By News18,Varun Jhaveri

Copyright news18

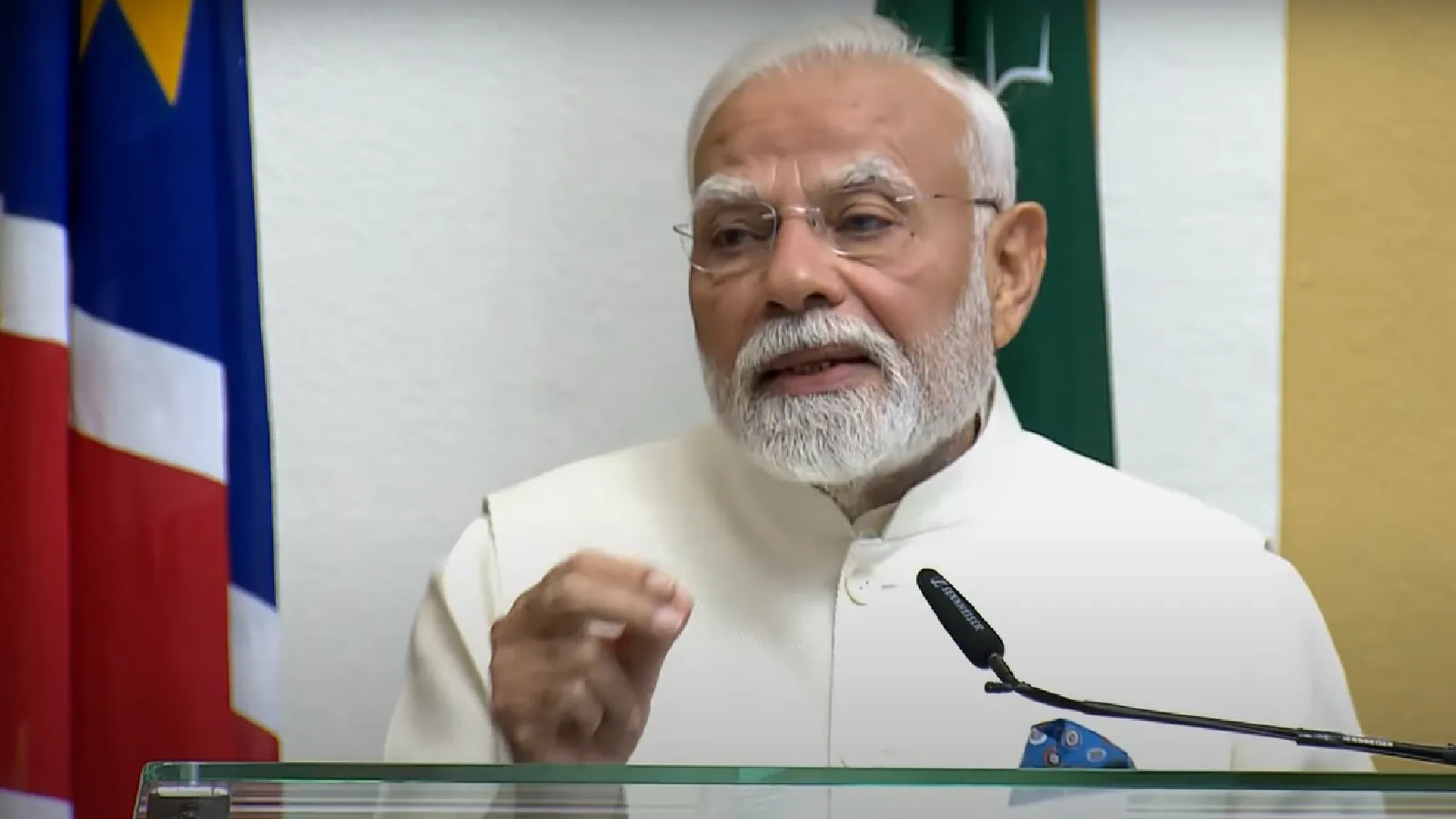

In the special address to the nation, Prime Minister Narendra Modi unveiled the ‘GST Bachat Utsav’, launching the next-generation GST reforms that go beyond conventional tax policy to become powerful tools of behavioural change and economic self-reliance.

These reforms — along with the income tax exemption on annual incomes up to Rs 12 lakh—are estimated to deliver Rs 2.5 lakh crore in annual savings, strategically applying behavioural economics principles to guide 140 crore Indians toward choices that strengthen Atmanirbhar Bharat.

By reshaping consumption patterns and incentivizing domestic production, these measures create a sophisticated choice architecture that nudges citizens toward healthier lifestyles, sustainable practices, and increased economic productivity, quietly accelerating India’s journey to becoming a truly self-reliant nation.

Unlike traditional economics, behavioural economics highlights that people’s decisions are influenced by biases, emotions, and social factors. The way choices are presented can have a bigger impact than the choices themselves. The GST reforms leverage this principle by creating a choice environment that gently nudges citizens toward better outcomes without imposing stricter rules or bans.

For instance, most dairy products such as ultra-high temperature (UHT) milk, pre-packaged and labelled chena or paneer, and all Indian breads such as chapati, roti, paratha, khakhra have been completely exempted from GST. This is a strategic nudge that rewards nutritious staples, encouraging healthier diets at millions of dining tables. This approach mirrors the flagship and successful scheme, “Beti Bachao, Beti Padhao”, which changed social norms through positive reinforcements and achieved enhanced sex ratio at birth along with higher school enrolments for girls.

The simultaneous 40% GST hike on tobacco and sugary beverages creates a powerful behavioural intervention. Data from the Indian Statistical Institute reveals that each 10% price increase triggers approximately 6% reduction in cigarette consumption, with the impact concentrated among price-sensitive consumers — primarily younger demographics and lower-income households. For India’s 100 million tobacco users, this price shock could trigger the largest voluntary consumption reduction in decades. Another profound behavioural nudge lies in completely exempting health and life insurance premiums from GST.

The exemption of tax on health and life insurance now allows more people to buy new health policy and enhance coverage, creating health security for families. This tax cut can spark a revolution. With wider insurance net, families will spend less out of pocket during medical emergencies, freeing up the money to either invest in business or buy new home. It creates a spiralling effect and generates jobs not just in insurance sector but also augment the overall economy.

Transportation accounts for 13% of India’s carbon emissions, with private vehicles contributing significantly. By keeping GST on electric vehicles at just 5%, Modi Government has engineered a price advantage that makes a Rs 10 lakh EV roughly Rs 70,000 cheaper than comparable petrol cars – a decisive nudge toward cleaner mobility.

The results speak volumes: EV sales surged 150% year-on-year in the first half of FY 2024, catapulting from 50,000 units in 2016 to over 2 million units today. Each EV displaces approximately 4 tonnes of carbon dioxide annually compared to internal combustion engines, meaning India’s 2 million electric vehicles now eliminate nearly 8 million tonnes of carbon emissions yearly. But the environmental dividends extend beyond carbon reduction.

Scientific studies demonstrate that electrifying transport cuts urban Particulate Matter 2.5 levels by up to 30%, reducing respiratory illnesses and healthcare costs. The 5% GST differential thus creates a virtuous cycle: economic incentives drive adoption, adoption improves air quality, and cleaner air enhances productivity making environmental protection economically self- reinforcing. These GST reforms are no less than an economic nudge of genius that changes the everyday decisions of 140 crores of Indians beyond just fiscal tinkering.

By making nutritious foods affordable, discouraging harmful consumption, promoting insurance uptake, and encouraging sustainable choices, the government has introduced a choice architecture without bans or mandates that nudges public towards more healthy choices with less effort. It demonstrates the incredible potential that small changes in price signals have for public health. This is behavioural economics applied to public policy at its best: not by giving instructions to people but by creating the decision space wherein the right thing to do becomes the easiest and most natural choice.

This isn’t just tax reform; it’s social engineering through economics, executed with a sophistication that would also impress economists from Cambridge to Chicago.

Varun Jhaveri is National Incharge, BJYM Policy Research and Training. Siddhartha Chepuri is National Member, BJYM Policy Research and Training. Views expressed in the above piece are personal and solely that of the authors. They do not necessarily reflect News18’s views.