Copyright newsbytesapp

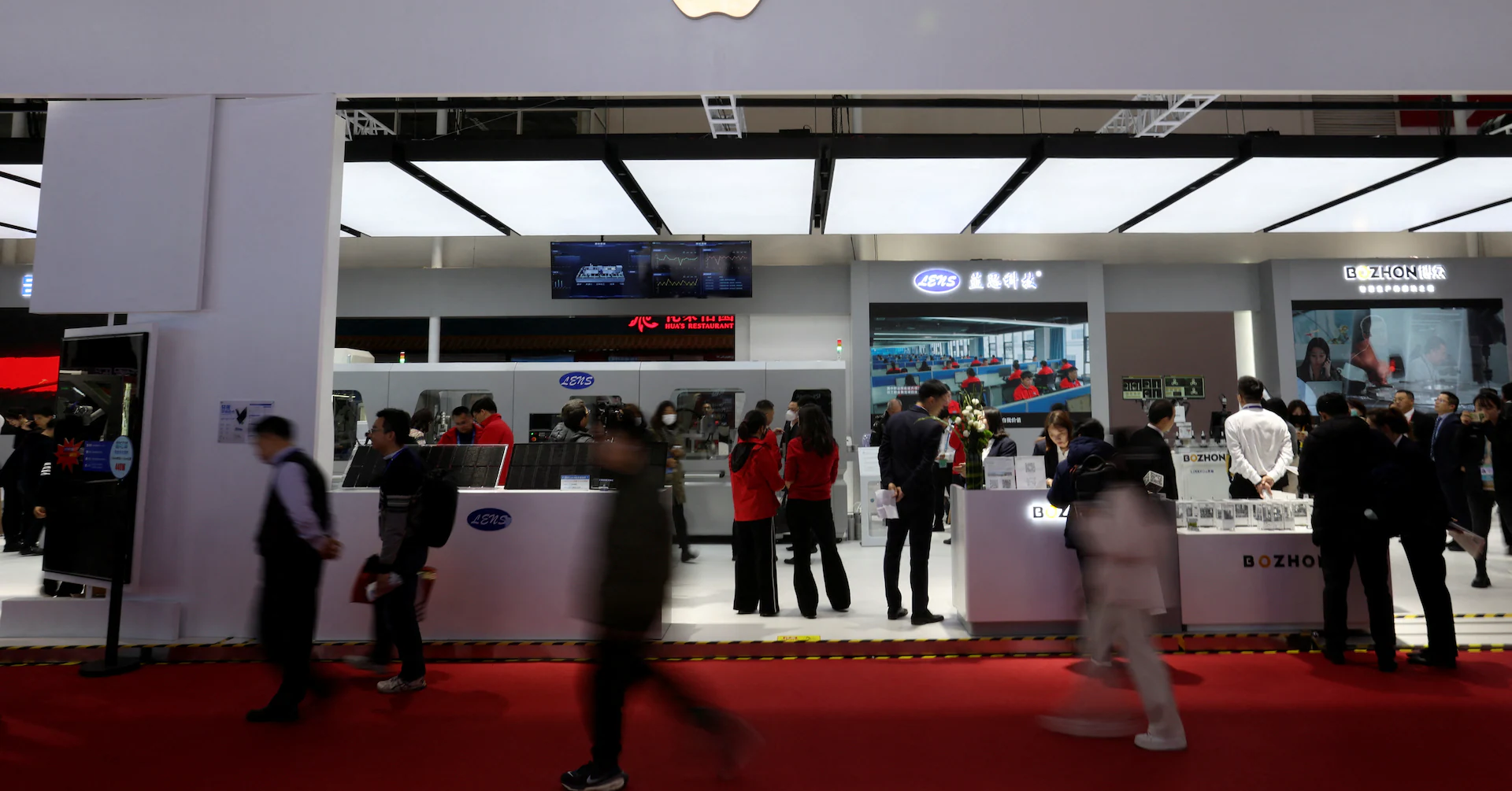

Leading eyewear retailer Lenskart is gearing up for its initial public offering (IPO), targeting a post-money valuation of around ₹70,000 crore ($7.97 billion). The company plans to launch the issue for public subscription on October 31, November 3, and November 4. The dates are subject to change depending on approval from the Registrar of Companies (RoC), Moneycontrol reported citing industry sources. The final size of Lenskart's IPO could be between ₹7,250 crore and ₹7,350 crore. This is due to pre-IPO rounds that may have reduced the Offer for Sale (OFS) portion. The company had filed its draft red herring prospectus (DRHP) in July with plans to raise ₹2,150 crore through fresh issuance, while promoters and investors intend to offload 13.22 crore equity shares. The upcoming IPO is expected to attract a lot of interest from top domestic and global investors. Billionaire investor Radhakishan Damani, founder of Avenue Supermarts (DMart), and SBI Mutual Fund are each likely to invest around ₹100 crore in the firm. Kotak Mahindra Capital, Citi, Axis Capital, Avendus Capital, Morgan Stanley, and Intensive Fiscal Services are the investment banks working on this deal. Of the ₹2,150 crore in fresh proceeds from its IPO, Lenskart plans to spend ₹272.6 crore on opening 620 new company-owned company-operated (CoCo) stores in India by FY29. It has also earmarked funds for lease deposits for existing CoCo outlets and technology/cloud infrastructure upgrades. The company reported a net profit of ₹297.3 crore in FY25 against a loss of ₹10.2 crore in FY24. Lenskart's revenues grew 23% YoY to ₹6,652.5 crore with a CAGR of 33% over the last two years. The company has a strong global presence with 2,723 stores, 2,067 in India and 656 overseas. It plans to add another 450 stores in FY26 as part of its expansion strategy. Robotic lens labs and AI-led fulfillment operations have enabled next-day delivery in 40 cities across India.