Nvidia Corp. today announced plans to invest $5 billion in Intel Corp. as part of a collaboration that will see the companies jointly develop new chips.

The partnership encompasses both the data center and consumer segments. In the server market, Intel will develop custom central processing units optimized to work with Nvidia graphics cards. For consumers, Intel will introduce personal computer processors equipped with Nvidia chiplets.

Shares of both companies rose on the news. Intel jumped more than 20% while Nvidia is up 3.8%.

“There’s more in this deal for Nvidia than there is for Intel,” said Dave Vellante, co-founder and co-CEO of SiliconANGLE Media and chief analyst at theCUBE Research. “Ironically, Intel’s stock is up much more than Nvidia’s today, underscoring a fundamental misunderstanding of this deal by the market. This gives Nvidia a more direct path to Intel’s PC ecosystem while at the same time helping accelerate enterprise AI adoption with a hybrid CPU/GPU approach.”

“$5 billion is nice, but it doesn’t address the core of Intel’s most pressing challenge, which continues to be what to do about foundry,” Vellante added. “Frankly, the design side of Intel’s business is solid, but it’s hampered by the financial drag of foundry. I would have preferred to see a $5B (initial) investment in foundry in the form of wafer-scale volume commitments, and that’s the missing piece here.”

Currently, data center operators link together the Nvidia graphics cards and Intel CPUs in their servers using the PCIe interconnect. As part of their collaboration, the chipmakers will give customers the option to use NVLink instead of PCIe. NVLink is an interconnect that Nvidia originally developed to let customers connect its chips to one another. The technology, which is currently in its fifth iteration, provides more than ten times the throughput of PCIe.

Nvidia plans to incorporate the custom chips that Intel will develop as part of the partnership into its “AI infrastructure platforms.” The graphics card maker sells a line of artificial intelligence appliances called the DGX series. The company’s most advanced DGX system, the GB300, combines 72 graphics processing units with 36 of its internally-developed Grace CPUs.

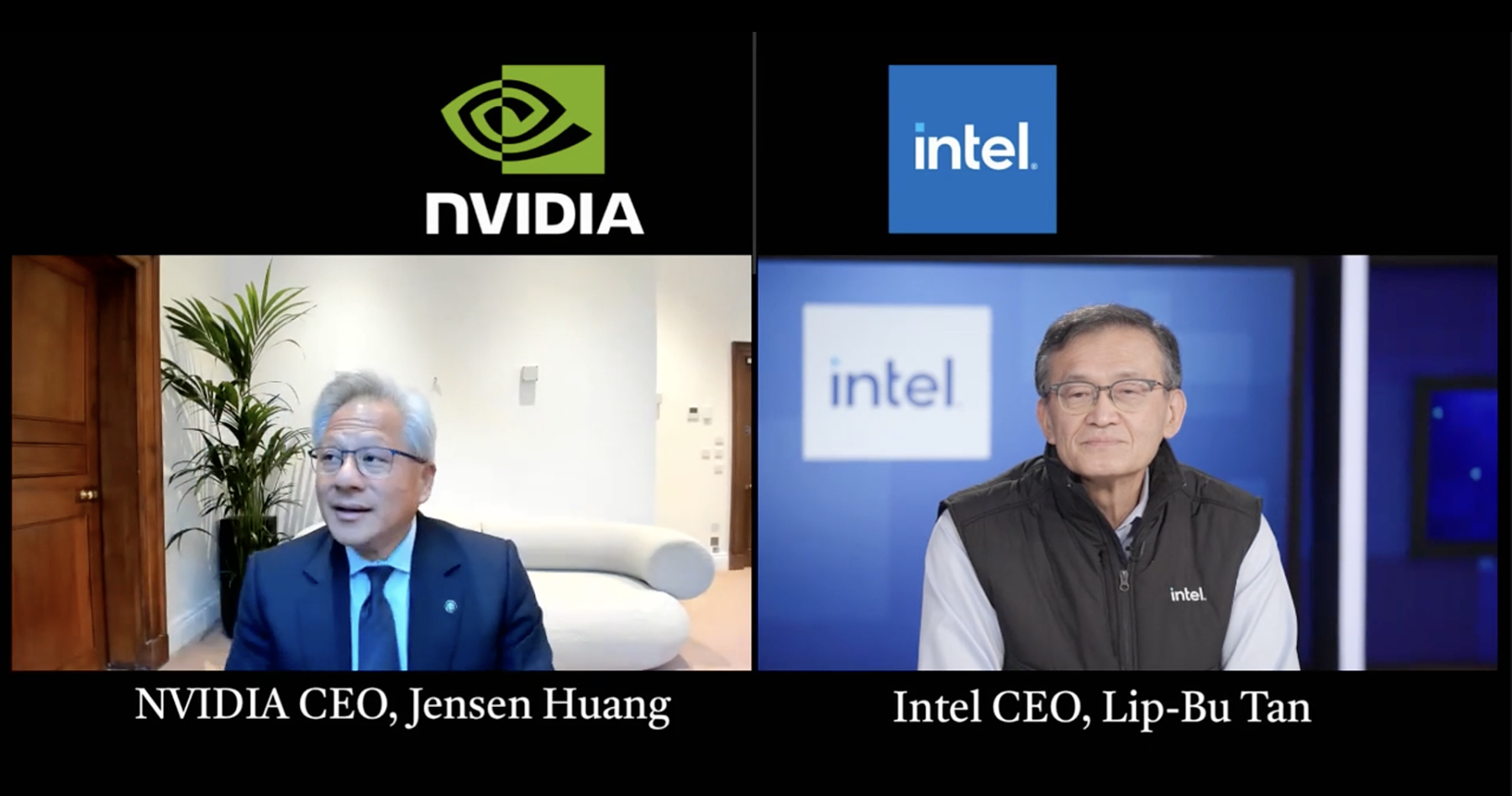

Nvidia Chief Executive Officer Jensen Huang said in a webcast today that the chipmaker will become a major Intel customer. It will resell the CPUs that it purchases to customers. Huang, who hosted the webcast with Intel CEO Lip-Bu Tan, stressed that Nvidia will continue to develop its own custom CPUs.

Huang said that Nvidia plans to ship not only its upcoming Vera chip, the successor to the Grace CPU in its GB300 appliance, but also a subsequent generation of custom CPUs. Furthermore, he confirmed recent rumors that Nvidia is working on a CPU called the N1. The chip will power the company’s DGX Spark system, a miniature version of its DGX data center appliances that can be used as a developer workstation.

“It’s a strategic move by Nvidia, which now gets control on the missing piece in its chip portfolio — CPUs,” said Constellation Research analyst Holger Mueller. “If Nvidia manages to tie its chips into the Intel server offerings, it will give it an additional foothold in the on-premises data center. Previously partnerships were the alley (such as with HPE), but partnerships in chip land don’t last forever. CxOs need to be aware of lock-in, but for now I think CxOs with Intel server farms are happy.”

In the consumer market, Intel plans to ship PC systems-on-chip equipped with Nvidia GPU chiplets. The chiplets will be derived from the company’s RTX series of standalone consumer graphics cards. The most advanced chips in the RTX series include AI cores based on Blackwell, the architecture that powers Nvidia’s data center GPUs.

Nvidia will use the $5 billion that it plans to invest in Intel to buy common stock for $23.05 per share. That’s a more than 5% discount to the latter company’s Wednesday closing price. The deal is poised to give Nvidia an approximately 4% stake in Intel, which will make it one of the chipmaker’s largest shareholders.

Image: Nvidia/Intel