Copyright The Street

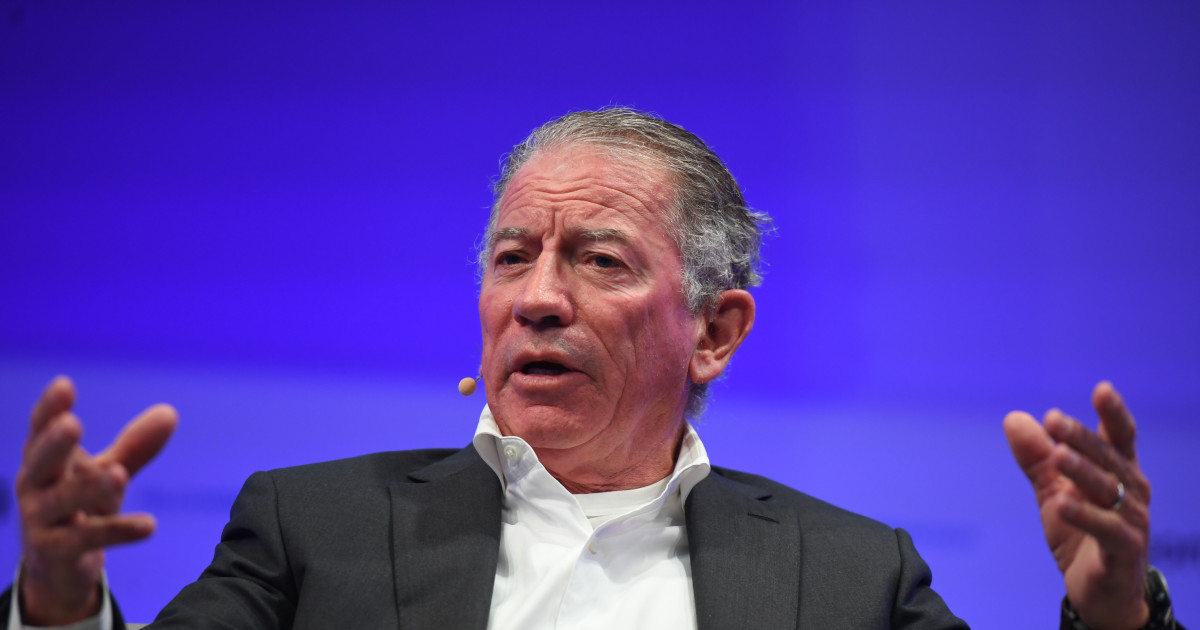

At the peak of the AI craze, C3.ai (AI) stock looked unstoppable, with a glossy ticker that represented the future. Today, according to a Reuters report, the company is weighing a sale, with investors adopting more of a show-me approach to once-hot and speculative “pure play” AI stocks. The shift is mostly poetic, though. Thomas Siebel, a Silicon Valley veteran who’s been instrumental in shaping the software space, confronts a market that seems to be running out of patience for promises. After slashing guidance and watching shares tank, C3.ai seems to be a cautionary tale of the moment. The business that once thrived on investor imagination finds itself scrambling to prove its real-world utility. In the post-hype AI market, that’s perhaps its toughest challenge of all. How C3.ai lost its spark Enterprise AI player C3.ai seems to be learning that perhaps the smartest tech stories can burn out. The business is exploring a sale after founder Thomas Siebel, who’s famous for selling off Siebel Systems to Oracle for billions, stepped aside for health reasons. He passed the baton to Stephen Ehikian, a former Salesforce executive, in September. Almost instantly, C3.ai withdrew its full-year guidance and began restructuring its salesforce, pointing to some major turbulence. Investors didn’t wait for clarity, either, as shares crashed by over 54% in 2025 alone, reducing its market cap to approximately $2.15 billion. A big part of the debacle had to do with its dismal results. The troubled AI player posted a worrying $116.8 million loss, along with a 19% year-over-year revenue drop. Now, reports suggest that its board is weighing “strategic alternatives,” from private-equity talks to a full sale. C3.ai’s hype outran the product C3.ai built its core business on enterprise AI tools for sectors such as energy, defense, and manufacturing. The problem was that its story continued to evolve much faster than its revenues. Founded as C3 Energy, the company rebranded itself as C3 IoT, and then finally transitioned into becoming C3.ai in 2019. That “AI pivot,” though, effectively turned out to be marketing gold. When ChatGPT hit the scene in late 2022, retail traders continued piling into anything with “AI” attached, and C3.ai’s ticker effectively became a magnet. By mid-2023, the stock’s market value had more than tripled as the frenzy peaked, spearheaded by Nvidia’s blowout forecast, sending AI stocks soaring. More Tech Stocks: As Palantir rolls on, rivals are worth a second look Nvidia’s next big thing could be flying cars Cathie Wood sells $21.4 million of surging AI stocks However, the exuberance outpaced the earnings. When C3.ai posted a weaker-than-expected sales outlook in June 2023, its shares dropped 13% in a single day, dragging down peers like BigBear.ai, SoundHound, and Guardforce AI. Consequently, C3.ai became both a meme stock and a cautionary tale for the market. When the memes met market math The meme-stock era was nothing short of extraordinary, beginning with GameStop and AMC, where Reddit-fueled traders essentially turned Wall Street into a spectator sport. In early 2021, GameStop stock, previously a laggard, skyrocketed from chump-change to $347, an eye-popping 10,000%-plus surge spearheaded by “diamond hands” memes, along with a collective mission to squeeze short sellers. Fast-forward to 2023, and that same playbook was on display under a shinier banner in AI. Traders rushed into anything that whispered AI. Even BuzzFeed’s stock nearly doubled after announcing plans to use OpenAI’s technology, despite the mounting losses. C3.ai rode that same wave, and its ticker alone became a rallying cry for retail investors looking to chase the next moonshot. AI’s hard reset For every AI stock soaring on the headlines, several others crashed back to earth. The past three years in particular showed that a transformative tech boom — despite the timing, execution, and market fit — still matters. Investors are learning that “AI-powered” doesn’t automatically mean profitable, or even sustainable, for that matter. From health care to defense to driverless cars, some of the biggest names in AI have faced reality checks. Some of the hardest AI falls: