By Henry Saker-Clark

Copyright independent

Moonpig has said its customers are “increasingly embracing” the online card retailer’s AI services to personalise products, as bosses hailed a “good start to the year”.

Shares in the London-listed company rose as it highlighted continued sales momentum in recent months.

The online card and gift business partly credited recent growth in orders to customers using its platform to personalise products for friends and family.

Ahead of the company’s annual general meeting, it said “customers are increasingly embracing our innovative personalisation features”, with around half of cards now including AI-generated stickers, audio or messages.

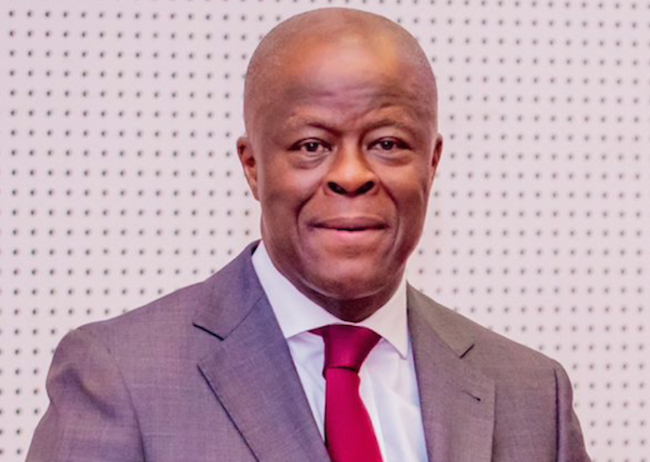

Boss Nickyl Raithatha said: “We continue to use technology, AI and data to enable our customers to connect with their loved ones in new and creative ways.

“AI-generated Stickers have quickly become our most widely adopted innovation, with customers now creating two million personalised images every month, demonstrating the resonance of our proposition and the scalability of our technology platform.”

It came as Moonpig reported that it has seen positive trading momentum and is on track to meet its guidance for the new financial year, which started on May 1.

Moonpig revenues are growing at around 10% year on year, while it has seen “modest” growth from its Greetz business, the group said.

The company added that average order value is also “rising” across both brands, with an increased uptake for Moonpig’s guaranteed delivery service.

It added that it expects growth across the key Christmas, Valentine’s Day and Mother’s Day trading period to be boosted by brand launches in flowers and gifting with Laura Ashley Flowers, Next Flowers and JoJo Maman Bebe.

Mr Raithatha added: “We have had a good start to the year, demonstrating the continuing power of the Moonpig proposition.

“With strong growth in the Moonpig brand and a return to year-on-year growth for Greetz, we are on track to deliver our full-year 2026 guidance.”

Shares in Moonpig moved 6.2% higher in early trading.