By Jasmine Laws

Copyright newsweek

Health insurers across the country have been proposing particularly high premium rate increases for 2026 Affordable Care Act (ACA) marketplace plans, according to two health policy research organizations.

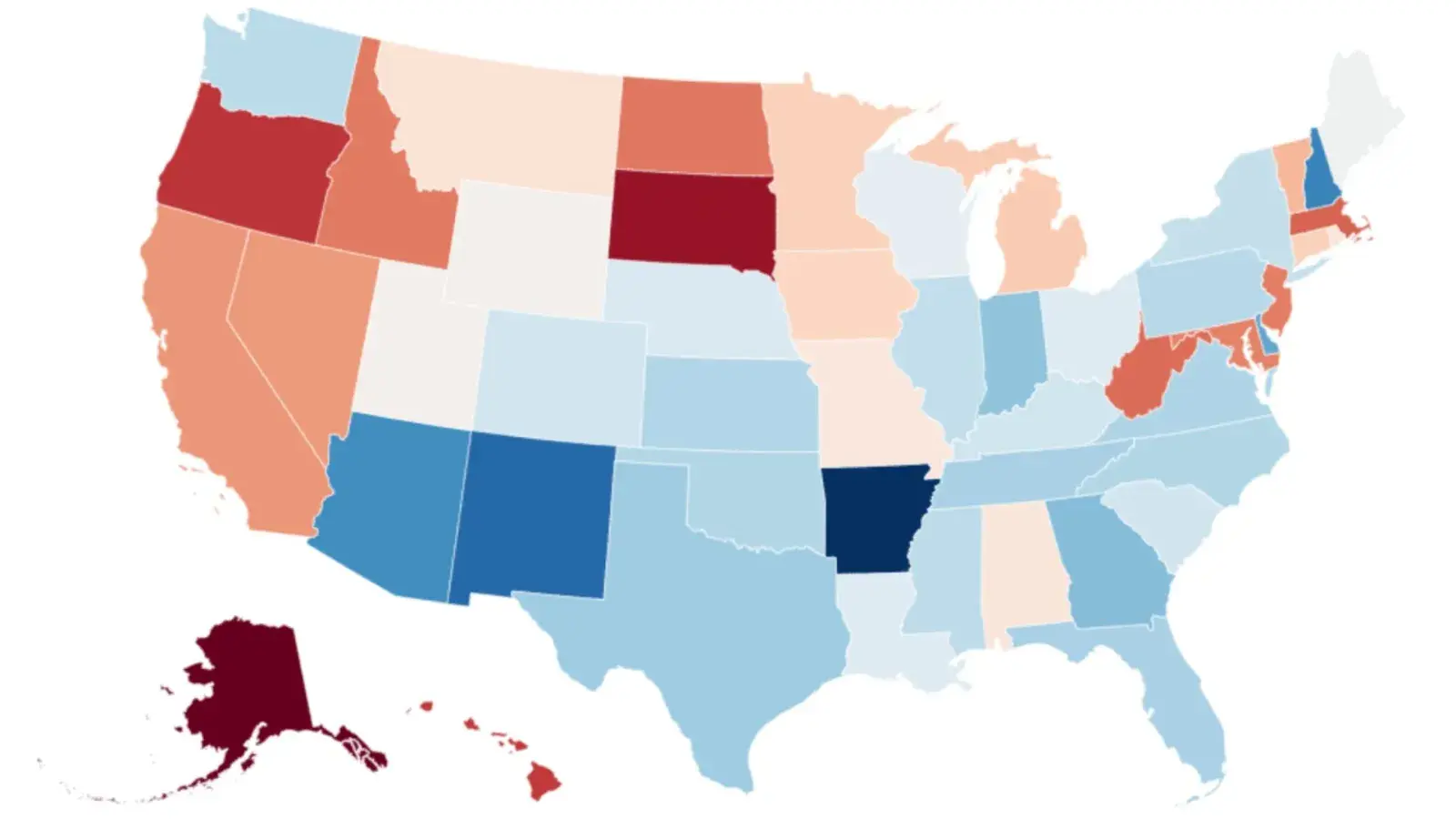

The range of requested rate changes varied from cost reductions, as low as -10 percent, to price hikes as high a 59 percent, while the average proposal was an increase between 12 to 27 percent, says data from the ‘Health System Tracker’ put together by the Peterson Center on Healthcare and KFF.

Coleman Drake, a professor in the Department of Health Policy and Management at the University of Pittsburgh, Pennsylvania, told Newsweek: “Increases in premiums caused by the expiration of enhanced subsidies will cause millions of marketplace enrollees to become uninsured because they will no longer be able to afford health insurance. These coverage losses will be largest among lower income enrollees, as they are the most sensitive and vulnerable to premium increases.”

Why It Matters

There are many factors behind the rising costs of health insurance premium rates, and this also follows what has been an ongoing trend in recent years, as both the increasing price of care and uptick in health care use have influenced premium rates.

Inflation is another factor, as is labor costs, as providers are seeking higher reimbursement rates in negotiations, due to elevated staff costs and continued difficulties and strain following the COVID-19 pandemic.

The growing demand of GLP-1 drugs like Ozempic and Wegovy, used for diabetes treatment and weight loss, have also increased prescription drug spending.

What To Know

Arkansas was the state with the highest proposed range of premium rate increases, having both the highest proposed rate increase overall, at 59 percent, but also the highest range of proposed increases, with the lowest requested increase at 42.5 percent.

Paul Shafer, a professor of health law, policy, and management and co-director of the Medicaid Policy Lab at Boston University, told Newsweek that this was likely because Arkansas is making “a large adjustment to how it prices in cost-sharing reductions for lower income enrollees and faces special circumstances because its ‘private’ Medicaid expansion is tied into Marketplace plans.”

“The premium changes depend on lot on local dynamics—how competitive the hospital market is, and how many and what kind of people are enrolling in the Marketplace in each state,” he said.

Other states with some of the highest proposed premium rate increases for ACA marketplace plans included New Mexico (53 percent), New Hampshire (50.1 percent) and Arizona (49 percent).

Of the all the states, Alaska’s highest proposed premium rate increase was the lowest, at 5.3 percent, followed by South Dakota (8.9 percent), and Oregon (12.5 percent).

While 125 health insurers proposed premium increases of at least 20 percent, there were four health insurers that actually proposed reductions in premium rates.

These health insurers were in Pennsylvania, where a health insurer proposed a reduction of 10 percent in premium costs, Kansas (6.1 percent reduction), Missouri (4.4 percent reduction) and Alaska (0.8 percent reduction).