Copyright indiatimes

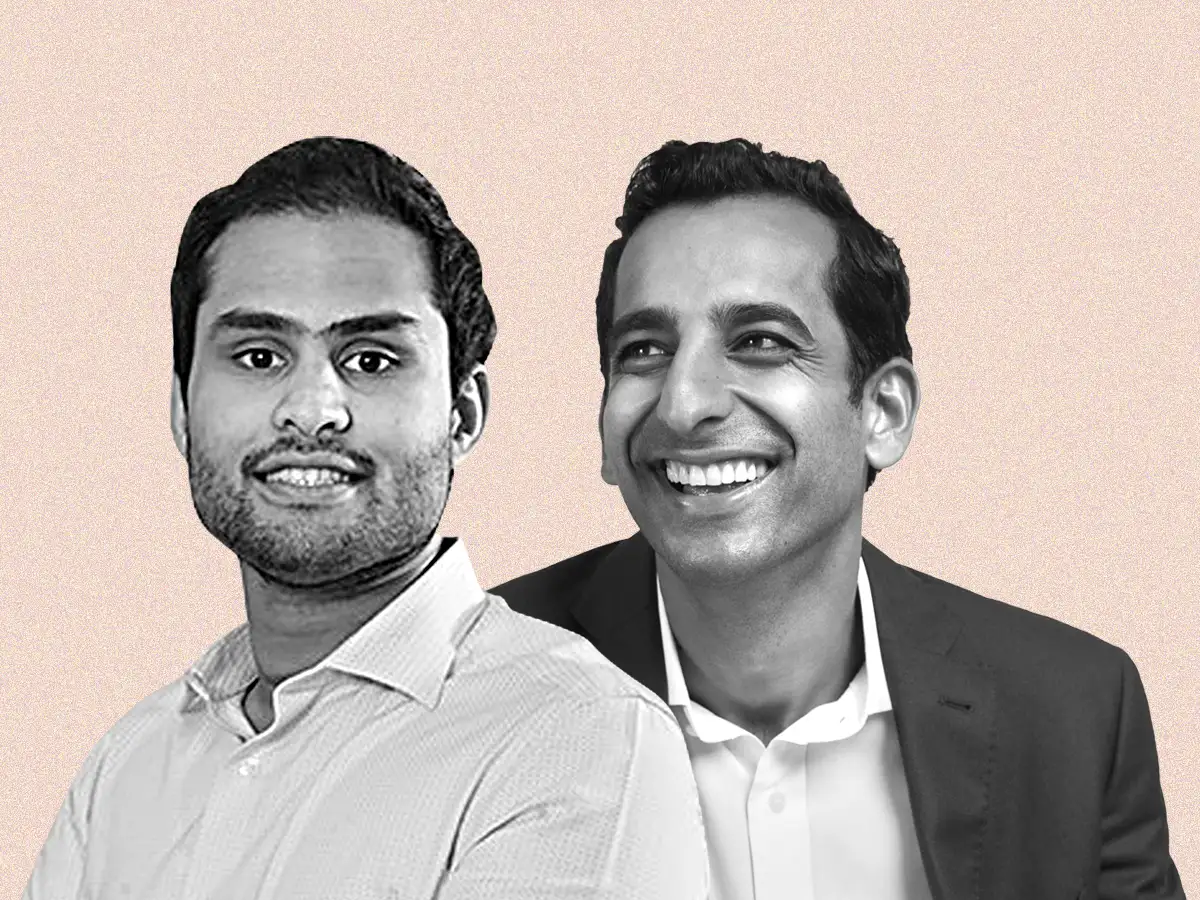

SoftBank in India has deployed around $10 billion across Vision Fund 1 and 2, with realised and still-liquid positions worth at least that amount, said Sumer Juneja, managing partner and head of EMEA & India at SoftBank Investment Advisers.As an increasing number of portfolio firms tap domestic public markets, Juneja told ET in an interview that SoftBank’s 13% stake in Lenskart--which listed on Monday and closed at a market cap of Rs 69,967 crore--has a paper value of about $1 billion, emerging as one of its biggest positions and potentially the largest return on capital for the investor in India if the price holds up for the omnichannel eyewear retailer.The initial public offering (IPO) from Lenskart came under scrutiny for being excessively priced as new-age economy stocks have still to show consistent profits.“It’s still very early in their journey... You can’t really put a verdict out yet... There’s a six-month lock-in, and during that period there’s pressure. FIIs (foreign institutional investors) have been big sellers in the Indian public market, and while domestic investors have absorbed a large chunk, there’s only so much they can take. The Indian market itself is up about 5-6% year-to-date, so it’s not booming…,” Juneja said. ETtech In the cohort of new age listed internet companies in India, Zomato and Blinkit’s parent Eternal; PB Fintech which operates Policybazaar; and beauty ecommerce platform Nykaa are among a few that have turned in profits, while most others are in need of cash to sustain growth. SoftBank sold shares worth $200 million through the offer-for-sale process and an earlier secondary transaction in Lenskart. Juneja said there was no pressure to exit.Among the Japanese group’s nine firms that have gone public over the past four years are Swiggy, Ola Electric, Delhivery and FirstCry.“There’s no pressure to sell because the parent or Vision Fund needs capital. Of course, we’re in the business of making money, so if incremental IRR (internal rate of return) isn’t attractive, we redeploy, but there’s no mandate to liquidate. We don’t report performance by region, but it’s safe to say India is one of the strongest-performing geographies in the Vision Fund,” said Juneja, who shuttles between London and Mumbai. SoftBank had ploughed around $200 million in the Peyush Bansal-led venture after having first backed it in 2019, when it was valued at $1.5 billion.The Masayoshi Son-founded conglomerate fully exited its position in Paytm and Policybazaar but Juneja said that despite several companies going public, SoftBank isn’t rushing to sell or list holdings. “We believe in compounding. Historically, SoftBank has held Alibaba and others for years. We evaluate execution, competition, macro conditions, and decide case by case. Sometimes we trim positions strategically; sometimes we hold,” he said. Ecommerce marketplace Meesho, where SoftBank holds 9.3% stake, is the next to go public with a Rs 6,500-7,000 crore IPO slated for December.Also Read: SoftBank expected to book $1.87 billion profit on IPOsFrothy public market valuationsSarthak Misra, partner at SoftBank Investment Advisers, said that while there’s debate about valuations, Lenskart and other startups have been able to snag a high-quality anchor book.“There are market factors and competitive dynamics, but it’s still too early to judge performance,” he said. Misra said that if one looks at Nykaa, the fashion business is still sub-scale; if they replicate what they achieved in beauty, today’s valuation will look cheap. “Maybe they execute, maybe not, but that’s the entrepreneur’s job- capital allocation,” he said.Similarly, Urban Company has built a strong platform, and now the instant house help category is emerging. “If they capture that effectively, we’ll look back and call today’s price conservative. Entrepreneurs who can spot and fund the next growth leg create outsized value”, Misra said.“Valuation is really a collective judgement… if companies can grow 25% or more for the next five to seven years, these valuations will hold”, he said.Also Read: SoftBank posts first annual profit in four years, but Ola and Swiggy weigh on Vision Fund 2 in Q4AI bets, new investmentsGlobally, SoftBank has been actively making big-ticket investments in artificial intelligence (AI), such as OpenAI, Perplexity, Runway, Tractable in Europe, Poolside, Graphcore and others, but with AI still not significant in India, the group has not closed a new investment here for more than three years. But Juneja said India remains a focus for SoftBank. Last year, it invested over $75 million across some of its existing portfolio firms Meesho, Juspay, Eruditus and Whatfix.“It’s been about three years since a new India investment, but we’re seeing a much better pipeline than 18 months ago. The AI opportunity is exciting…but we’re careful. You can always get carried away by hype…we’d rather get it right,” Juneja said.ET had reported in June that SoftBank was exploring buyout opportunities in India, marking a significant shift from being a growth- and late-stage technology investor to that of a direct acquirer of assets, according to two people aware of its plans. The group was considering acquiring Indian IT and BPO firms to integrate AI, having held talks with AGS Health, which didn't fructify into a deal.“We do want to deploy more capital. You’ve seen SoftBank group companies like Graphcore commit large amounts to infrastructure; Arm keeps committing more to compute. The intent is very high,” Juneja said, noting that Son visited India last year and met entrepreneurs and Prime Minister Narendra Modi.As for deploying smaller cheques, he said SoftBank is fairly flexible. “If we find a great company, we can go earlier. Our first cheque in Juspay was $35 million because it was a unique asset… We’ll adjust cheque sizes; there’s no rigid threshold,” he said.On AI valuations running into frothy territory, Juneja said, “Bubbles don’t mean you can’t make money. We’ve seen that before. We did much of our best investing in 2019-2021, which some called a tech bubble. But we backed strong founders with solid fundamentals and stayed disciplined. Now we’re seeing the rewards--Swiggy, Lenskart, Meesho, FirstCry. Even in a bubble you can win if you price right and pick well.”