Copyright forbes

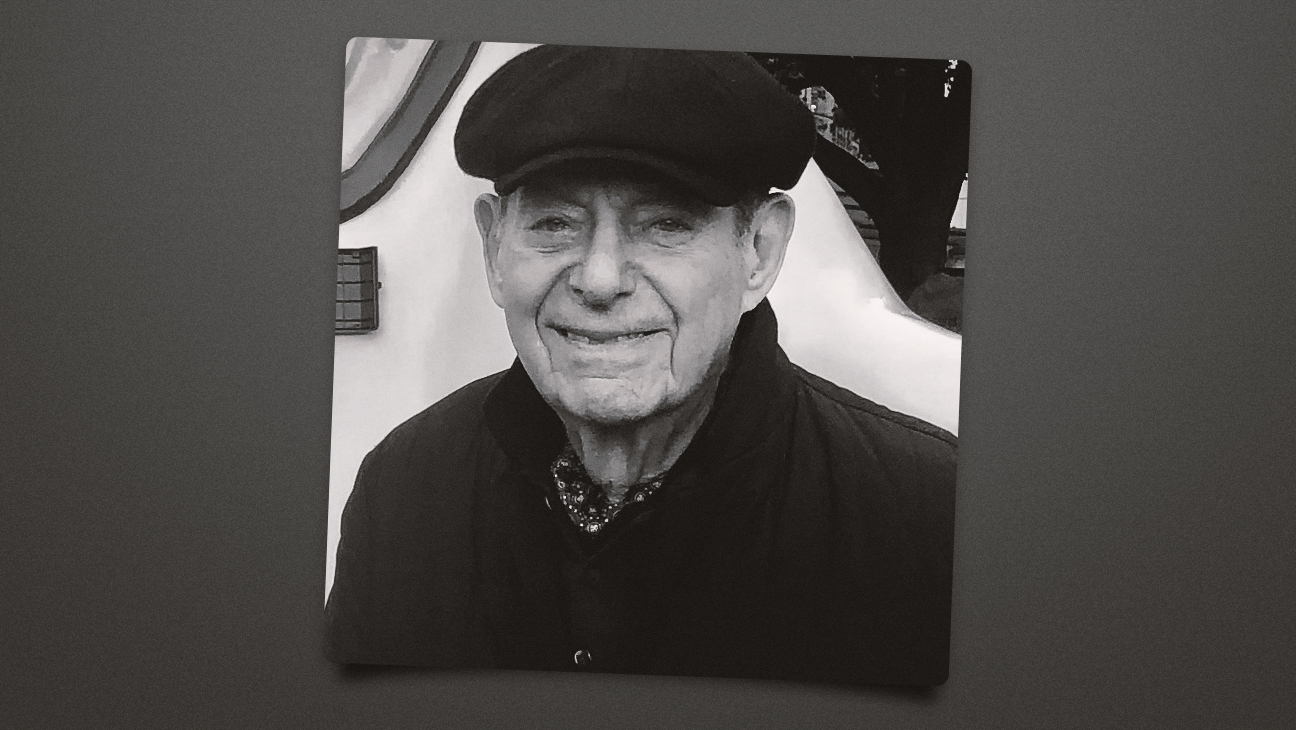

With Oracle stock decreasing 10% in a week, it’s prudent to reassess it in relation to its competitors. The recent sell-off comes amid concerns about the margins for the company’s cloud computing business, as well as rising capital costs. SAN FRANCISCO, CA - OCTOBER 22: Oracle co-founder and Chairman Larry Ellison delivers a keynote address during the Oracle OpenWorld on October 22, 2018 in San Francisco, California. The Oracle co-founder and Chairman kicked off the annual Oracle OpenWorld conference that runs through October 25th. (Photo by Justin Sullivan/Getty Images) Getty Images Regularly evaluating alternatives is fundamental to a solid investment strategy. Below is how Oracle (ORCL) stock compares with its peers in terms of size, valuation, growth, and margin. ORCL’s operating margin of 31.6% is considered high, surpassing most competitors, although it is lower than ADBE (36.2%). ORCL’s revenue growth of 9.7% over the past 12 months is moderate, exceeding the growth rates of IBM, CRM, and SNPS, but trailing behind INTU and ADBE. ORCL appreciated by 60.2% in the last year and is traded at a PE ratio of 63.0, outperforming its rivals. For some quick background, Oracle offers cloud software as a service, industry-specific cloud solutions, application licenses, license support, an enterprise database, a development language, and middleware services. Recently, ORCL stock has seen a significant decline, and we currently consider it relatively overvalued. While this may seem like a buying opportunity, relying solely on one stock involves considerable risk. Conversely, a diversified approach offers substantial value, as demonstrated with the Trefis High Quality Portfolio. Should you invest in a single stock you favor, or develop a portfolio crafted to succeed across various cycles? Our data indicates that the High Quality Portfolio has transformed stock-picking uncertainty into consistent market-beating performance. This portfolio is included in the asset allocation strategy of Empirical Asset Management – a wealth manager located in the Boston area and a partner of Trefis – whose asset allocation framework generated positive returns during the 2008-09 period when the S&P fell by more than 40%. MORE FOR YOU Why does this matter? ORCL just declined by 10% in a month – comparing it with peers provides context for stock performance, valuation, and financials – indicating whether it is genuinely outperforming or lagging behind, and most importantly – can this trend persist? Read Buy or Sell ORCL Stock to determine if Oracle is truly a falling knife. Revenue Growth Comparison Revenue Growth Operating Margin Comparison Operating Margin PE Ratio Comparison P/E Comparison The Trefis High Quality (HQ) Portfolio, which includes a collection of 30 stocks, has a history of comfortably outperforming its benchmark, encompassing all three – the S&P 500, S&P mid-cap, and Russell 2000 indices. What accounts for this? Collectively, HQ Portfolio stocks have yielded superior returns with lower risk when compared to the benchmark index; it presents a smoother ride, as illustrated by the HQ Portfolio performance metrics. Editorial StandardsReprints & Permissions