Copyright Benzinga

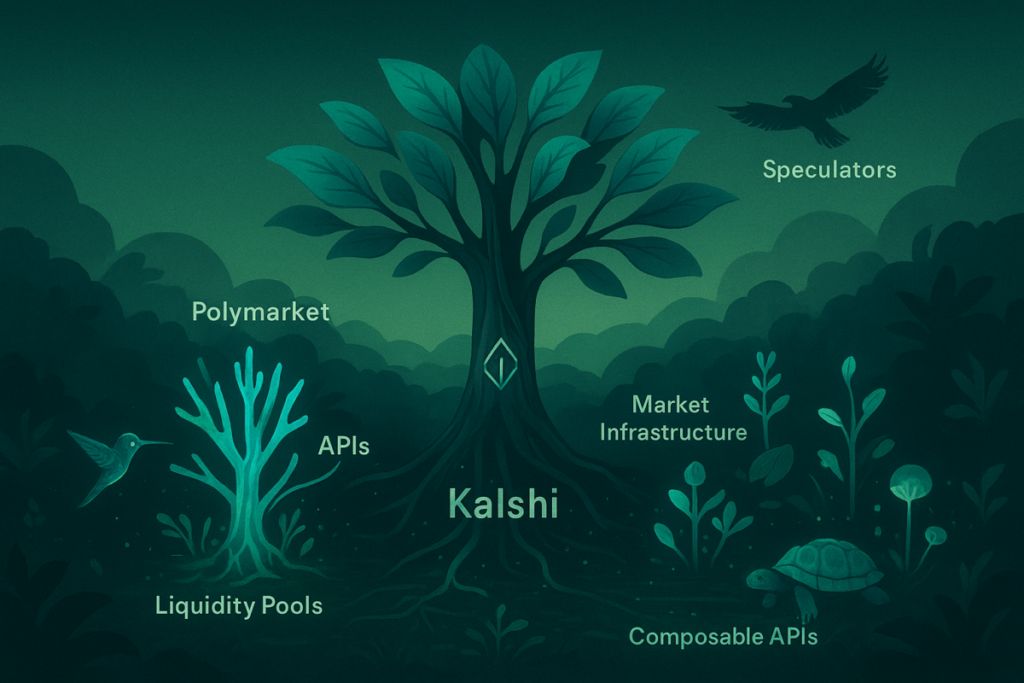

Snapshot: Kalshi, Polymarket, and a wave of DeFi-native protocols are quietly building financial micro-economies, complete with infrastructure, toolmakers, and data pipelines. The real contest is no longer over pop culture happenings and political outcomes. It's about who builds the rails on which future forecasts will run. At crypto's edge, a new economic frontier is forming. Kalshi, Polymarket, and their on-chain rivals are moving beyond listing event contracts to seeding ecosystems, each vying to become a new kind of financial infrastructure based on predictive intelligence. A thicket of analytics dashboards, automated liquidity providers, and AI-powered forecasting tools is emerging. The end game is a parallel information economy where crowdsourced probabilities, not pundits, do the talking. Ecosystems, not exchanges Polymarket launched its Builders program earlier this year to entice developers, analysts, and content creators to build new tools atop its protocol. More than a hundred have already appeared, ranging from trading bots and sentiment monitors to scrapers that scan social media for market-moving chatter. Kalshi, keen not to be left behind, recently launched the KalshiEco Hub, offering grants, infrastructure support and marketing to new projects that expand its reach. Recent link-ups with Solana and Base let users deposit crypto as well as fiat currencies, suggesting an ambition to bridge both TradFi and the wider on-chain world. The supporting cast is growing. Verso offers professional-grade discovery and strategy tools for serious traders. Kalshinomics produces analytics aimed at researchers and casual users. Caddytrade helps users navigate an expanding catalogue of contracts. Meanwhile, others are eyeing the space. Binance, the world's largest crypto exchange, is pitching its BNB Chain as a base layer for prediction market start-ups, promising lower transaction costs and access to its deep liquidity pools. Innovation at the frontier Crypto analyst and social influencer 0xJeff says innovation is clustering around four categories: Stock price and volatility Weather forecasting Sports General interest "Several subnets have shown that they're close to the productization stage," he adds, noting that a few have built out both the infrastructure and application layer, "highlighting what's possible with the intelligence." AI models are being used to identify statistically significant events and automatically generate new event contracts before humans even notice. DeFi protocols are experimenting with decentralized oracle systems – systems used by prediction markets to verify outcomes without a central authority – and sports-betting platforms are signing integration deals, hoping prediction markets might help boost engagement. For all the enthusiasm, familiar obstacles remain. Liquidity is plentiful in high-profile political markets but vanishes further down the long tail. Information asymmetries can be sharp, with well-informed insiders occasionally running circles around ordinary punters. And while decentralization offers ideological purity, it clashes with regulators seeking accountability and oversight. Signals from speculation Why persist? Because prediction markets generate not merely bets but data. A live probability of a government shutdown may carry more weight than the latest leak from a Capitol Hill insider. Market-implied odds of a central bank tweak to monetary policy can rival survey-based forecasts. Companies, too, are beginning to ask whether crowd-sourced probabilities might guide strategy on product launches, supply-chain disruptions or geopolitical risk. Traditional finance shows that, over time, even modest informational advantages can compound. Just as Bloomberg made its terminals indispensable by aggregating financial data. Prediction-market terminals could become a new essential source of forward-looking intelligence. The take away The sector faces a familiar crypto-era dilemma: innovation surges ahead, regulation lumbers behind. Heavy intervention could choke off experimentation; too light a touch invites manipulation and political unease at betting on matters of state. Yet history offers a hint. Credit rating agencies, for all their flaws, found a way to embed themselves into finance. Prediction markets may follow a similar trajectory – not replacing expert judgement but sharpening it.