Copyright Benzinga

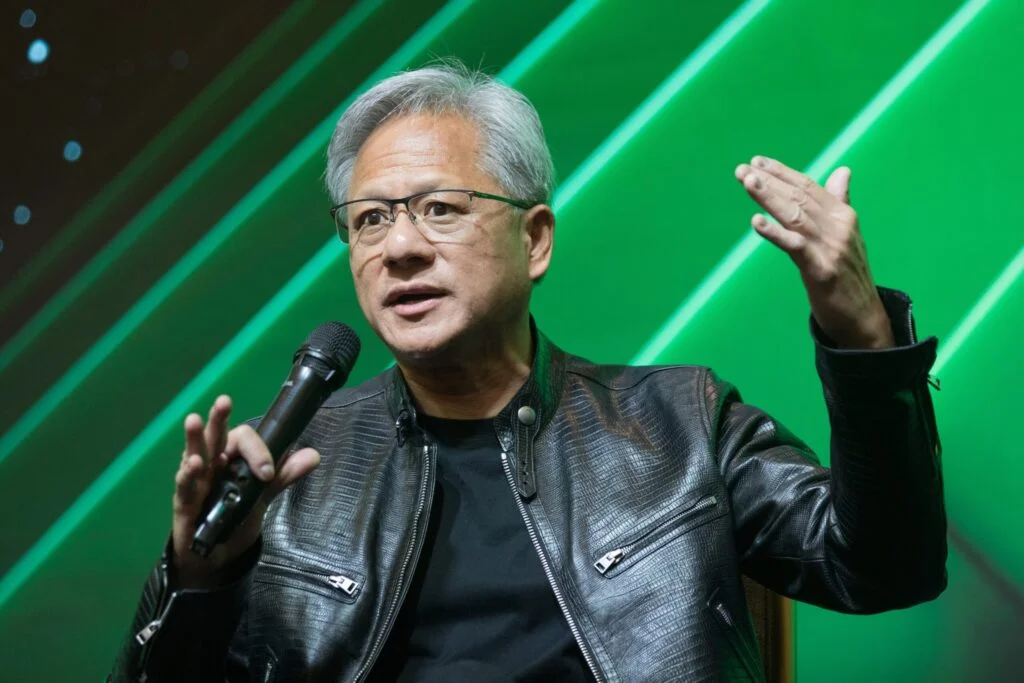

Nvidia Corp's (NASDAQ:NVDA) exit from China has been framed as a policy-driven blow, but AI-focused investors may view it as a chance for the company to double down on high-margin opportunities elsewhere. Last week, CEO Jensen Huang noted the company went from 95% market share in China to zero — a huge market loss on paper. Nvidia’s financial forecasts no longer assume any revenue from China, he added. Track NVDA stock here. Yet the real story lies in where Nvidia is channeling its resources now: into AI data centers, enterprise GPUs, and cloud partnerships that are driving unprecedented demand. Read Also: Nvidia’s Silicon Silk Road: From China’s Firewalls To Saudi Arabia’s Data Palaces Shifting Focus From Volume To Profitability China represented scale, but not necessarily the high-margin growth that powers Nvidia's AI leadership. Freed from the geopolitical and compliance challenges of the Chinese market, Nvidia can now focus on premium AI chips, enterprise deployments, and U.S.-friendly cloud partnerships. Investors should see this as a reallocation of capital from politically constrained volume to sectors where Nvidia can capture pricing power and strong margins, a subtle but meaningful shift in strategy. Supply Chains That Align With AI Growth The China exit also forces Nvidia to realign its supply chains and production priorities. By focusing on countries and partners aligned with Western technology policies, Nvidia reduces regulatory risk and ensures faster deployment of AI-focused GPUs to hyperscale cloud providers — the very engines of AI revenue growth. In other words, what looks like a market loss is actually an operational pivot toward the fastest-growing and most profitable segments of the AI market. The Investor Takeaway Nvidia's zero exposure to China is headline-grabbing, but the real implication is about strategic prioritization. By trading geographic scale for profit-focused AI growth, Nvidia is betting on sectors with stronger pricing power, less political risk, and higher margins. For investors, the lesson is clear: sometimes policy costs aren't a loss — they're a forced lens that sharpens focus on where the money actually is in AI. Read Next: Nvidia Doubled Its Trillions In Months—And The Charts Are Screaming ‘More’ Image: Shutterstock