Copyright NBC10 Boston

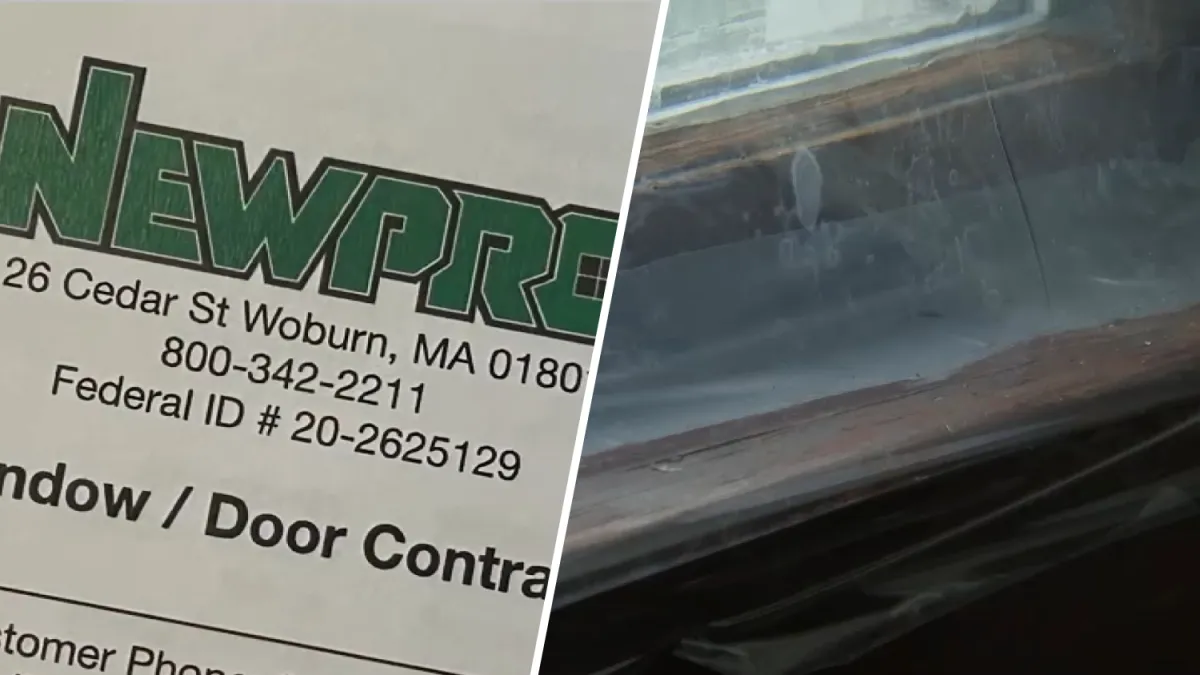

Stella Hills-Thompson was just trying to stay warm this winter. The widow in Boston's Hyde Park neighborhood had plastic and tape covering her windows, desperate to keep the cold out. So when she received a recommendation from Mass Save to use Newpro for energy-efficient, three-pane windows — she jumped at the chance. But now, she's facing a nightmare scenario: a loan of nearly $39,000 for windows that were never installed. "I'm going to go another winter without decent windows," Hills-Thompson said. "Being elderly, I didn't want another freezing winter. I have everything short of a bear covering my windows." She didn't go through Mass Save for financing, instead working with GreenSky, a third-party lender. Newpro came out on Oct. 7 to measure the windows and promised to begin work by the end of the month. But the work never started. Newpro, once a family-run home renovation company, was sold three years ago to Renovo Home Partners, a private equity firm owned by global investment giant BlackRock. Hills-Thompson didn't know that when she signed on for 27 windows to be installed in her home and garage — a job that would cost nearly $80,000. Now, Renovo has filed for Chapter 7 bankruptcy, abruptly shutting down Newpro and leaving hundreds of customers and employees in limbo. "I feel like I've been taken advantage of," Hills-Thompson said. "No work was ever completed. I'm going to pay them $38,000 to measure windows? I don't think so." Chapter 7 bankruptcy: A legal shield for companies, a wall for consumers NBC10 Boston legal analyst Michael Coyne says Chapter 7 bankruptcy is a "straight liquidation" — not a reorganization plan. That means the company's remaining assets will be sold off and distributed to creditors, but those assets are likely minimal. "Any claims that anyone has at this point, once the bankruptcy is filed, have to go through the bankruptcy court," Coyne explained. "It's a method of protection for the company to wind up its affairs without fighting lawsuits in courts across the commonwealth." The classification broadly shields the company, but "it's really problematic for the employees, it's problematic for the consumers," Coyne said. "Because they're likely not to see much of a return on that money at all." While employees may be among the first in line to receive payment due to priority wage claims, Coyne says consumers are likely to be left with little. "There are very few assets to distribute, and secured creditors come first," he said. "That leaves consumers far down on the list." Coyne also pointed out that BlackRock, which owns Renovo, is likely shielded from liability due to the corporate structure. "They've got a separate company doing business as Newpro, so their assets are protected," he said. "That's why these investment firms set up different corporations — to protect the major investors." He added that while BlackRock has the resources to cover the losses, "they're not going to throw good money after bad … that's the whole idea behind private equity is — we're in it as long as we can make money. And when BlackRock figures it cant make money, then it's time to terminate the business, and that's what appears they've done here." Attorney general investigating Massachusetts Attorney General Andrea Joy Campbell says her office is receiving a wave of complaints from affected homeowners. "Once we learn more in the bankruptcy filing, there may be avenues for these constituents to get restitution and to be made whole, so we are on top of it as best we can," Campbell said. "It's unfortunate, to say the least, but I think there are some channels and opportunities available for, hopefully, people to get their money back." Campbell urged anyone impacted by Newpro's shutdown to file a complaint online or contact her office directly. Hills-Thompson is trying to work with GreenSky, which asked for documentation to build a profile of her case. But she's worried about what would happen if she isn't released from the debt. "I don't really know where I stand in all of this, and it's really scary," she said with tears in her eyes. "I don't have family. I'm a widow. I don't know what I would do. I really don't." She's not alone. Renovo listed 685 likely creditors in its bankruptcy filing. Newpro employees left without pay Darrell Interbartolo, a former bath installer for Newpro, says he's still waiting on nearly $8,000 in unpaid wages. "We earned that money. We worked hard for it," he said. "For what we did for this company, and the amount of money we made for them — to not pay us our final check, it definitely left a sour taste in my mouth over it." Interbartolo says he was shortchanged $7,720. "It doesn't even make sense," he said. "We were a profitable company. We had more jobs than we've ever seen in our warehouse ready to go." He says the company was paying workers $15 an hour, despite paperwork showing they were supposed to earn $40. Still, Interbartolo is trying to turn the situation around. He's launched his own business — D. Bartolo Remodels LLC — and says he's willing to help customers left stranded by Newpro's collapse. "I've already applied for my LLC and contractor's license," he said. "I'm just kind of taking a bad situation and turning it into a positive." A cautionary tale Hills-Thompson hopes her story serves as a warning to others. "Do your homework. I thought I did," she said. "But you never know who's out there and what masks they wear — until something like this happens and all the layers start coming off." She says no one ever told her the company was in financial trouble. "Had I realized this, I wouldn't have gone with them," she said. Now, she's left with a loan, faulty windows and a fear that she'll be left out in the cold — literally and financially. "I don't want them to put a lien on the house," she said. "I don't want to freeze. I don't want to die and have someone find me dead, frozen in the house."