Copyright Benzinga

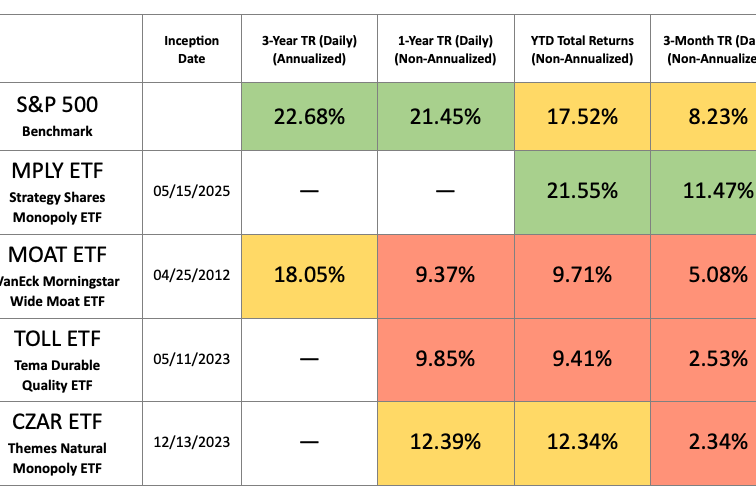

The Rise of Monopoly-Themed ETFS Investors have long been drawn to companies with monopoly-like characteristics — those companies with attributes that make them dominant in their markets with little effective competition. Such firms often enjoy strong pricing power. In fact, they’re very often the “price makers.” Naturally, this translates to higher margins and economies of scale create barriers that generate economic rents (essentially, profits above what a perfectly competitive market would allow corporations to have) ensuring that these companies remain flush with cash, which they can reinvest into R&D, vertical integrations, or put into acquisitions that either extend their MOATS further-or secure their market share. It’s no surprise, then, that several ETFs themed around “monopoly” investing have emerged to capitalize on these sought-after qualities with the most recent addition being Strategy Shares Monopoly ETF (BATS:MPLY). In this piece, I’ll examine how MPLY compares against a far more established monopoly ETF—VanEck Morningstar Wide Moat ETF (BATS:MOAT)—and discuss the reasons behind the wide difference in performance that we see. In short, not all monopoly ETFs are the same-each one brings in a slightly different spin and the differences can’t be more obvious that when comparing Strategy Shares’ MPLY with VanEck’s MOAT. I’ll start with a brief overview of the two funds. When gauging the YTD returns, it may be helpful to bear in mind that the S&P 500 has had YTD total returns of +17.52% as of 10/31/2025. Strategy Shares Monopoly ETF (MPLY) MPLY was launched in May 2025 and describes itself as an actively managed fund explicitly built around companies exhibiting “Monopolistic Attributes.” According to MPLY’s prospectus, its focus is on firms that “dominate a market or collectively form an oligopoly, enabled by traits like brand dominance, regulatory exclusivity, industry concentration, pricing power, and high barriers to entry.” The result is a portfolio expected to hold roughly 75–125 stocks with a notable tilt toward large-cap companies (in sectors like information technology where many modern US “monopolies” reside). MPLY charges a 0.79% expense ratio, but this hasn’t discouraged investors as the fund has accrued $11.31 million in investor capital in the first 24 weeks since its launch. MPLY’s YTD returns stand at +21.55%, which is impressive not least as the fund was launched in May this year. The +21.55% is not an annualized figure, but represents the returns from the fund’s launch to 10/31/2025. Thus, MPLY ETF is the only monopoly-themed ETF to beat the S&P 500 YTD; and it does so in an astonishing 24 weeks rather than the full 44 weeks YTD. VanEck Morningstar Wide Moat ETF (MOAT) The oldest and largest of the group (launched in 2012 with assets under management currently in excess of $12 Billion). MOAT tracks the Morningstar Wide Moat Focus Index, which selects U.S. companies that Morningstar’s equity research deems to have sustainable competitive advantages and, crucially, are also trading at attractive valuations. This index-driven, passive strategy yields a concentrated portfolio of around 50 U.S. stocks that have strong moats — whether via network effects, cost advantages, intellectual property, or other factors – but also inserts a value coefficient. Prioritizing value can be a double-edged sword because true monopolies typically carry hefty valuations, making them unattractive investments in MOAT’s view. We see this by looking at MOAT’s holdings. Out of the 50 or so stocks that it holds, nearly 32% are medium cap and around 22% are small caps. Compare that to MPLY ETF where 95% of holdings are large cap. MOAT has an expense ratio of 0.47% and has had an underwhelming track record when compared against the S&P 500. The fund’s 10-year annualized returns slightly underperform the S&P 500 (14.47% versus the S&P 500’s 14.64%). This lackluster performance is largely the result of poor performance in the last 5 years where the fund returned +15.25% in annualized returns against the S&P 500’s more impressive +17.64%. Portfolio Strategies & Holdings Comparison I don’t need to tell anyone that the stock market today is a very different entity than the one we had in 2012 when MOAT was first launched. In 2015, the Magnificent 7 (Apple, Amazon, Google/Alphabet, Meta, Microsoft, Nvidia, and Tesla) contributed just 12.3% of the S&P 500’s market cap. Today, they account for 36.6% with the returns of the Magnificent 7 ballooning in comparison to the S&P 500. In fact, the Magnificent 7 were responsible for over 50% of the S&P 500’s returns in 2023-2024, accounting for around 63% of the index’s performance in 2023 specifically. With all this in mind, it feels a little odd that MOAT would have no holdings in 4 out of the Magnificent 7 stocks (AAPL, META, TSLA, and NVDA). Its holdings in the remaining 3 are also surprisingly small. GOOG, MSFT, and AMZN only account for 1.61%, 1.30%, and 1.21% of MOAT’s holdings (AS OF 09/30/2025). While these three stocks account for just 4.12% of MOAT’s holdings, they produced 16.3% of the S&P 500’s total returns in 2024. In contrast, MPLY holds all the Magnificent 7 stocks and allocates 22.95% to the aforementioned stocks (as of 09/30/2025). Why Forcing Value Into Monopoly Investing Doesn’t Work It’s clear from the data that MOAT fails to deliver against the S&P 500, while MPLY ETF has shined in the little time that it has been around for. There really is no easy way to say this. MOAT fails against the S&P 500 because it focuses on value, which ends up undermining its wide-moat and monopoly ideals. As mentioned earlier, companies with wide moats tend to carry hefty valuations because the wider market tends to recognize them as monopolies and rewards these attributes. For example, one reason why MOAT underperformed the S&P 500 in recent years is because the fund completely missed out on NVDA’s returns. It missed out on these returns because NVDA was always too expensive for MOAT to allocate investor capital to. This, despite the fact that NVDA would go on to return 171% in 2024, contributing a staggering 22% to the S&P 500’s total returns. Apple and Meta, two stocks that MOAT does not invest in, contributed a further 7.4% and 5.5% to the S&P 500’s total returns. Forcing value into a conversation about monopolies and wide moats seems to do nothing but select value trap investments. It’s the kind of thinking that ends with a fund like MOAT investing in Nike (2.29% allocation), Pfizer (1.19% allocation), Airbnb (1.25% allocation), and Clorox (2.13% allocation). Respectively, these stocks have returned -13.18%, -2.06%, -3.71%, and -28.15% YTD (as of 10/31/2025)—all in an environment where the S&P 500 is returning +17.52% YTD. MOAT’s strategy clearly doesn’t work anymore. Why MPLY Performs Substantially Better Unlike MOAT, MPLY does not attempt to restrain its monopoly strategy with extra baggage and strings. This leaves you with a basket of stocks that leans heavily towards tech, but also has a healthy mix of other sectors too. For the little time that MPLY has been around for, this strategy has worked exceptionally well. The biggest criticism of MPLY ETF really is that it can leave its investors overexposed to the information technology sector in a downturn. For example, MPLY’s overlap by weight with Invesco QQQ Trust (NASDAQ:QQQ) and Schwab US Large-Cap Growth ETF (NYSE:SCHG) is 59.28% and 68.26%, respectively (as of 09/26/2025) and has performed reasonably well against QQQ and SCHG, marginally outperforming both funds since its launch in 05/15/2025, as shown in the YCharts graph below. Investors should, however, note the risks of investing in a newly launched ETF, which can include fund closure should the fund prove unable to achieve a financially viable economic size for its managers. Final Thoughts “Monopoly” can be a powerful narrative. Yet, the implementation of that narrative heavily determines outcomes. MOAT is the clear veteran here, yet its strategy has recently failed to match the S&P 500’s returns—likely due to the changing nature of the stock market with the Magnificent 7 monopolies producing the largest share of S&P 500 returns and, thus, earning themselves hefty valuations, which makes them unattractive investments from MOAT’s standpoint. I find this personally troubling because my biggest investment losses in the last 10 years or so have been in stocks that were trading at “attractive” valuations — not quite understanding that the market was punishing these companies for one reason or another. I fear that MOAT’s focus on value may be forcing it to make the same poor investment decisions I was making when I was 25 years old. With all this in mind, it’s perhaps easy to understand why MPLY is such a welcome newcomer. It does away with all the pretenses about valuation and invests in monopolies with healthy cash flows, employing what is perhaps the most literal interpretation of monopoly investing and favoring cash-engine mega-caps. This leaves it overexposed to the tech sector and its volatility, but if the last 10 years are anything to go by… it should allow MPLY to produce stronger returns on average than both MOAT and the S&P 500.