By Aman Kidwai

Copyright newsweek

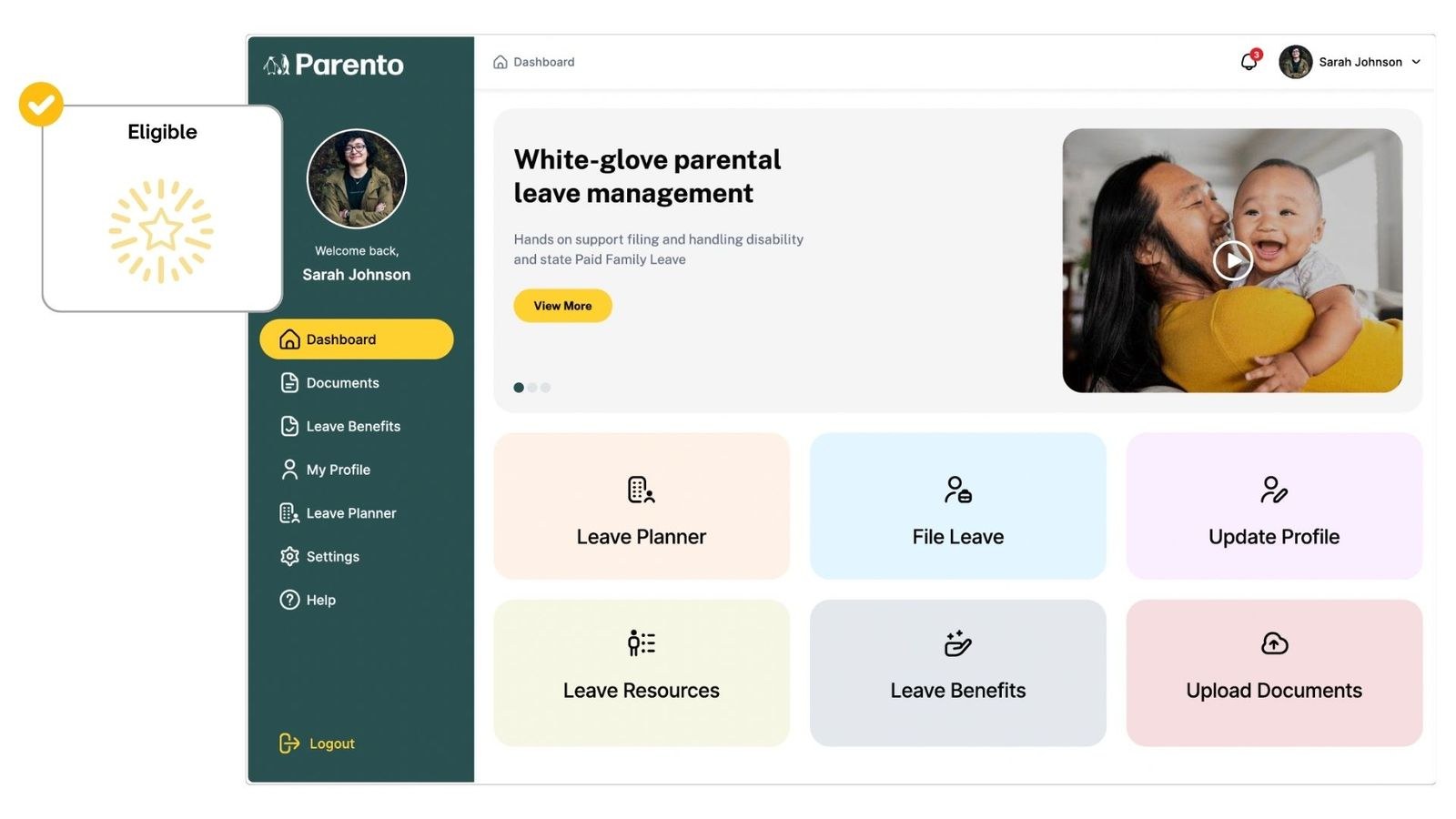

As the CFO of a small business, Dirk Doebler saw the difficulties that small businesses face when planning for its employees’ parental leave, especially from a cash-flow perspective. In a given year, for example, four employees may need parental leave, while in the next year it may be only one. That uncertainly makes it difficult for companies to prepare.Doebler started Parento in 2019 to address the challenge. The company offers insurance that reimburses companies for the salaries of employees who take parental leave. Parento’s service helps employers of all sizes manage turnover risk and the costs associated with both paid leave and with the lack of such a program. Parento also covers non-birthing parents and foster parents.Today, the company is thriving. Parento has announced a $5.9 million second seed round, led by ResilienceVC, with contributions from Kapor Capital, Bread & Butter Ventures, Operator Stack, Coyote Ventures, ffVC, Human Ventures, Springbank, Precursor, Cross Impact, K Street, Evidenced and Avesta.Here’s how Parento works: Based on the demographics of a company’s workforce, the company develops a model for how much parental leave its employees are expected to take in a given year and charges a premium based on expected payouts. With Parento, companies pay the monthly premium and are reimbursed through their plan.”Insurance is basically one big data problem,” Doebler explained. “Pricing an insurance product requires understanding complicated data sets and putting them together to get the right price.”Today, only 56 percent of small businesses offer paid medical leave, and only half of small businesses offer formal paid parental leave programs, according to a survey by Small Business Majority. And most of those parental leave periods last only a month or less.Companies that have more than 50 employees are required to provide 12 weeks of unpaid parental leave through the Family and Medical Leave Act (FMLA).”What we found is a vast majority of our clients offer short-term stability insurance at birth for moms, and maybe have a voluntary policy,” Doebler told Newsweek. “By and large, there was nothing in place. People were taking PTO if they had any available and HR was basically telling people to go to the state website [to file for disability].””We see a lot of volatility for our clients year to year,” Doebler said. Navigating the cash-flow volatility and administering leave programs “is a big lift for companies that have no experience with this.”Small-business managers often don’t have time or budget to administer robust parental leave and other support programs. Doebler found that instead, they frequently cobbled together disjointed plans that hinge on disability leave and PTO – plans that cannot compare to larger employers’ offerings. The lack of robust programs, small-business managers find, can lead to higher rates of turnover for working parents or employees who want to start families.By talking to finance leaders, Doebler said, he found that many small businesses are using short-term disability insurance as “kind of a proxy for maternity leave,” he said. “Companies are buying it for the pregnancy coverage. It doesn’t actually retain more women than doing nothing, but it provided cost certainty and risk mitigation to firms.”Doebler sees the lack of parental leave programs as “a financial problem with severe social repercussions,” he said. “It drives a large portion of gender wage gap. We see parents and moms that want to get back to work but can’t.”Companies who engage with Parento, Doebler observed, often see improved retention of older, tenured employees and an increase in the number of employees having children, at first. Then, the rate of employees taking parental leave tends to level off. Companies also tend to see continued boosts in retention, for both parents and aspiring parents.In addition to helping enable parental leave, Parento also offers coaching and support for parents on topics like feeding, sleep schedules and other aspects of newborn and toddler care. The company found that 95% of parents at client organizations return to work after leave, compared to around 65% for self-funded programs.”We’re helping to address the non-financial challenges or barriers that might prevent someone from work, especially moms,” Doebler said. “That helps HR sell this. They’re not only getting that cost and risk mitigation, they’re getting the resources to make sure that people have a really good experience when they come back to work.”Offering a 10- or 12-week paid leave program, he said, can reduce the turnover risk for working parents between 30% and 40%. A small business spending money on only a six- or eight-week program, however, isn’t a good solution for either side: managers may get angry at spending that much money, and employees “aren’t going to come back at high rates, so people won’t be happy with the policy.”He continued, “When we have clients who have six-week policies or eight-week policies and are not happy with it, we’ll bring that feedback to the company. It’s not going to actually drive impact.”Besides having worked as an equity analyst at Barclays, Doebler also worked as an analyst at a defense manufacturer and as CFO of Dame Products, a retailer of sexual health essentials.”HR generally understands the importance of offering paid leave…but they can’t convey to finance the ROI or the financial impact and certainly can’t figure out the budgets they need get there,” he said. “From my perspective, this is a financial problem that needs a financial solution for companies.”