Copyright thestar

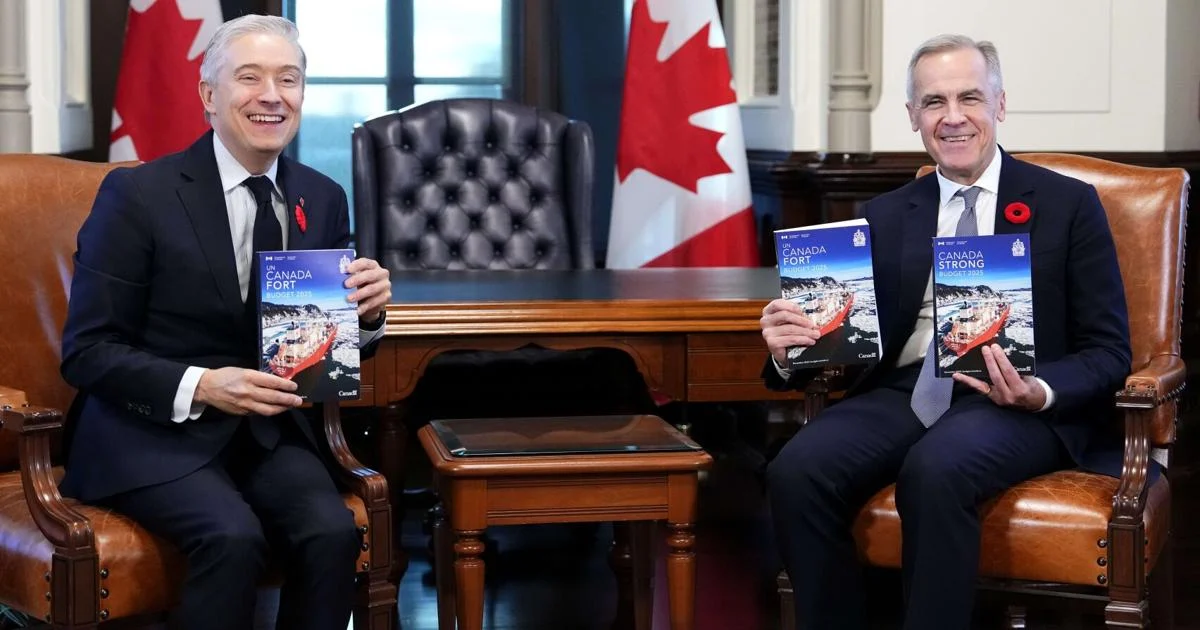

The news junkies who tend to drive political chatter have come away disappointed after Mark Carney’s first budget this week. They (OK, we) were underwhelmed — there were no surprises, the budget was pretty much as advertised, and the previously-touted big sacrifices at the altar of economic overhaul were things we already knew were coming. Here’s a news flash: the budget is not for the finance junkies, not really. It’s for the public, and in this age of nasty U-turns, disruption and volatility, the predictable nature of Budget 2025 is one of its strongest points. For a budget to have staying power, it’s not enough to wow those who are hooked on the adrenalin of receiving a list of shiny political objects. Rather, a budget’s long-term success depends on bringing the public along, and building trust with the very households, corporations and organizations the government needs to implement its budget decisions. That is especially true of this one. Over the past few weeks, Carney let it be known that his first budget would dramatically ramp up defence spending, finance home-building, lean in to infrastructure and favour help for business over social programs. He also primed the public for larger deficits and government layoffs. But the work of building up the trust that will ensure this budget turns into a long-term plan to whip the Canadian economy into shape has only just begun. For this budget to truly succeed, Carney will need to marshal public support at every single step, because it’s not at all obvious that regular Canadians stand to benefit. For one, the payoff for the public of this “supercharging” exercise (as the Liberals dubbed their revival plan for the economy) is a very long way away — even if everything goes according to plan. As Carney and Finance Minister Francois-Philippe Champagne pitch it, there’s a chain reaction that is required to face down the changed economic reality of 2025, and its foundations are in this week’s budget. It’s a big bet that requires a lot of moving parts to come together, with the hope that the benefits will eventually flow to all corners of the Canadian economy. First, the government borrows billions of dollars for capital investment. The deficit balloons, and the government uses that money and money already baked into the fiscal framework to pull together almost $500-billion in cash, tax breaks, lending and long-term commitments, all in an effort to expand the ability of the Canadian economy to produce goods and services. Then, it sets up new structures or reforms old structures, streamlines regulations, absorbs some risk and spices up tax incentives to get that money out into the world. At that point, the private sector is expected to step up with $500-billion of their own, investing to take advantage of the opportunities the government has fostered. Along the way, the companies and government entities leading the way on “supercharging” will presumably hire people, pay them good wages, enhance their training and boost everyone’s productivity. That’s the plan anyway. “The short-term effect of those projects is thousands of good jobs in construction, the trades and logistics,” Carney said Wednesday in a post-budget news conference at a public transit yard in Ottawa. “The longer-term effect is high-paying fulfilling careers with recurring contracts year after year. That is what a trillion dollars in investment builds.” The end goal is a Canadian economy that is less dependent on the United States, more efficient and competitive around the world, and able to resume a steady pace of growth. This is a far cry from the Keynesian approach to economic revival that we are familiar with, and that Canadians at least sort of believe has worked in the past The era of government spending on job creation, directly using its spending power to juice up consumption and economic activity, has been replaced — in Canada and elsewhere — by a morphing definition of industrial policy that takes aim at leveraging private sector investment to boost productivity. “Industrial policy, once seen as secondary to market forces, is returning to the forefront,” the budget confirms. Regular Canadians could benefit if and when the new-found productivity produces jobs, higher wages and broad economic growth. Carney had some thoughtful remarks about this approach to economic policy when he was in Asia a few days before tabling the budget. With geopolitics and technology fundamentally changing the way the world works, clinging to the economic equations of the past won’t suffice. “At the core of this will be a new partnership between government and business at the service of our fellow citizens,” he said. The central bank is down for the supply-side, productivity-enhancing approach too. “We’ve over-relied on priming demand and not spent enough time on the tougher decisions of structural reform and making the investments that we need to actually grow the economy over the long term,” Bank of Canada Governor Tiff Macklem said in an interview with Bloomberg at the end of September. That appears to be what Carney is banking on. And for sure, this could all happen and the prime minister’s plan could work. We can hope. But it could just as easily not happen, especially since investors have not responded en masse in the past to many years of incentivizing, competitive taxation, subsidies and blatant pleading of all kinds. That’s where government building trust with the public becomes essential. The rewards of this plan, if they materialize as hoped, are far off in the distance. We don’t really know who will reap the benefits or how — or even whether — they will trickle down. The subtext of Carney’s budget is “please be patient.” The public is being asked to trust that Carney’s plan will prompt investors to change course, put billions of dollars into changing how Canada’s economy works, and stick around for the long term. It’s an enormous ask, even if Carney hasn’t spelled it out clearly. In the lead-up to the budget, Carney took the rare step of addressing Canadians on prime-time television, warning us that we will be asked to make sacrifices. He took some political heat in the days after that speech for not naming those sacrifices. The obvious answer is that he was referring to the budget’s cuts to the public service. But there’s a more subtle answer contained in the budget that applies more broadly: an economy that will see no growth this year. Economic growth in Canada was already tepid in recent years. But the tariff battle with the United States has erased even that growth, setting Canada on a growth trajectory that is 1.8 per cent below where it would have been. That’s unless we do things very differently, and that process has only just begun. Canadians don’t yet know who will be paying the price for the change in geopolitics that is roiling us, beyond the workers in the industries that have been hit hard and directly by American tariffs. We haven’t yet had the difficult political conversation about how to cushion the blow for those who are side-swiped and how to share the wealth of those who prosper. Despite what pundits may say, Carney and Champagne were wise to ease the public into their plan by rolling it out piece by piece before budget day was upon us. But preparing the public was only one step of many. They will also have to sustain their trust-building measures for the long term if they want to both persuade private investors to find $500 billion and put it to good use in Canada, and for voters give them time to set Canada on a new path. In his speech in Asia, Carney had some other “wise words” that he meant as advice to world leaders but could be applied to his own government right now. He quoted an Indonesian leader who said, according to Carney: “Growth that excludes is growth that divides …. Division causes instability, and instability is not conduce to peace and prosperity.” Carney added: “And we’re here, of course, for peace and prosperity.” Yes, we are. But that’s going to mean some long, hard work by government and business alike to build trust. It’s a complex bet on how to fix Canada’s future that has only just begun to take shape.