Copyright mwnation

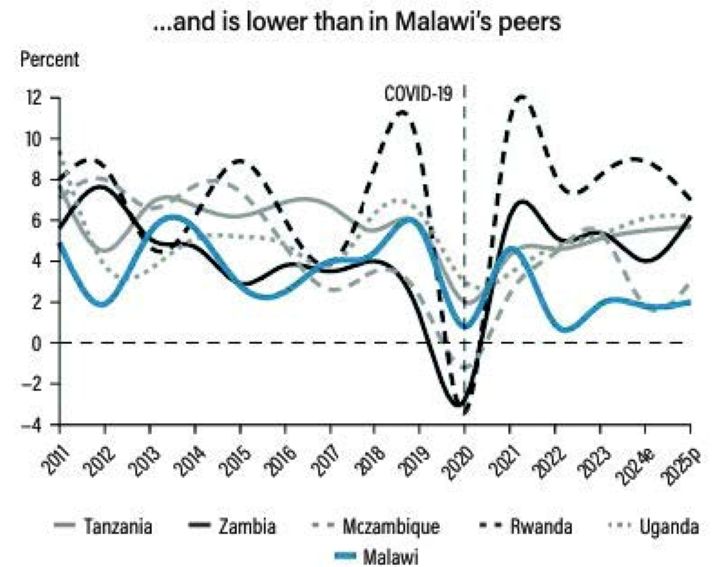

The International Monetary Fund (IMF) says Malawi’s economy is losing ground to its regional peers as reform momentum stalls, inflation persists and public debt mounts. In its Sub-Saharan Africa Regional Economic Outlook for October 2025, the global lender said there is a widening gap between Malawi and other economies in the region. While the average growth rate for sub-Saharan Africa is projected at four percent, Malawi’s growth is projected at 2.8 percent this year. Inflation, on the other hand, is at 28.7 percent and remains one of the highest in Africa, which is three times the regional median. Fiscal and debt metrics are equally concerning, according to the IMF, with Malawi’s fiscal deficit estimated at eight percent of gross domestic product (GDP), double the Southern Africa Development Community (Sadc) average of four percent. Malawi’s public debt, now surpassing 90 percent of GDP, stands far above the Common Market for Eastern and Southern Africa (Comesa) and East African Community average of between 55 and 60 percent. In an interview on Sunday, economist Dalitso Kubalasa likened Malawi’s economic position to “a bucket that leaks but still needs to be filled with water, money, goods and foreign currency to support everyone”. “The problem is that the bucket has too many leaks and we are not pouring in enough water to keep it full,” he said. Kubalasa identified four major leaks, namely overdependence on rain-fed farming, a chronic shortage of foreign exchange, unsustainable government borrowing and sluggish policy execution. “When droughts or cyclones hit, food production collapses, prices rise and inflation spirals. Meanwhile, the foreign exchange shortage makes it harder for businesses to import fuel, medicines and raw materials, leading to shortages and further price hikes,” he said. Kubalasa said Malawi can still turn things around, but only through implementation of difficult reforms. “We need to fix the forex problem by adopting a realistic exchange rate. It may be painful in the short-term, but it will make our exports competitive and attract the dollars we desperately need,” he said. Kubalasa urged government to “stop the bleeding” by cutting wasteful expenditure, improving tax collection and making the fertiliser subsidy programme more efficient. “We cannot rely solely on subsistence agriculture. We must invest in sectors that create jobs and add value.” In an interview on Sunday, Economics Association of Malawi president Bertha Bangara-Chikadza said the figures reflect “deep-rooted structural vulnerabilities and ongoing macroeconomic instability” that continue to limit growth and resilience. She said: “Unlike some of its neighbours, Malawi still depends heavily on rain-fed agriculture, making it extremely vulnerable to climate shocks. “This, combined with slow reform efforts, persistent fiscal deficits, and chronic foreign exchange shortages, creates low confidence and weak private sector investment.” Bangara-Chikadza, who teaches economics at the University of Malawi, further warned that prolonged fiscal and external imbalances “pose a serious and immediate threat to long-term debt sustainability and investor confidence”. On his part, economist Gilbert Kachamba said: “A predictable macroeconomic environment is crucial for attracting investment, but current fiscal and exchange rate challenges make that very difficult. The government must show consistency and discipline in implementing reforms if we are to reverse the trend.” He agreed that regional lessons offer hope, adding that Tanzania and Rwanda have shown that fiscal discipline, agricultural diversification and investment in infrastructure can accelerate recovery. The IMF report shows that by contrast, regional peers are showing stronger fundamentals, with Tanzania maintaining inflation in single digits.