Copyright Reuters

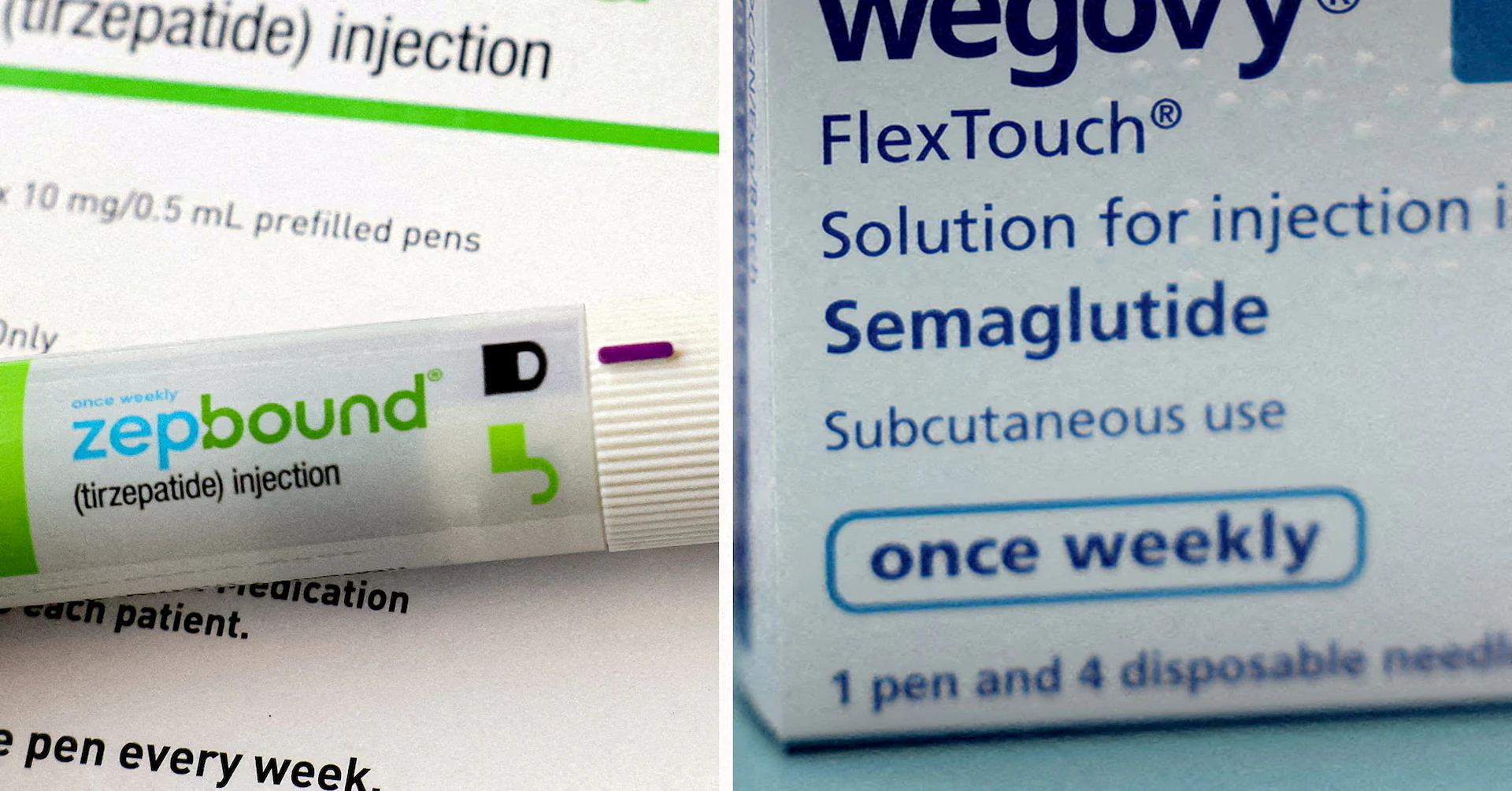

LONDON/LOS ANGELES, Nov 7 (Reuters) - A Trump administration deal to cut prices for popular weight-loss drugs like Wegovy and Zepbound will allow millions more Americans to give them a try, but the cost may still be too high to keep patients long term, U.S. obesity specialists said. Sign up here. Current costs for people without insurance are closer to $500 per month at the higher doses. The drugmakers also pledged to launch a new generation of weight-loss pills at $149 per month for the lowest dose, increasing to $399 for higher doses, if they are approved for the U.S. market. Americans on the Medicare program for people age 65 and older will see the biggest change from the agreement, with expanded eligibility for a prescription and an out-of-pocket cost capped at $50 per month. The agreed prices are part of a government pilot program that would become regular Medicare policy if it shows that by losing weight, Americans need less medical care for related, and costly, health problems, such as heart disease. "When monthly costs fall below $200, access to evidence-based treatment expands dramatically," Dr. Leslie Golden, an obesity medicine physician in Wisconsin, said. The new prices should lead to "a noticeable increase in patients receiving life-changing treatment." LOWER PRICE NEEDED FOR LONG-TERM USE Dr. Caroline Apovian, an obesity specialist and professor at Harvard Medical School, said the deal with Lilly and Novo helps, "but some people still can’t pay at $350 per month and these are drugs that are needed to be taken forever." Studies have shown that many patients regain weight after stopping the medication. Under the deal, commercial health insurers would also be able to access prices estimated to be 25% lower than current cash prices. Doctors said the expanded Medicare coverage could persuade more employers to include weight-loss drugs in their benefit plans. The agreed prices will come into effect no later than January for cash payers, by mid-2026 for Medicare patients and on an ongoing basis for enrollees in the Medicaid program for low-income people depending on when states sign up. Dr. Sarah Ro, medical director of the University of North Carolina Health’s weight-management program, said coverage of weight-loss drugs had been trending in the wrong direction this year. Many of her patients had lost coverage for the GLP-1 weight-loss drugs on their employer health plans, while North Carolina’s Medicaid program recently dropped coverage for the obesity medications due to rising costs. “That’s why this is such wonderful news,” Ro told Reuters. The new prices mean that people without insurance will pay less out of pocket, and may be enough to persuade some to switch from compounded alternatives sold on telehealth platforms like Hims & Hers, doctors said. "I do think that there will be a migration over to the branded and clinically tested versions," said Dr. Fatima Cody Stanford, an obesity medicine physician at Massachusetts General Hospital. Reporting by Bhanvi Satija in London and Chad Terhune in Los Angeles; Additional reporting by Deena Beasley in Los Angeles; Editing by Michele Gershberg and Sonali Paul Our Standards: The Thomson Reuters Trust Principles., opens new tab Bhanvi is a London-based reporter covering European pharmaceutical companies and the healthcare industry. She previously covered U.S. health and pharma firms, with a focus on the new weight loss drugs that are transforming the obesity treatment space. Her coverage includes a trend piece on the underuse of their weight-loss drugs among men, increased interest in therapies being developed for preservation of lean mass, and a scoop on gene therapy maker Sarepta defying an FDA order to stop shipping its muscular dystrophy treatment.