Copyright thepatrioticvanguard

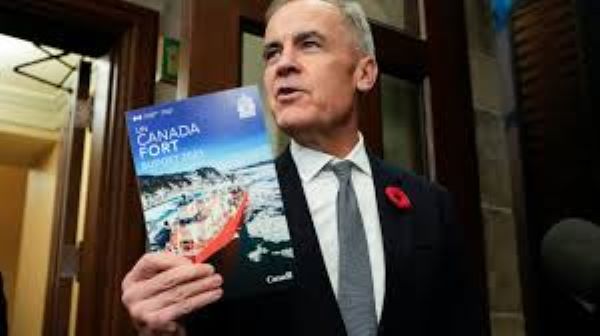

The world is increasingly dangerous and divided. Changes in the global trading system are causing massive disruptions and uncertainty for Canadians. In addition to that upheaval, business investment has been flat in Canada for a decade. This has caused productivity to grow by only 0.3% annually during that time – lagging behind the majority of our G7 partners. This has weighed on wages, job creation, and Canada’s prosperity. Budget 2025: Canada Strong confronts these challenges head-on. This is Canada’s new government’s plan to mobilise investment and supercharge growth. We will harness our strengths to drive innovation and productivity – creating more high-paying careers, thriving businesses, and greater certainty for investors. Today, the Prime Minister, Mark Carney, outlined the government’s plan to enable $1 trillion in total investments over the next five years in Canada. Through targeted tax incentives, major infrastructure projects, stronger competition, and a bold new approach to attracting talent, Budget 2025 sets the foundation for long-term prosperity, so we can build the strongest economy in the G7. The government’s plan to enable $1 trillion in total investments in five years includes the following measures: Introducing a Productivity Super-Deduction to make it easier to do business and invest in Canada. Budget 2025 reinstates the Accelerated Investment Incentive and includes immediate expensing for manufacturing or processing machinery and equipment, clean energy generation and energy conservation equipment, and zero-emission technologies. It also moves forward with immediate expensing for productivity-enhancing assets and research capital expenditures for scientific research and experimental development, and introduces immediate expensing for new manufacturing or processing buildings and accelerated depreciation for low-carbon LNG facilities. Together, these measures form a Productivity Super-Deduction that will lower costs, spur private investment, and reduce Canada’s marginal effective tax rate to 13.2% – reinforcing Canada as the most tax-competitive country for new business investment in the G7. Enhancing the Scientific Research and Experimental Development (SR&ED) tax incentives to help businesses innovate and grow. Budget 2025 moves forward with increasing the capital phase-out thresholds for the enhanced tax credit, extending the enhanced credit to eligible Canadian public corporations, and restoring the eligibility of capital expenditures. It also proposes increasing the annual expenditure limit on which the enhanced credit can be earned to $6 million. Accelerating nation-building projects through the Major Projects Office (MPO) to supercharge growth across Canada. The new MPO serves as a single point of contact to fast-track transformative projects in energy, trade, transportation, and more. The first five projects referred to the MPO in September collectively represent more than $60 billion in total capital investment. Additional nation-building projects will be announced later this month and, taken together, this is expected to trigger at least $150 billion in total capital investment. Launching the International Talent Attraction Strategy and Action Plan to make Canada a magnet for global talent. Budget 2025 invests $1.7 billion to recruit over 1,000 world-class researchers, attract top doctoral and post-doctoral fellows, and support universities in hiring internationally – positioning our immigration system to meet the needs of a modern, competitive economy. Strengthening competition and consumer choice to lower costs and drive innovation. Budget 2025 launches bold pro-competitive measures to deliver lower prices, better service, and more choice for Canadians. It will boost telecom competition by cutting red tape, releasing new spectrum, and making it easier to switch providers. It will also advance open banking and modernise payments for Canadians through the forthcoming Real-Time Rail system. This, along with limits on non-compete clauses, will foster a fairer, more dynamic economy where Canadians pay less and get ahead. Combined, these measures form a drastically different economic strategy to supercharge growth. Our plan focuses government spending where it delivers the highest return: in workers, businesses, and nation-building projects. This will drive lasting prosperity to help Canadians get ahead. Credit: Prime Minister’s Office, Ottawa.