What matters in U.S. and global markets today

By Anna Szymanski

Sign up here.

While investors last week welcomed the Federal Reserve’s first rate cut of 2025 and signals of further easing, sentiment is more cautious today, with U.S. stock futures easing slightly before the bell. President Donald Trump said on Friday that U.S. companies would need to pay $100,000 for new H-1B worker visas,, opens new tab a potential blow for the dominant U.S. tech sector. Investors will hear from a host of Fed officials this week as everyone awaits the release of the Fed’s favored inflation gauge on Friday.

Mike’s off this week, but check out his column today explaining why the ECB could have a “contingency cut” in its pocket and what that means for dollar bets.

Market Minute

* India’s $283 billion information technology sector will have to overhaul its decades-old strategy of rotating skilled talent into U.S. projects following U.S. President Donald Trump’s move to impose a $100,000 fee for new H-1B visas from Sunday, according to tech veterans, analysts, lawyers and economists.

* South Korea’s economy could fall into crisis rivalling its 1997 meltdown if the government accepts current U.S. demands in stalled trade talks, opens new tab without safeguards, President Lee Jae Myung told Reuters., opens new tab

* U.S. tariffs imposed in August risk slashing up to one-fifth of Vietnam’s exports to the United States, making it the worst-hit country in Southeast Asia, according to estimates by the United Nations Development Programme.

* The breathtaking expansion of U.S. gas exports in the last decade has reshaped global markets, but, writes ROI energy columnist Ron Bousso, a looming global oversupply along with rising power prices domestically could leave the industry exposed on both sides of its value chain.

* China’s onshore equity markets are booming, outperforming many of their developed market counterparts this year, writes Emmer Capital Partners Founder Manishi Raychaudhuri in his latest piece for ROI. But he argues that whether this is the beginning of a true Chinese equity boom will likely depend on government stimulus and corporate discipline., opens new tab

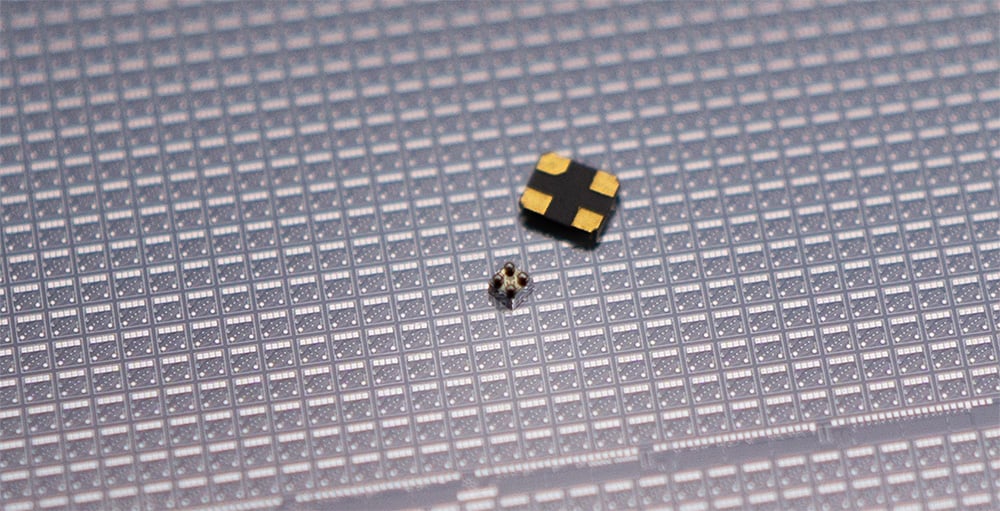

Chart of the day

After the Trump administration said on Friday that it would ask companies to pay $100,000 per year for H-1B working visas, some big tech companies and banks, including Microsoft, Amazon, Alphabet and Goldman Sachs, warned employees to stay in the U.S. or quickly return. However, the White House on Saturday clarified that this is a one time, not an annual fee, and that it will not be applied to existing visa holders re-entering the country.

Today’s events to watch

Want to receive the Morning Bid in your inbox every weekday morning? Sign up for the newsletter here. You can find ROI on the Reuters website, opens new tab, and you can follow us on LinkedIn, opens new tab and X., opens new tab

Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, opens new tab, is committed to integrity, independence, and freedom from bias.

By Anna Szymanski; Editing by Peter Graff.

Our Standards: The Thomson Reuters Trust Principles., opens new tab

Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias.

Anna is a New York-based columnist covering fixed income and emerging markets. She was previously a research consultant with Fintech Advisory, a family office specializing in special and distressed opportunities in emerging markets. From 2014 to 2017, she worked on the Emerging Markets Opportunities Fund and Emerging Markets Debt Total Return Fund at Oaktree Capital Management. She began her career in finance at Fintech Advisory in 2008. Anna has also been the co-host of the Slate Money podcast since 2017. She holds a master’s and a bachelor’s in English from New York University, and she is a CFA charterholder.