Copyright cambridge-news

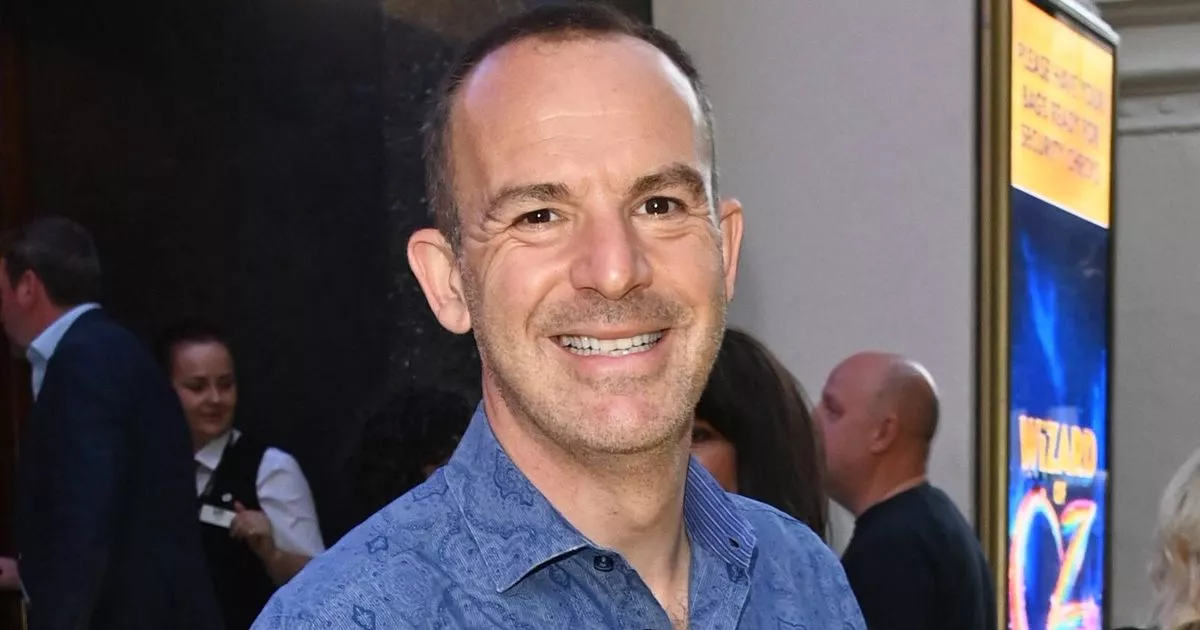

Martin Lewis has shared his thoughts on the potential reduction of the cash ISA allowance, as rumours suggest that the Chancellor could announce significant changes to the tax-free savings account in her upcoming Budget. An ISA is a unique type of savings account where any interest you earn is tax-free. At present, you can save £20,000 every tax year across any ISA accounts you may have. However, a recent report by the Financial Times suggests that Rachel Reeves is contemplating halving the amount you can save into a cash ISA to £10,000. The Chancellor is reportedly considering this move to encourage more people to invest in the stock market, reports the Mirror. However, in a post published earlier this month on X, Martin Lewis expressed his belief that reducing the cash ISA limit "isn't the solution" to promoting investment. He stated: "A cash ISA cut would simply piss millions of, often older, people off and I doubt will change the dial on investing. It'd just mean more tax paid on savings, and be a problem for building societies raising cash for mortgages. "If they were saying they were doing it to raise revenue, at least that would be logical. What is needed is for them to encourage investment, better education, and better incentives." No changes have been confirmed by the Treasury. If any updates to the cash ISA are confirmed, these will be part of the Budget on November 26. Martin Lewis had previously encouraged savers to "keep going" as usual. Speculation about the cash ISA being reduced initially began circulating earlier this year, and at one stage it was suggested that the threshold could be slashed to as little as £4,000. The Treasury Committee also advised the Government last week against reducing the cash ISA limit, cautioning it would be unlikely to motivate people to switch to investing. Rather, it suggested enhancing financial education and improving access to advice and guidance, enabling people to make well-informed choices with their savings. The primary categories of ISAs include cash ISAs, stocks and shares ISAs, Lifetime ISAs, and innovative finance ISAs. Young people have their own variant known as Junior ISAs. Recent figures reveal that during 2023/24, the country contributed to 9.9 million cash ISA accounts. Over 14 million individuals across the UK are believed to hold more than £10,000 in cash savings. Responding to the Treasury Committee report, Rachel Reeves stated: "We want to help people to be able to save for mortgages, but we want people to get better returns on the money they're investing, to put money in an ISA or indeed in a pension means that you're sacrificing spending today to save for the future."