Copyright Forbes

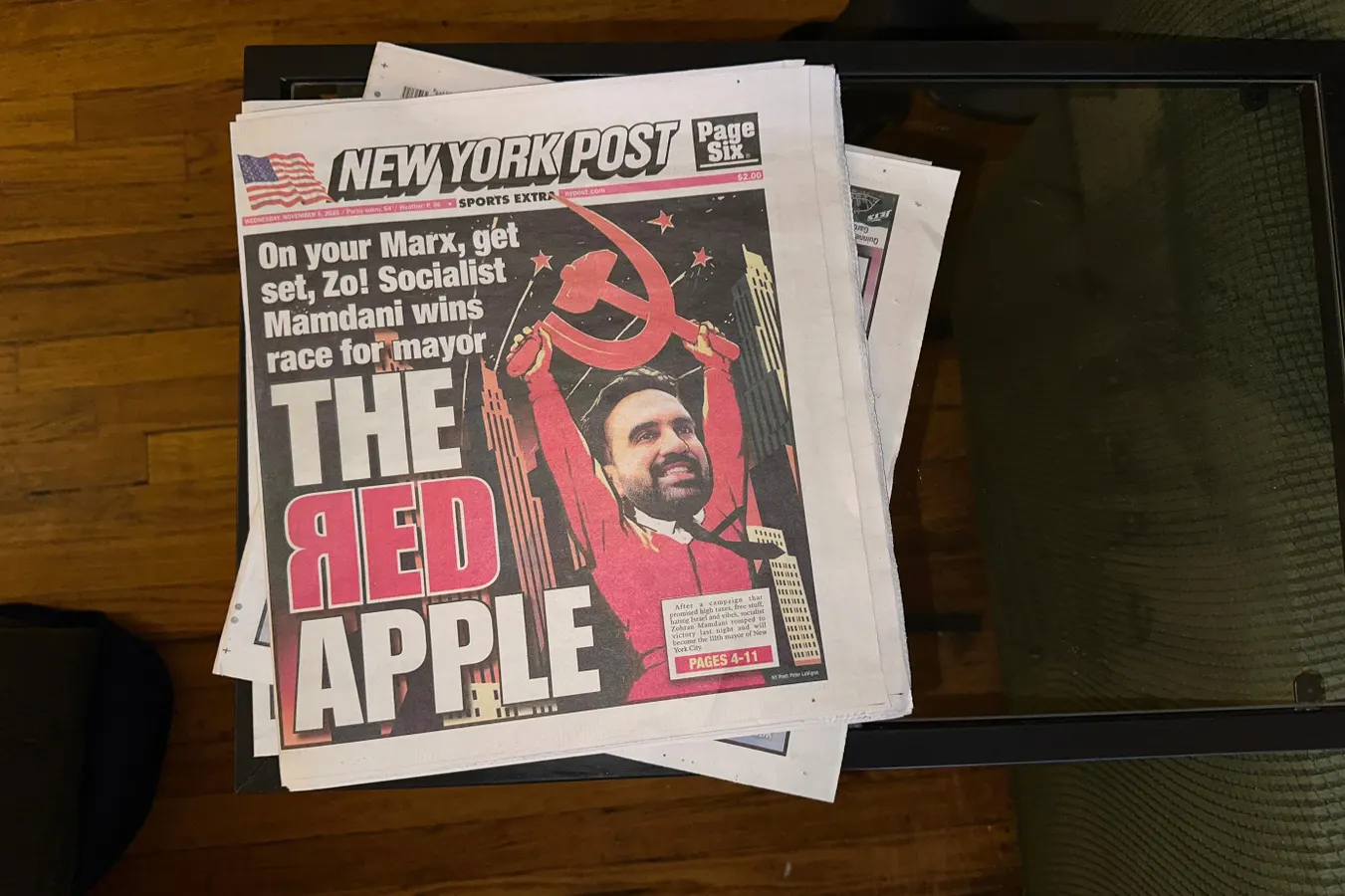

Richard Pollina reported in the New York Post that nearly a million New Yorkers were ready to flee the city in the event of Zohran Mamdani’s election as mayor. And it seems that it is not just the city. "The Carolinas, Florida, and Tennessee have emerged as top escape destinations thanks to lower income taxes and property taxes." People contemplating the move need to consider how difficult it can be to sever their tax ties with the State of New York. A recent decision by the New York Division of Taxation can give you some sense of that. John J. Hoff and Kathleen Ocorr-Hoff were planning to transition from being New Yorkers to being Floridians. They thought they had gone far enough to have filed a part year New York non-resident return for 2018 and full year non-resident for 2019. The New York Division of Taxation did not agree and Administrative Law Judge Barbara J. Russo agreed with the Division. The Division did not raise the issue of statutory resident for 2019, so the opinion is all about domicile. Reading domicile opinions can be more interesting than some novels, as a judge struggles to determine someone's true home. About Domicile According to the Division's regulation domicile is the place that an individual intends to be their permanent home. It is the place they always intend to return to. Once a place is established as their domicile it remains so until they establish a new one. The burden is on the person claiming a change of a domicile to prove it. Doing something like registering to vote in the new home is indicative but not determinative particularly if there is a tax motivation involved. When someone has more than one home, the length of time spent at each of them is an important factor, but not determinative. Even though you can only have one domicile it is possible to be a resident of more than one state. While domiciled in one state you can be a "statutory resident" of a different state. If you have a permanent place of abode in New York and spend more than 183 days in New York (and a day is any part of a day unless you are in transit) you will be a statutory resident of New York regardless of your domicile. On the other hand, New York will not treat you as resident even though domiciled in New York if you don't maintain a permanent abode in New York and spend less than thirty days there. MORE FOR YOU The Story Statutory residence was not an issue with the Hoffs. The decision was solely based on domicile. Had they become Floridians on October 29, 2018 or did they remain New Yorkers through 2019? At stake was $59,648 in tax plus interest. The Bureau of Conciliation and Mediation Services sustained the tax amount, but cancelled a proposed penalty. The Hoffs had both lived in the State of New York since the late seventies. They were married in 2008. Between them they have five adult children from previous marriages. Three of them live in New York as do Mrs. Hoff's elderly parents. In 2011 they purchased a home in Canandaigua NY, referred to as the Poplar Beach home. Previously they had lived in Honeoye NY. On their income tax returns they reported rental income from three New York properties. In 2014 they purchased a 2,650 square foot, three bedroom, three bathroom condo in Naples FL. The Naples home was furnished with furniture purchased in Naples rather than moved from New York. They did move their Waterford crystal, of great sentimental value, to Florida. The Naples property had an estimated value of $1.3 million in 2020 and was assessed in 2023 at $1.6 million. The Poplar Beach home in New York was assessed at $907,000 in 2022. In 2018, the transition year, the Hoffs were in New York 186 days, Florida 131 days and elsewhere 48 days. In 2019 it was 164 days in New York, 153.5 in Florida and 47.5 days elsewhere. They spent Christmas in New York in both years whereas Thanksgiving was 2018 in New York and in Florida in 2019. Mr. Hoff was president and 100% shareholder of a company called Global Point Technology (GPT) located in Farmington NY. Mr. Hoff indicated that his sole role in the company was sales. The occupation listed on his 1040 was "MGR/Salesman". Sometimes a lot of thought goes into answering that question. Often it ends up being copied over from year to year. The move to Florida was part of his retirement plan. He planned to work less and have his son step into his role. Concerns about the business environment caused him to abandon that plan. Instead he handed more responsibility to someone who had been managing much of the company up till then. Ultimately he sold the company in 2021 agreeing to continue working for it till 2023. Mrs. Hoff worked as a graphic designer filing a Schedule C which was moved to Florida. The Hoffs filed Florida Declaration of Domicile, obtained Florida drive's licenses and registered to vote in Collier County FL in 2018. Mr. Hoff entered a 2020 Florida hunting & fishing license in evidence and testified that he probably had an earlier one. Revocable trusts and wills were updated to indicate Florida residence. There was also discussion of accountants, lawyers, medical providers, country clubs and surgery. The Ruling Judge Russo's ruling could be summed up as the Hoffs are heading towards being Floridians but really hadn't crossed over yet. "The record is clear that petitioners planned to make Florida their permanent home at some point. The question is, when did their plan finally materialize such that they effectively changed their lifestyle “to give up the old and take up the new place” (Matter of Newcomb, 192 NY at 251). Upon review of the entire record and pursuant to the foregoing standards, it is concluded that petitioners have not proven, by clear and convincing evidence, that they gave up their New York domicile and acquired a new domicile as their fixed and permanent home in Florida as of October 30, 2018." Probably the biggest factor in the decision was Mr. Hoff's stalled business transition. Continuing to own the Poplar Beach home and spending more time in New York than Florida were also very significant. Then there were the little things, which might have been avoided. Mrs. Hoff had claimed that she had closed her New York business and opened one in Florida. Judge Russo noted that on the federal returns there was a New York business address for both 2018 and 2019. Mr. Hoff's W-2 for 2018 had his New York address. Dan O'Brien of Woods Oviatt Gilman, who represented the Hoffs, declined to make any comments before the matter was formally concluded. Other New York Cases Many states will strive to hang on to people as taxpayers. Only Alaska, which sort of pays people to live there, seems to lean in the opposite direction. New York seems to be one of the clingiest. Here are some other New York residence cases I have covered. What Happens When You Are A Full Year Resident Of More Than One State - Samuel and Louise Edelman, domiciled in Connecticut, ran afoul of the statutory resident rule. Hard For Snow Birds To Avoid New York Tax - Donald and Rose Liberman with places in Queens and Boca Raton. They just could not show enough enthusiasm for Florida to establish a domicile change. There were also problems with their logs so they might have been caught as statutory residents regardless. Manhattan Spring Costs Internet Executive Quarter Million in State and City Tax - A two month delay in clearing out an apartment led to a quarter million in tax on a large capital gain. Donald Trump Floridian - This is not a decision, but there is a worthwhile if light hearted discussion of going from New Yorker to Floridian. I anticipated President Trump's domicile switch to Florida by almost two years. Match Group CEO Wins Tax Case By Arguing His Heart Was In Texas With His Dog - This story illustrates the almost mystical nature of domicile. A case with terrible facts is won by the taxpayer's dog. Other Coverage Geoffrey Weinstein and David Jasphy on the Cole Schotz P.C. Tax. Trusts & Estates blog have Snowbirds' Wings Clipped by New York Tax Appeals Tribunal. "Because the primary factors remained present in New York, the Tribunal gave little weight to 'formal declarations' or estate planning that purported to show Florida was their new home." They close with advice that while perhaps self-interested is sound. "With the political environment about to change in New York and New Jersey with many anticipating an all-out assault on high net worth taxpayers, ensure that you engage competent tax attorneys to guide you in planning a change of domicile and protect your rights in anticipating a residency audit."