Luanda’s infrastructure financing summit set to mobilise $1.3tr for projects across Africa

By Ngozi Ekugo

Copyright businessday

The Luanda infrastructure financing summit holding in October is set to mobilise a fund to transform infrastructure across Africa.

Part of the funds is an estimated $1.3 trillion to implement the Continental Power Systems Master Plan (CMP) and realise the African Single Electricity Market by 2040.

Organised by the African Union Development Agency (AUDA-NEPAD) and the African Union Commission (AUC), in collaboration with the Government of Angola, the high-level gathering, is scheduled for October 28 to 31, 2025 in Angola’s capital- Luanda.

Africa’s economy and labour market future could be dramatically reshaped during the summit which seeks to mobilise capital for infrastructure and energy access as global priorities, and will reinforce Africa’s leadership in proposing solutions tailored to its unique challenges and opportunities.

Currently, the continent faces an annual infrastructure financing gap exceeding $100 billion. The Programme for Infrastructure Development in Africa (PIDA) alone requires $16 billion annually to deliver cross-border projects that underpin Africa’s industrial and energy ambitions by 2030.

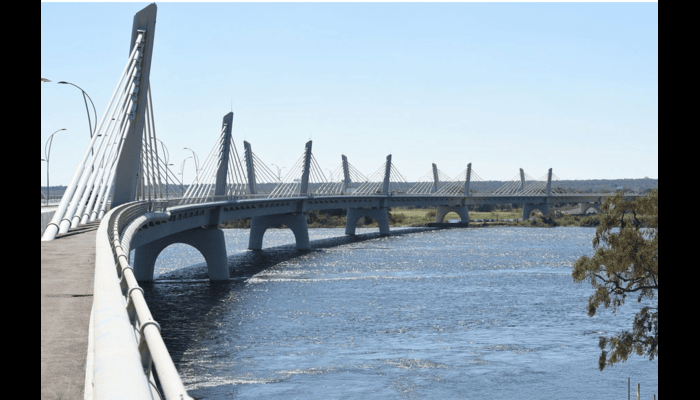

The high-level gathering, scheduled for October 28 to 31, 2025 in Angola’s capital- Luanda, aims to mobilise capital for transformative infrastructure projects such as roads, railways, ports, power grids, and digital networks, which are essential for trade, industrialisation, regional integration, and job creation across the continent.

The summit builds on the momentum of previous editions, notably the 2023 Dakar Summit, and aligns with the African Union’s Agenda 2063 and the PIDA.

Read also:DMT, GLO sign MoU to improve telecom infrastructure in Delta State

Speaking earlier this year, João Lourenço, AU chairperson and Angolan president underscored the urgency of infrastructure investment, noting,“We must mobilise all available financial resources to achieve our goals; from roads and railways to ports, power lines, and digital networks.”

The Luanda summit will feature curated deal rooms and investment pitch sessions, enabling African governments and institutions to present infrastructure portfolios to global investors. Strategic corridors such as the Lobito Corridor, LAPSSET, and the Dakar–Bamako–Djibouti route will be showcased as integrated models linking infrastructure with trade and industrial development.

A major focus will be Africa’s energy deficit, with over 600 million people lacking access to electricity. Through initiatives like the African Single Electricity Market and PIDA Energy Projects, the summit will explore financing mechanisms to close this gap, including partnerships with philanthropic organisations and climate-aligned capital. The Nairobi Roadmap, adopted by AUDA-NEPAD and key financial institutions, will serve as a guiding framework.

How Africa’s infrastructural development can catalyse labour market growth

Infrastructure development offers a powerful catalyst for labour market growth across Africa, with wide-ranging benefits that extend beyond traditional employment sectors. One of the most immediate impacts is job creation. Large-scale projects such as roads, railways, ports, and power grids generate millions of employment opportunities in construction, engineering, logistics, and maintenance. These roles not only absorb existing labour but also stimulate demand for new skills and services. Additionally, the expansion of energy and digital infrastructure opens up fresh avenues in technology, utilities, and entrepreneurship, creating a more diversified and resilient job market.

Beyond job creation, infrastructure investment drives skills development, particularly among young people. The complexity and scale of these projects require a skilled workforce, prompting governments and private sector actors to invest in vocational training and technical education. This focus on capacity building ensures that local populations are equipped to participate meaningfully in infrastructure delivery and maintenance.

The benefits also extend to the informal sector, as improved transport networks and energy access empower informal traders, farmers, and artisans by connecting them to broader markets and reducing operational costs. With better infrastructure, these workers can expand their reach, increase productivity, and transition into more formalised economic activities.

Read also: Afreximbank, MDGIF sign MoU to mobilise $500m for Nigeria’s gas infrastructure development

From physical infrastructure to digital transformation

Beyond physical infrastructure, the summit will delve into digital transformation. With Africa positioning itself in the global digital and artificial intelligence (AI) revolution, discussions will explore how fintech, artificial intelligence, and digital infrastructure can enhance service delivery, financial inclusion, and industrial growth under the African Continental Free Trade Area (AfCFTA).

Disussions around water security and climate adaptation infrastructure will also feature prominently, with emphasis on sustainable financing for transboundary water resource management.

In a bid to reduce reliance on external funding, the summit will spotlight domestic capital mobilisation. Africa’s pension and sovereign wealth funds, which is estimated at over $70 billion annually, will be targeted through innovative public-private models, blended finance, and project bonds.

Registration for the summit, including opportunities to showcase projects and engage with organisers, can be made here