By Jon Robinson,Simon Orange

Copyright cityam

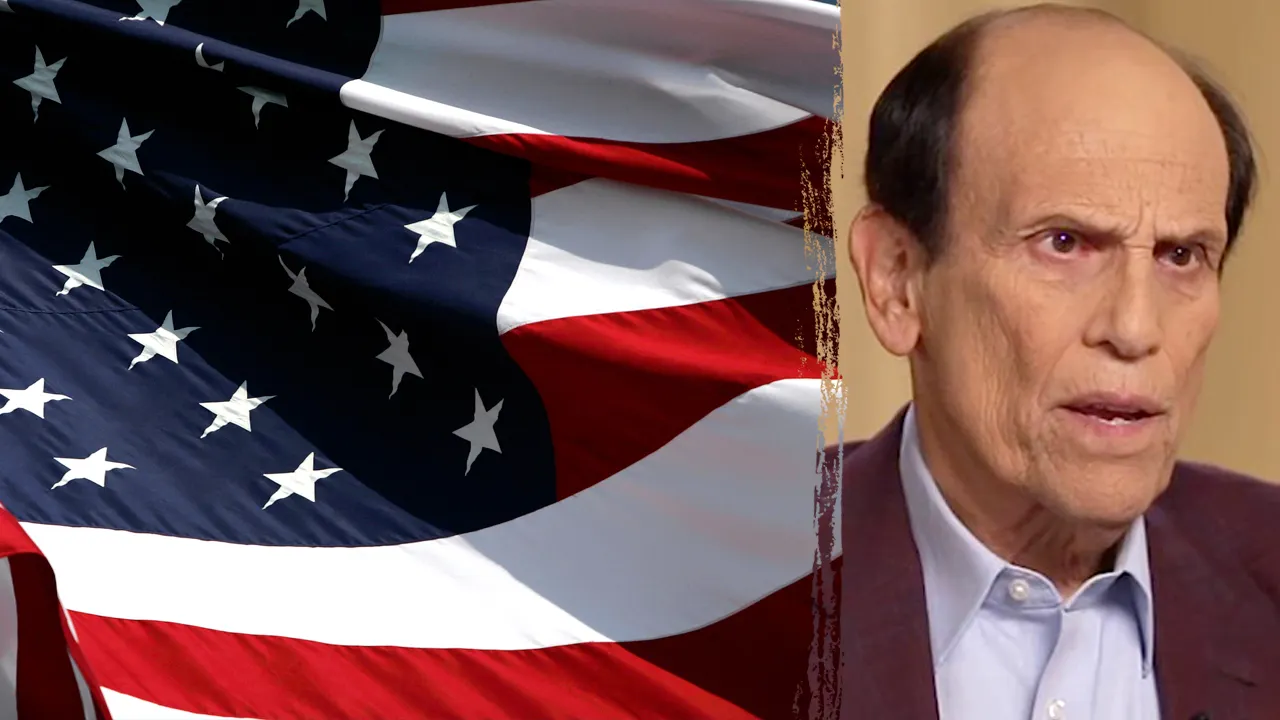

Losses at the empire built up by Simon Orange, the self-made millionaire who co-owns rugby union side Sale Sharks, almost tripled in the year before being taken over.

Cheshire-based CorpAcq counts more than 40 businesses as part of its portfolio including the likes of Cotton Traders but does not include the Prem Rugby club.

The group hit the headlines in January 2025 after private quity giant TDR Capital has agreed to acquire a majority stake in the business which was founded in 2006 by the entrepreneur, the brother of former Take That singer, Jason Orange.

CorpAcq made its name by focusing on a buy and build strategy and has particularly targeted small to medium-sized businesses.

TDR is the majority owner of supermarket giant Asda as well as having investments in the likes of David Lloyd and Jollyes.

Takeover costs hit CorpAcq

Now, new accounts filed with Companies House have revealed that CorpAcq’s pre-tax loss went from £11.4m to £33.8m in 2024.

The losses came despite its revenue increasing from £696.2m to £769.8m over the same period.

CorpAcq said its finances were impacted by £14.7m of “non-core professional fees” related to the takeover and share-based compensation of £6.2m.

In a statement signed off by the board, the company said: “The directors are satisfied with this performance in the current challenging economic environment and are confident of continued growth during 2025.”

CorpAcq’s accounts come after Simon Orange bought the UK’s second-largest steel contractor a few months ago.

Orange snapped up a majority stake in Greater Manchester-based William Hare which can trace its roots back to 1888.

William Hare has previously completed work on the likes of Media City in Salford, the headquarters of Aldar in Abu Dhabi and the Bloomberg building in the City of London.

Mixed results for TDR Capital’s portfolio

Elsewhere in TDR Capital’s portfolio, Asda slumped back into the red after losing almost £600m in 2024 despite its total sales rising by more than £1bn.

In June, the Leeds-headquartered supermarket giant posted a pre-tax loss of £599m for its latest financial year, having reported a pre-tax profit of £180.3m for 2023.

The profit in 2023 came after Asda made a pre-tax loss of £432m in the prior 12 months.

Accounts filed with Companies House also showed its revenue increased over the same period from £25.6bn to £26.8bn. Excluding fuel, Asda’s sales fell from £21.9bn to £21.7bn.

When not accounting for non-underlying costs, which totalled £714.4m, Asda achieved a pre-tax profit of £115.4m.

However, the rising popularity of padel and pickleball helped health club chain David Lloyd make a profit for the first time since being acquired by TDR Capital.

The Hertfordshire-headquartered chain, which TDR Capital has just sold back to itself, reported a pre-tax profit of £32.2m for 2024.

The group registered a pre-tax loss of £25.7m in 2023.

Since TDR Capital acquired David Lloyd in 2023, the chain has racked up pre-tax losses of around £600m.

The accounts for the group also showed its revenue jumped in 2024 from £756.3m to £860.7m.

In March, City AM reported that accounts for the group also show its revenue jumped in 2024 from £756.3m to £860.7m.

The company posted a pre-tax loss of £13.3m for the year to 26 May, 2024, after having also made a £5.3m loss in the prior 12 months.

However its turnover jumped from £115.2m to £144m over the same period.