Copyright radarr

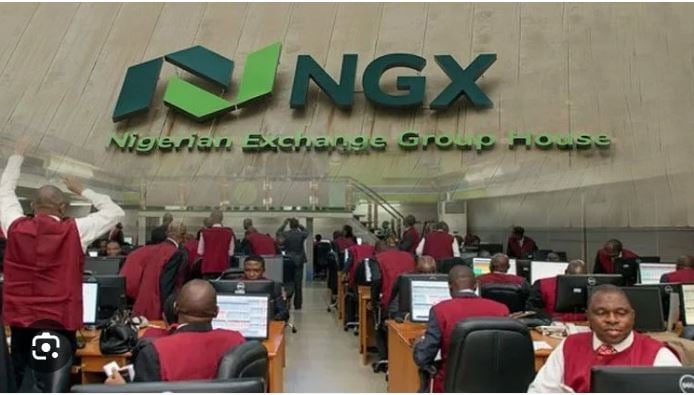

The Nigerian equities market started the week on a bearish note on Monday, as investors moved to take profits from recent gains in high-capitalisation stocks. The sell-off led to a loss of N94 billion in market capitalisation at the close of trading. Data from the Nigerian Exchange Limited (NGX) showed that the market capitalisation fell to N98.7 trillion from N98.8 trillion recorded on Friday, representing a 0.1 per cent decline. The All-Share Index also dropped by 148.90 points to close at 155,496.15 points. Despite Monday’s decline, analysts noted that the market remains largely positive. The NGX has maintained a one-week gain of 3.71 per cent, a four-week gain of 9.4 per cent, and an impressive year-to-date return of 51.08 per cent, reflecting strong investor sentiment and continued confidence in the Nigerian economy. Trading data revealed that investors traded a total of 502.99 million shares valued at N24.94 billion across 39,945 deals. This represented a 58 per cent decline in trading volume and a 21 per cent drop in turnover compared to the previous session. However, the number of deals increased by 33 per cent, suggesting higher trading activity despite reduced volume. The day’s market activity was dominated by transactions in the financial and industrial sectors. Access Holdings led the volume chart with 68.9 million shares worth N1.62 billion, followed closely by FBN Holdings, which traded 66.6 million shares valued at N2.09 billion. Universal Insurance and Sovereign Trust Insurance both recorded active trades of 19.2 million and 19.1 million shares respectively, while Zenith Bank traded 18.2 million shares. On the value chart, Aradel Holdings emerged as the top performer, recording trades worth N5.63 billion. It was followed by Presco Plc with N2.25 billion, FBN Holdings with N2.09 billion, Dangote Cement with N1.65 billion, and Access Holdings with N1.62 billion. The overall market breadth closed negative, as 25 stocks gained while 34 declined. Aradel Holdings led the gainers with a 10 per cent rise, closing at N869 per share. NEM Insurance gained 9.67 per cent to close at N32.90, Aso Savings & Loans rose by 9.09 per cent, and Eterna Plc appreciated by 8.75 per cent. On the losers’ table, Deap Capital Management and Trust recorded the biggest loss of the day, falling by 9.71 per cent to close at N1.58. Champion Breweries followed with a 9.64 per cent decline to N15 per share. Red Star Express dropped by 8.64 per cent, while Wapic Insurance and PZ Cussons fell by 6.45 per cent and 5.94 per cent respectively. Sectoral performance across the market was mixed. The Oil and Gas Index rose by 4.24 per cent, supported by gains in major energy stocks. The Insurance Index also advanced by 1.09 per cent, while the Main Board Index increased slightly by 0.22 per cent. On the other hand, the Pension Index fell by 0.48 per cent, and the Top 30 Index recorded a marginal decline of 0.08 per cent, reflecting mild profit-taking by institutional investors. Market analysts attributed the day’s loss to a natural correction following last week’s strong rally. They noted that after weeks of sustained growth, investors often take profits, particularly in blue-chip stocks such as Dangote Cement, BUA Cement, and MTN Nigeria. Last week, the Nigerian stock market recorded one of its best performances in months. The NGX gained 4.48 per cent, adding N4.32 trillion to its overall value in a single week. The market capitalisation had closed at N98.79 trillion, while the All-Share Index settled at 155,645.05 points. Analysts said that renewed investor confidence, driven by improved liquidity and stronger earnings reports, had boosted the market’s performance. Despite Monday’s setback, investment experts maintain that the outlook for the Nigerian equities market remains positive in the medium term. Factors such as improved corporate earnings, ongoing reforms in the financial sector, and increased local participation are expected to sustain growth. However, they advised investors to remain cautious and focus on fundamentally strong stocks while taking advantage of price corrections. With market capitalisation still near record highs and trading activity remaining strong, the Nigerian stock market continues to reflect investor optimism in the country’s economic recovery and long-term potential.