Copyright forbes

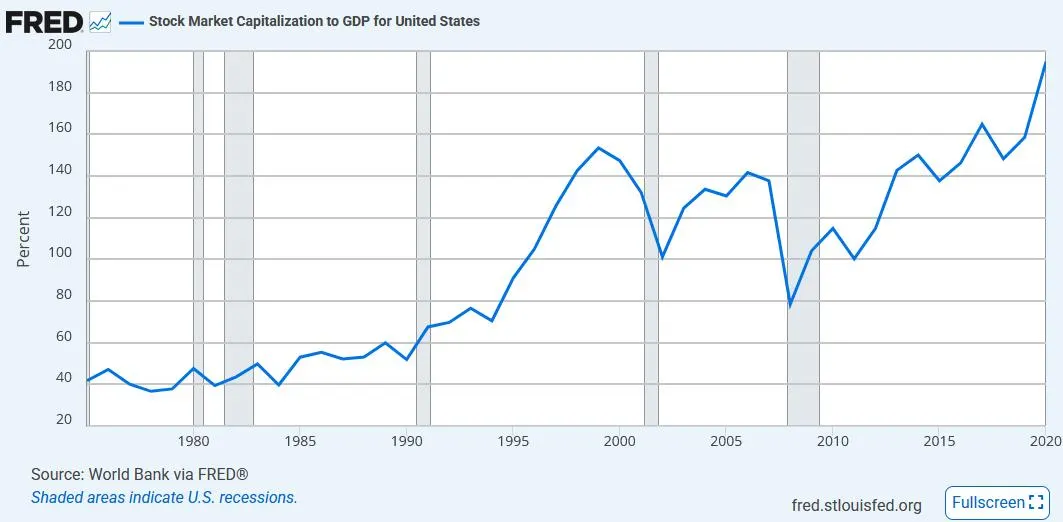

As we end the third quarter of 2025, the U.S. stock market faces an unusual situation. Stock prices are at historic highs, higher than almost any other time in history. However, the economy underneath remains healthy. Investors are conflicted. Many are both nervous of the lofty valuations (with potential for a market correction), and also have fear of missing out on further gains. In this letter, we outline how Equitas is approaching the market. STOCK MARKET CAPITALIZATION TO GDP FOR US WORLD BANK via FRED Several important measures show stocks are incredibly expensive relative to past earnings. The Buffett Indicator has reached an unprecedented 217-218% of GDP, above the 200% level where he is quoted that investors are “playing with fire.” This is even higher than the dot-com bubble peak of 160% in 2000. The Shiller PE ratio sits at 39.8—the second-highest reading in over 140 years. The S&P 500 trades at a forward P/E ratio of 22.5-23.6, much higher than the normal range of 16-17. Even more alarming, the trailing P/E recently crossed 30. This has only happened once before since the 1800’s, during the dot-com bubble of 1998-2002. After that bubble burst, it took seven years for markets to recover. SHILLER PE RATIO MULTPL.NASDAQ, INC. Goldman Sachs projects modest 3% annual returns for stocks over the next decade. They say there’s a 72% probability that stocks will underperform bonds through 2034. Even JP Morgan projects a return slightly higher than 6%. This sobering forecast comes directly from today's elevated valuations. Sentiment across institutional investors remains skittish, with 58% of the Bank of American Global Fund Manager Survey deeming markets “overvalued.” Despite these extreme valuations, the economy shows remarkable strength. The unemployment rate holds steady at 4.3% as of August 2025, with 7.2 million job openings available. Consumer spending remains robust, with retail sales rising 0.6% in August and up 5% for the year. Workers are seeing wage growth of 3.7% annually, giving them real purchasing power. Credit markets also show resilience. Credit card delinquencies remain near historic lows at 3.05%, well below the long-term average of 3.71%. This healthy credit environment supports continued consumer spending while reducing financial risks. Most of these figures are listed on our website: https://equitas.capital/economic-strength/ MORE FOR YOU ECONOMIC STRENGTH Equitas Capital Advisors, LLC Corporate America continues delivering impressive results. S&P 500 companies posted 11.8% earnings growth in Q2 2025—the fifth consecutive quarter with profit margins exceeding 12%. Even better, 81% of companies beat earnings estimates. Corporate balance sheets remain fortress-like, enabling record-breaking buyback programs exceeding $1 trillion through August 2025. Several structural changes help support these elevated valuations. The number of publicly traded companies has declined significantly. This creates concentration effects, with the top 10 S&P 500 stocks making up nearly 40% of the index. These mega-cap companies like Nvidia (7.2% weight), Microsoft (6.3%), and Apple (5.9%) are highly profitable, driving both growth and expectations higher. Opportunities As we wrote last quarter in “Dividend Aristocrats,” dividend investing maintains defensive appeal during recessionary periods. During the worst modern period for dividends, the 2008 financial crisis, S&P 500 dividends declined just 23% while stock prices fell over 50%. The average cut in a bear market is just 2%. This income resilience provides behavioral advantages, reducing the temptation to time markets. Further, firms like Goldman Sachs forecast 6% dividend growth in 2025, rising to 8% in 2026. Tax advantages enhance dividend strategies' appeal. Qualified dividends face maximum federal tax rates of just 20% for high earners, compared to ordinary income rates up to 37%. Since 1960, reinvested dividends account for 85% of the S&P 500's total return, demonstrating the power of compounding income. We’ve got a leading dividend strategy at Equitas, and we invite you to call us to learn more about it. TOTAL DATA CENTER ELECTRICITY CONSUMPTION 2024 US DATA CENTER ENERGY USAGE REPORT While broad market valuations appear stretched, compelling opportunities exist in overlooked sectors. The energy sector trades at a P/E ratio of 17, representing a 30% discount to the S&P 500's multiple of 24. Morgan Stanley, Berkley, MIT, and Chevron have all predicted that the projected power demand for AI will primarily feature natural gas. LNG exports are projected to double by 2028. Master Limited Partnerships (a name for the pipelines that move this gas from the well to the market) offer another pocket of value, combining attractive yields averaging 5% with tax advantages. These equities currently trade at P/E’s near 15, and can be combined with call writing to further increase the yield. There are many more ways to approach energy investments, and we invite you to call us to learn more. In environments of extreme valuations, tactical asset allocation strategies demonstrate their value through active risk management. Our own research on recessions from the past three decades indicates that the median tactical fund has roughly half the downside of the S&P500. However, most of the tactical industry is just as good at protecting from the upside as they are the downside. When looking in this area, be sure to find a fund that can excel in both bull and bear markets. The Equitas Global Navigator strategy exemplifies modern tactical allocation. We combine both fundamental data on the real economy, with pure technical measures regarding market prices. This approach enables monthly rebalancing between aggressive growth positioning and defensive cash allocations based on market conditions. Please give us a call to learn how tactical strategies can impact your portfolio. ANNUALIZED RETURN DURING RECESSIONS EQUITAS CAPITAL ADVISORS, MORNINGSTAR INC The current market environment presents unprecedented challenges with valuations at historic extremes. The Buffett Indicator's record reading of 217% and the Shiller PE approaching 40 signal clear warning signs that cannot be ignored. Yet several factors differentiate today's market from previous bubble periods. Corporate fundamentals remain strong with double-digit earnings growth. The labor market shows resilience. Credit quality remains healthy, and consumer spending continues expanding. Investment opportunities exist for those willing to search beyond the overvalued mega-caps. Energy sector valuations offer compelling valuations, with Master Limited Partnerships also providing attractive tax-advantaged income with yields of 5%. Tactical asset allocation strategies offer crucial risk management tools for navigating extreme valuations. Meanwhile, dividend strategies provide portfolio ballast through steady income generation. The current environment demands careful portfolio construction balancing participation in continued market strength with protection against inevitable corrections. Equitas Capital Advisors, LLC In 2002 Equitas Capital Advisors, LLC was established as a unique company that blends the resources of a large global corporation with the flexibility of a small boutique firm. The registered service mark of Equitas Capital Advisors is Engineering Financial Solutions® and the purpose of Equitas is to design, build, and deliver investment solutions to meet the goals and objectives of our investors. Equitas Capital Advisors, LLC located in New Orleans, has over 200 years of combined investment management consulting experience providing professional investment management services to investors such as foundations, endowments, insurance companies, oil companies, universities, corporate retirement plans, and high net worth family offices. Disclosures and Disclaimers: Above information is for illustrative purposes only and has been obtained from reliable sources but no guarantee is made with regard to accuracy or completeness. This information including any specific securities mentioned is for educational, entertainment and illustrative purposes only and not a recommendation or solicitation to purchase or sell any individual security. You cannot invest directly in an index. Equitas Capital Advisors, LLC is registered as an investment advisor with the U.S. Securities and Exchange Commission (“SEC”) and only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the advisor has attained a particular level of skill or ability. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author on the date of publication and are subject to change. This publication does not involve the rendering of personalized investment advice. Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment or strategy will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals, and economic conditions may materially alter the performance of your portfolio. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for an investor. Charts and references to returns do not represent the performance achieved by Equitas Capital Advisors, LLC, or any of its clients. Asset allocation and diversification do not assure or guarantee better performance and cannot eliminate the risk of investment losses. All investment strategies have the potential for profit or loss. There can be no assurances that an investor’s portfolio will match or outperform any particular benchmark. Editorial StandardsReprints & Permissions