By Alden Abbott,Contributor,Mark Wilson

Copyright forbes

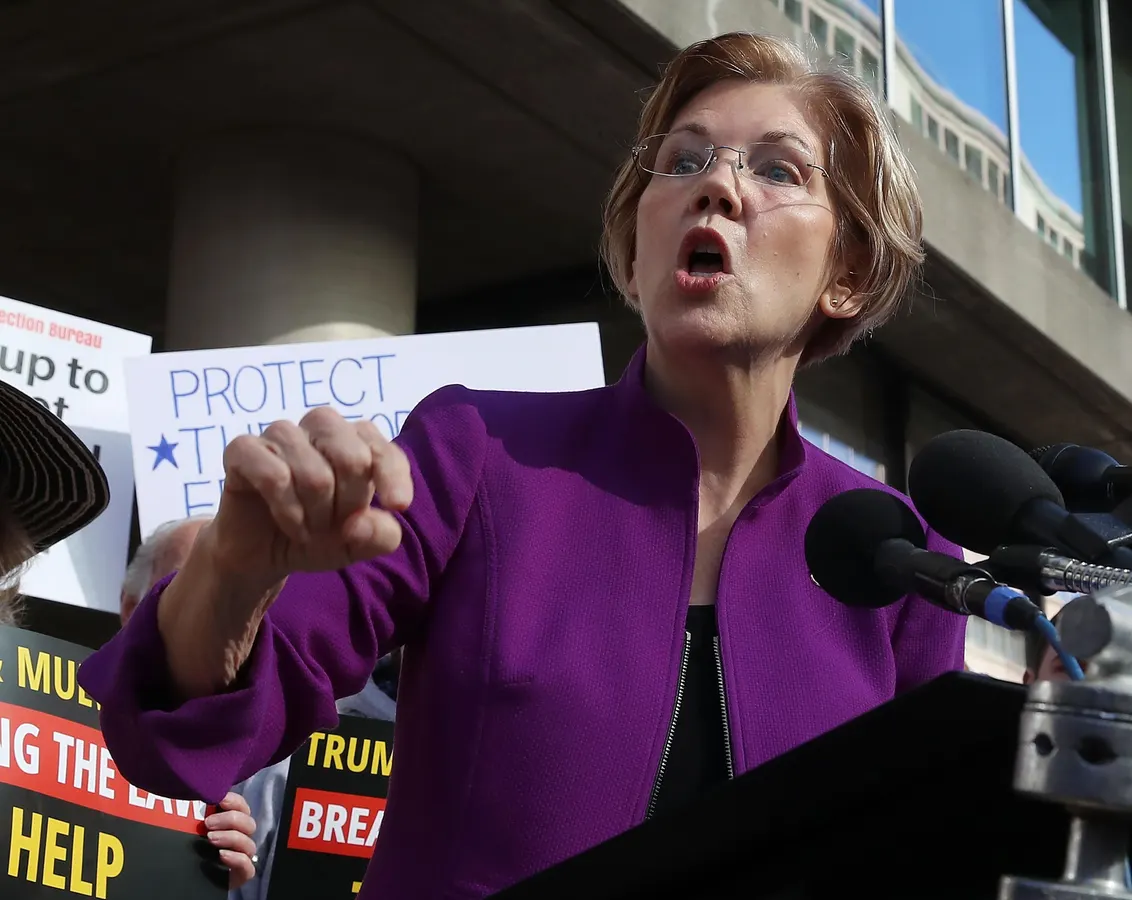

WASHINGTON, DC – NOVEMBER 28: Sen. Elizabeth Warren (D-MA) speaks during a protest in front of the Consumer Financial Protection Bureau (CFPB) headquarters on November 28, 2017 in Washington, DC. Sen. Warren is demanding that Mick Mulvaney step aside and let acting CFPB director Leandra English do her job. President Trump named Office of Management and Budget (OMB) Director Mick Mulvaney to replace outgoing CFPB Director Richard Cordray. (Photo by Mark Wilson/Getty Images)

Getty Images

Strong and vibrant financial markets are key to a thriving American economy. Rising regulatory costs, however, pose a burgeoning threat to financial market efficiency. Trump Administration initiatives to harmonize federal government oversight of U.S. financial markets and to reform existing regulatory programs are notable. A new push to eliminate anticompetitive federal financial rules could yield further dividends and might serve as a catalyst to energize American economic growth.

Financial Markets Underpin the U.S. Economy

Access to capital underpins business transactions throughout the economy, from local small business contracts to multibillion dollar mergers and acquisitions.

Financial market efficiency is extremely important to the U.S. economy, as it allows for the effective allocation of capital to businesses, which drives economic growth and job creation.

Efficient markets also provide mechanisms for risk management, fair price discovery, and increased investor confidence, leading to greater financial stability and prosperity. They connect savers with borrowers at a low cost, ensuring that funds flow to their most valued uses.

The U.S. is a global leader in financial markets due to its scale, influence, and innovation, but its markets still face efficiency challenges from technology gaps, data issues, and fragmentation. Potential improvements include broader technology adoption, harmonized regulations, and enhancing market data for better transparency and liquidity. In addition, ensuring that financial services regulations are procompetitive could further improve the workings of those markets.

MORE FOR YOU

Rising Regulatory Costs

Increasing regulatory requirements that drive up costs are a growing problem for financial markets. They erode firm profitability, stifle innovation, and hinder economic growth.

The costs of financial services regulation include substantial direct expenditures by firms on compliance staff, technology, and advisory services, as well as indirect costs such as higher operating expenses, potential fines for non-compliance, and broader economic impacts like increased capital costs and reduced economic growth due to stringent rules.

Other huge costs arise from the inefficient distortion of competitive forces by regulations that limit the lawful activities in which financial firms can engage. Such distortion discourages innovation and new investment, reduces product quality, and slows economic growth.

The costs of compliance alone are massive:

Some estimates place global annual financial crime compliance costs at $206 billion, with North American firms spending $61 billion.

Financial institutions’ own spending on compliance grew by 61% in employee hours between 2016 and 2023, and their IT budgets for compliance increased significantly.

Direct and indirect compliance costs can average 19% of a firm’s annual revenue, depending on its size.

Total costs continue to rise, due to increasing regulatory complexity (in such areas as cybersecurity, data privacy, and anti-money laundering).

Harmonizing SEC and CFTC Oversight

Government can do its part to reduce financial market regulatory complexity, which is a “real pressure point[] for capital markets firms” in 2025.

The Trump Administration is taking initial steps in this regard.

Securities and Exchange Commission Chairman Paul Atkins announced on September 29 a new plan for harmonizing Securities and Exchange Commission and Commodity Futures Trading Commission oversight over a key subset of financial markets.

The SEC regulates securities such as stocks, bonds, and investment contracts, while the CFTC regulates financial instruments directed at commodities and their derivatives, such as futures and swaps.

After noting the convergence of what were once separate markets overseen by the 2 agencies, Chairman Atkins highlighted the problems created by continued regulatory fragmentation:

“[D]ecades of regulatory fragmentation have left innovation stranded. Entrepreneurs forced to navigate two, often conflicting, rulebooks have taken their ideas overseas. Investors have been saddled with duplicative collateral requirements, locking up capital that could otherwise drive growth. America, the nation that gave the world the deepest, most dynamic markets, has watched innovation migrate abroad as our two agencies protected their turf at the expense of the American investor.”

Atkins stressed that excessive regulatory burdens imposed by the SEC and CFTC can be reduced, even without fully merging the 2 regulators:

“What matters is building a framework where our [2] agencies coordinate seamlessly, reduce duplicative regulation, and give markets the clarity they deserve. The path forward right now is collaboration, not consolidation. I look forward to working with Congress and my counterparts across the Administration to ensure the SEC and CFTC operate in concert, side by side, hand in glove, so that American innovation and investment can thrive.”

The details will have to be fleshed out, but that is a good start.

The Bigger Task: Reforming All Federal Financial Regulation

While important, SEC and CFTC oversight is only a small corner of federal financial regulation, as a 2023 Congressional Research Service report explains:

“At the federal level, [financial] regulators can be clustered in the following areas:

Depository [banking] regulators—Office of the Comptroller of the Currency (OCC), Federal Deposit Insurance Corporation (FDIC), and Federal Reserve for banks and National Credit Union Administration (NCUA) for credit unions;

Securities markets regulators—Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC);

Government-sponsored enterprise (GSE) regulators—Federal Housing Finance Agency (FHFA), created by HERA, and Farm Credit Administration (FCA); and

Consumer protection regulator—Consumer Financial Protection Bureau (CFPB), created by the Dodd-Frank Act.”

In addition to harmonizing securities market regulation (already discussed), the Trump Administration has taken or is considering various regulatory reform actions directed at the other 3 areas. These include:

Ending Debanking

An August 2025 executive order barring regulatory support for “debanking”:

The order directs federal banking regulators not to promote policies and practices that allow financial institutions to deny or restrict services based on political beliefs, religious beliefs, or lawful business activities.

The order points to specific debanking efforts (such as “Operation Choke Point”) aimed at disfavored businesses under prior administrations.

Possible GSE Privatization

The Trump Administration is said to be considering public offerings of stock to take GSEs Fannie Mae and Freddie Mac out of federal government conservatorship (instituted in 2008 to prevent a systematic crash in the U.S. financial system). How this might affect the nature of GSE regulation has not been addressed publicly.

CFPB Reform

Key CFPB reform initiatives have been focused on reducing the agency’s size and scope, rolling back regulations, and decreasing its enforcement authority. Actions taken include:

A 50% budget cut, authorized by the One Big Beautiful Bill.

Using the Congressional Review Act (CRA), Congress and the President nullified a 2024 rule that would have capped bank overdraft fees (a “junk fees” rule that could actually have harmed poorer consumers by limiting their access to banking, according to analyses by Scalia Law School Professor Todd Zywicki).

Scrapping a rule that would have subjected data brokers to stricter requirements under the Fair Credit Reporting Act. The withdrawal came after commenters raised concerns about the rule’s alignment with FCRA and the CFPB’s statutory authority.

Deciding to rewrite a Biden “open banking” rule requiring bank data sharing. Many financial institutions had raised concerns about data security, costs, and the rule’s perceived overbreadth.

Terminating multiple investigations and consent decrees that new CFPB leadership deemed no longer justified.

The Next Challenge – Anticompetitive Rules

The Trump Administration has been diligent in carrying out financial regulatory reforms that are feasible without major statutory change. Those reforms, while significant, are necessarily limited (and will predictably be subject to judicial challenges).

A broad legislative simplification of the incredibly complex and onerous financial oversight framework might be beneficial, but does not appear to be in the cards at this time.

A new highly beneficial reform agenda would entail the repeal of anticompetitive financial regulations, pursuant to an April 2025 executive order targeting such harmful rules economy-wide.

There is substantial economic evidence that anticompetitive financial rules have harmed the economy. The Dodd-Frank Act, for example, enacted in the wake of the 2008-2009 financial crisis has imposed many billions of dollars in new regulatory costs. What’s more, research shows that Dodd-Frank has benefited large incumbent banks while raising barriers to the creation of new bank competitors – thereby undermining competition.

A new Administration focus on eliminating anticompetitive financial regulations potentially could catalyze faster economic growth.

Editorial StandardsReprints & Permissions