Copyright Deadline

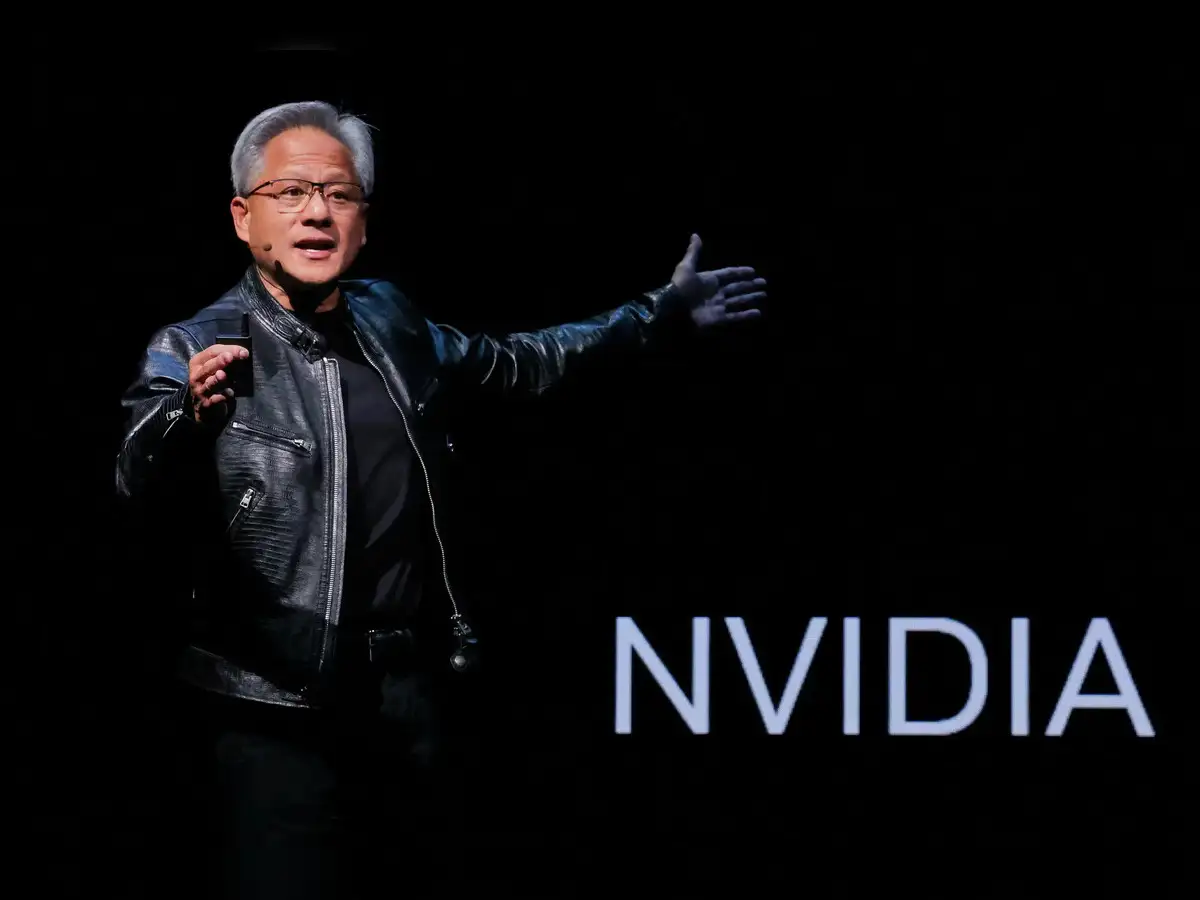

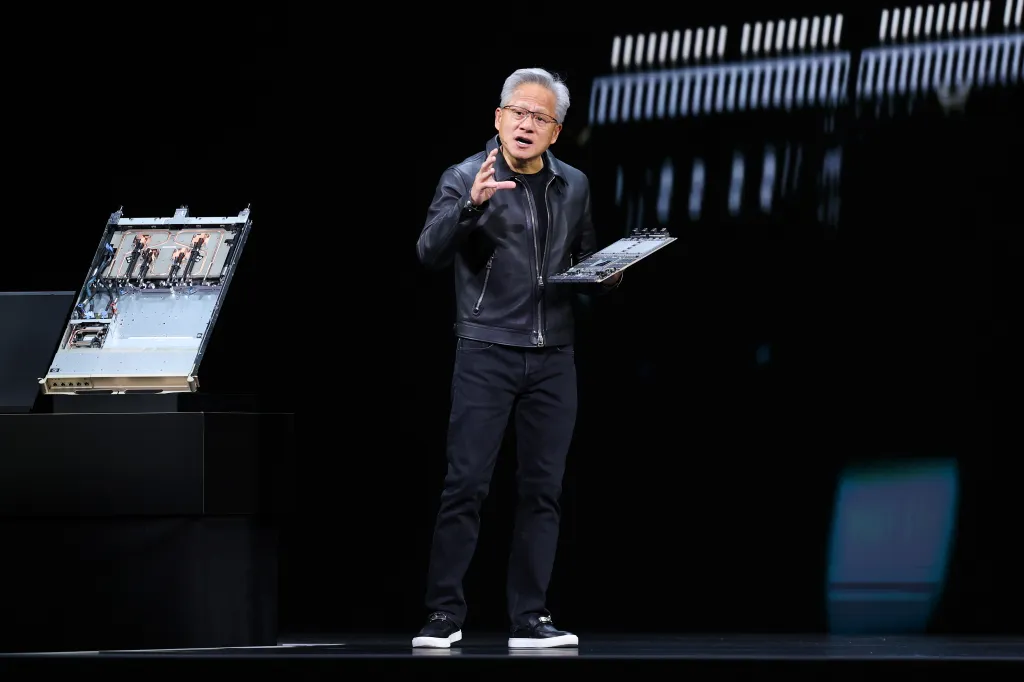

Nvidia is closing in on a record $5 trillion market value after a spree of announcements Tuesday lifted its shares another 5%. The company introduced a raft of innovations during its annual GTC event (which is short for GPU Technology Conference, a reference to Nvidia’s core product, the graphics processing unit). Partnerships with Uber, Palantir, Nokia and Oracle were unveiled, as were initiatives across computing, robotics, vehicles, medicine, telecom and other areas. Clad in his customary all-black ensemble of sneakers, jeans and leather jacket, CEO Jensen Huang delivered the news during his keynote address. Co-founded by Huang in 1993, the once-obscure maker of chips designed to power GPUs has vaulted to prominence during the artificial intelligence boom. The company’s high-flying shares added another 5% after the conference, closing at $201.03. They have risen 50% in 2025 to date. The company’s market value stood at $4.89 trillion at the end of Tuesday’s trading day. It is already near the $5 trillion mark after hitting $4 trillion only last July. “We couldn’t do what we do without Nvidia’s ecosystem of partners,” Huang said. Analysts said the diversification of the deals across so many sectors helped ease investor fears of an AI bubble. That element, combined by eager expectations for a Federal Reserve rate cut have propped up many tech stocks of late. With a projected $3 trillion in capital expenditure earmarked for the building of data centers and other AI capabilities in the coming years, bears on Wall Street as well as tech industry observers have questioned the sustainability of such spending. Bulls have countered that infrastructure is always a crucial phase for any major stage of progress, and that infrastructure comes at a price. Microsoft, whose value has soared past $4 trillion recently, is another tech giant focused on AI. It has been a longtime backer of OpenAI, maker of ChatGPT and video model Sora. On Tuesday, Microsoft said it had agreed with OpenAI on a new structure for its investment. It will hold a 27% stake in the for-profit arm of OpenAI, with the position valued at roughly $135 billion.