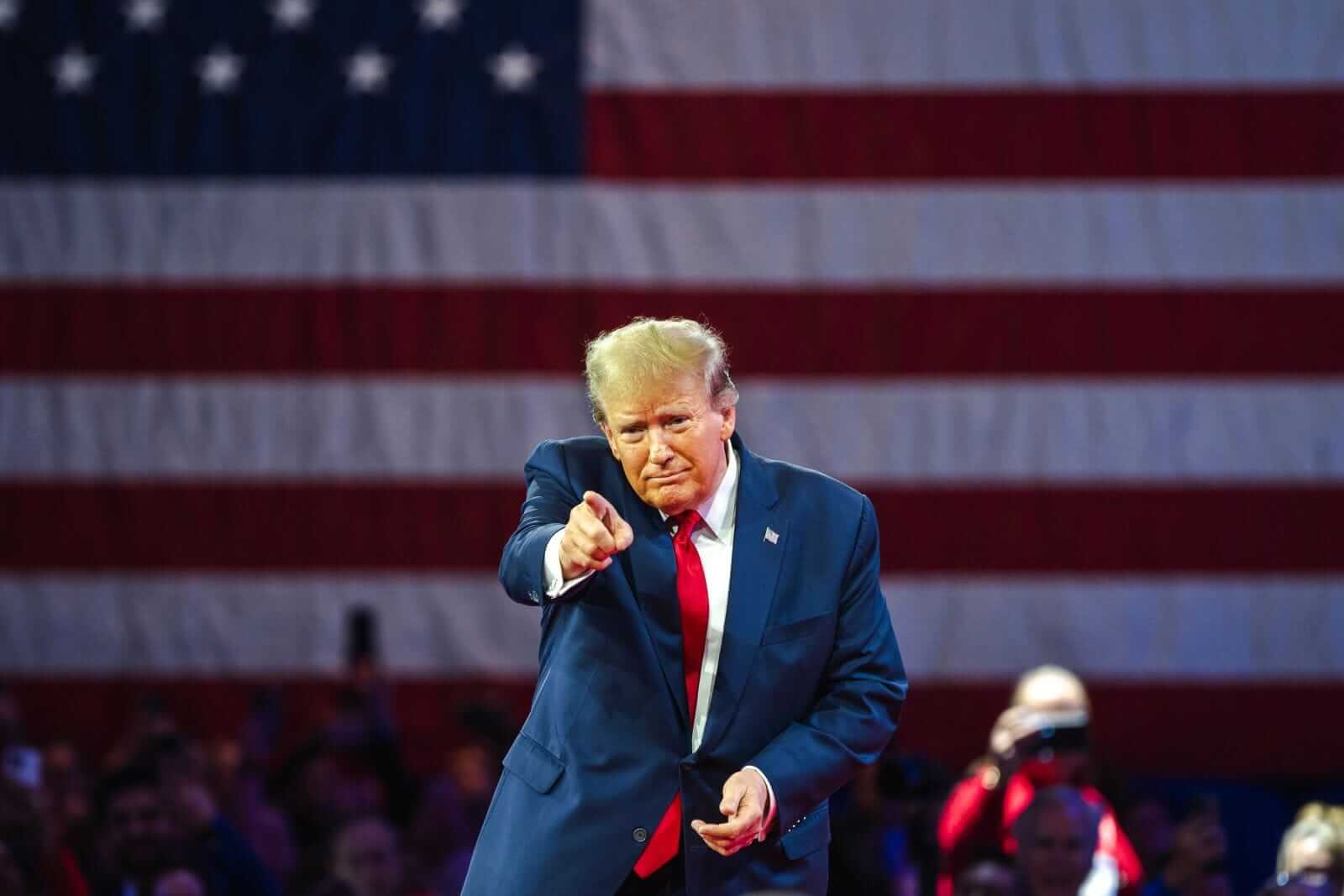

Howdy market watchers! Wow, it has been a wild week in the markets! That’s even an understatement considering the day-to-day volatility and whiplash seen from the constant uncertainty of what the next headline will be. There is no degree of normalcy of the level of division in US politics despite it being more of the same in the years since COVID and perhaps longer. Happy Veteran’s Day ahead to all those who have served our great country over the centuries. We remember and honor you and your families this weekend and during the week ahead. Markets will be open on Veteran’s Day despite banks being closed. This week marked a new record for the length of the US government shutdown with no conclusion by the writing of this on Friday. After Tuesday elections that saw Democrats prevail in several Gubernatorial races, they proposed on Friday to extend the current enhanced healthcare benefits for one year as a bargaining chip to reopen the government. We will see if anything materializes over the weekend. Meanwhile, 10 percent of flights have been cancelled with the risk of 20 percent of flights being cancelled due to a lack of air traffic control employees due to the shutdown. With just three weeks until busy Thanksgiving travel, the time is extra critical and public as the shutdown begins to impact everyone in addition to just federal government employees and programs. Despite this unknown, the USDA does intend to release the November WASDE and Crop Production reports on Friday, the 14th, that was originally scheduled for Monday, the 10th. There was more rhetoric on China purchases of US agricultural products this week, but more talk than action. The PRC government took steps this week to officially reduce tariff rates and re-authorize State-Owned Companies to import US ag products. Most tariffs were reduced by 10 percent from elevated levels. With much anticipation and chatter about China buying US wheat leading to an extended wheat rally, the fact finally emerged from the rumor revealing that purchases for US SRW and HRS were made for December shipment, but in limited quantities. China also bought US sorghum. Profit taking starting in Thursday’s session followed these announcements across wheat and soybeans and to a lesser extent corn. The wheat market traded down to support levels to finish the week while corn stayed under pressure and soybeans managed a slight rebound after Thursday’s 26 cent correction. The market will now turn to expectations ahead of the USDA reports that we have lacked for over a month. Corn yields and soybean exports and ending stocks for both will be key variables given all that has transpired with harvest and trade deals since we last had updated figures. We’re not even sure what export business has been done in the past month at the most critical time to have such data for row crops. The US dollar has been a headwind in recent weeks until the topping action on Wednesday with the index trading above 100 for the first time since May. US economic data has also been lacking although it is becoming clearer that US consumer sentiments and strength are declining. Equity markets have had a softer start to November with this picture changing as consumer debt is finally showing signs of the weakness that many have long expected was present. As we enter the key retail spending season of the year with holidays just ahead, these reports will be watched closely with job cuts and layoffs accelerating. This weaker job market will likely lead the FOMC to make further interest rate cuts as long as inflation doesn’t tick higher in the meantime. While tariffs are thought to be inflationary, there was also pre-stocking of inventory ahead of tariffs that has resulted in an excess of some items that firms are now having to discount to get rid of and leading to deflation in some price categories. There are so many moving parts that it is difficult to get a good read on where the economy is presently. Domestic and international politics have painted a hazy picture of the clear path forward for companies and supply chains. Major announcements have been made regarding investments in the US, but it is unclear how all of this will play out with only three years remaining in the Trump Administration. How many of these commitments are being made for leverage with the current Administration whereby commencement will be drawn out as a bridge to the next election. I do believe China is and will play this game as it always does with changing US politics. My question is what will bring us together as a country? With our country divided, other countries are able to widen the divide and take advantage of our disunity. In an uncertain world, one thing remains certain – the fundamentals in the US cattle market remain extremely tight making for one of the wildest futures markets to trade! Tweets and rumors and extreme sensitivity to headlines has whipped the feeder and live cattle futures all around with limit down and expanded limits again this week. Early in the week while visiting Mexico, Secretary Rollins reconfirmed that the border would remain shut with no timeline for reopening due to the New World Screw Worm. However, we heard nothing more throughout the week leaving the markets to wonder. Not until Friday after the market close, we see this very targeted tweet from President Trump completely changing the tone on the cause of higher beef prices. As all of us in the industry have been commenting, the truth has finally reached President Trump and he seems more vindictive than ever against the large packers that are actually the reason for high beef prices at the counter, not the cattlemen. Trump has called for the DOJ to investigate the large packers, namely JBS and Marfrig, both Brazilian owned, and possibly the others, namely Tyson and Cargill. From Trump’s first tweets on this until now, we have the President back behind the American rancher. With the Brazilian influence among the meat packers, I believe this could also strengthen the resolve to keep Brazilian tariffs in place that has largely restricted it from US markets due to price. If it is these packers that are lobbying Trump for the Mexican border to be reopened or the Brazilian tariffs to be removed, you can bet that it is now more likely than ever that this will not happen. Depending on other developments over the weekend, I believe we could see feeder and live cattle futures surge on Monday and possibly trade limit up. That would be welcome news for a market that has been severely damaged technically on the charts. There are chart gaps above that are lining up to the 20-day moving average. These gaps are at $352.20 on November feeders with other gaps even higher. Remain vigilant, but we may get another opportunity to lock in $350.00 on feeder futures and possibly higher depending on how the situation develops. The key is that we need to keep consumer demand intact and buying our product. If this market rebounds, just remember, anything can happen and do so quickly and so be ready to get risk management in place and hope that you don’t need it. The recent weeks should have reminded all of us that even the strongest market can be vulnerable to all the uncertainty that exists.