LANSING, MI – As the Michigan Senate gaveled in just after midnight Friday morning, Sen. Sarah Anthony, D-Lansing, delivered a brief invocation: “Dear God, please help us pass this budget, amen.”

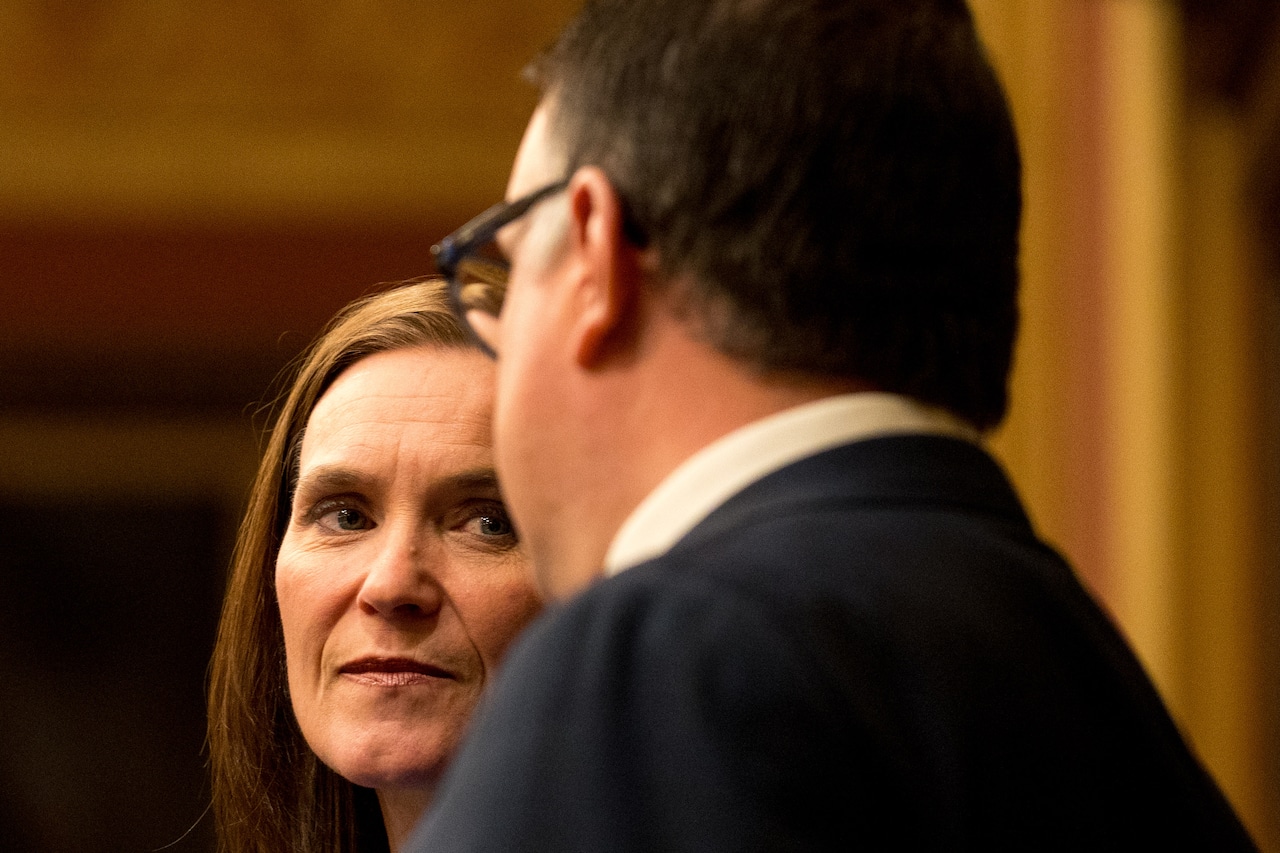

It wasn’t until a few hours later that Anthony, who oversees the budget process in the Senate as appropriations chair, had her prayer answered.

Well after 3 a.m., the state government finalized its budget for 2025-26. Both omnibus bills moved fairly quickly with bipartisan support through each chamber.

But a separate bill to create a new 24% wholesale tax on marijuana, one of several pieces of legislation necessary to create road funding revenue, was held up in the Senate.

House Speaker Matt Hall, R-Richland Township, previously said the budget bills were contingent on that tax also being approved.

It’s tacked onto an existing 10% excise tax on retail marijuana sales and is expected to generate about $420 million in annual revenue when it takes effect Jan. 1.

Michiganders in the cannabis industry have protested the tax, however, arguing that it will put the state at the second highest cannabis tax rate in the country. They say it will hurt businesses and raise customer prices.

During a Senate floor speech, Sen. Jeff Irwin, D-Ann Arbor, said the legislation routes around the will of voters who legalized marijuana in 2018. Sen. Jonathan Lindsey, R-Allen, said he believes the tax won’t work and will cripple small businesses.

Sen. Edward McBroom, R-Waucedah Township, said the industry is “out of control,” and has failed to deliver on promises of investment in border communities like his Upper Peninsula one.

The tax is part of a budget deal pitched by Whitmer and legislative leaders after months of stalled negotiations.

Lawmakers failed to pass the 2025-26 spending plan before their constitutionally mandated Oct. 1 deadline, instead passing a short-term plan while they worked out final details on the permanent plan.

In the House, Rep. Alabas Farhat, D-Dearborn, said the budget’s passage ensures that the government will be permanently funded after months of back and forth that resulted in two missed budget deadlines.

“We can give certainty that the next time you’re watching the Tigers game, you don’t have to be interrupted with a news bulletin asking if the state government (will be) shut down or not,” Farhat said.

He highlighted the general government budget for including “no tax on tips, no tax on overtime” and a long-term sustainable road funding plan.

The $51.8 billion budget boosts funds to the state Department of Transportation, part of a roads plan that includes $1.1 billion in increased ongoing funding.

Shoring up road funding relies on the new 24% wholesale tax on marijuana. It also requires a shift of all existing gas tax revenue – including what goes to the state’s School Aid Fund – and some corporate income tax revenue to roads.

All three pieces have prompted opposition.

Farhat said, “One thing I’ll say is that we did all of this without compromising on the programs that the working families in the state of Michigan come to rely on.”

But not everyone appears to appreciate the budget’s big changes.

Michigan business organizations, including the Detroit Regional Chamber, Grand Rapids Chamber, Michigan Chamber of Commerce, Michigan Manufacturers Association and the Small Business Association of Michigan, issued a joint statement early Friday morning criticizing changes to the corporate income tax they say would result in a $2 billion tax increase over the next five years.

A bill passed to accompany the budget modifies Michigan’s income tax policy in response to President Donald Trump’s One Big Beautiful Bill Act, also allocating corporate income tax revenue to fund roads.

Business leaders say it’s separating from federal tax reforms, something that will result in Michigan businesses paying higher state taxes.

“In a time of growing uncertainty for Michigan companies of all sizes and industries, creating conditions for economic stability and future investment must be the priority,” the statement read.

Rep. Ann Bollin, R-Brighton Township, said she believes the budget cuts waste, fraud and abuse, sounding the alarm on “‘phantom employee’ positions that state departments are funded to hire, but that never get filled.”

Bollin, the head of appropriations in the House, said the budget includes the removal of 2,000 phantom employee positions and prevents the authorization of 900 more, saving “over half a billion dollars.”

It also includes new requirements that state departments “maximize utilization of its in-person workforce,” with required office occupancy rates of 80% or higher for some departments.

“We’re turning the lights back on, ending wasteful spending on empty office space, returning state workers to Lansing,” Bollin said. “In the private sector, office buildings average 80% occupancy. State government should be held to a similar standard.”

Bollin pointed to cutting general fund expenditures and “shrinking the overall size of the state government” as a reset of priorities.

The budget significantly cuts funding to multiple state departments, including over $7 billion to the Department of Health and Human Services, mainly due to federal spending cuts.

Other line items included in the general government budget include:

$26 million in one-time funding for the runway replacement project and infrastructure improvements at Selfridge Air National Guard Base, an $11 million increase from the previous year.

$7.7 million for a study and 3-year pilot program to look at options for a per-mile fee on drivers, an alternative to Michigan’s gas tax.

$14 million for cleanup and reforestation activities after the March 2025 ice storm that left an estimated 100,000 homes without power.

$1.4 million in federal funding for the installation of high-speed internet infrastructure on DNR lands.

Following the passage of the general government budget, both chambers also passed the School Aid omnibus bill.

The $21.3 billion spending package – roughly half a billion more than last year – includes a 4.6% hike in general per-student funds, a restoration of $321 million for mental health and safety needs and a continuation of free school meals for Michigan’s K-12 students.

The 4.6% per-student hike is a roughly $400 increase from what was allocated last year, going from $9,608 to $10,050, but some advocates say it doesn’t account for inflation or go far enough.

In a floor speech, Rep. Carol Glanville, D-Walker, said while she believes “everyone in this chamber wants what’s best for our students, it’s obvious we have decidedly different view on how best to achieve that goal.”

She pointed to a per-pupil funding amount below the national average of $17,277 for K-12 public schools. Glanville also criticized the shift of “hundreds of millions” of School Aid dollars to higher ed.

But she and others also applauded the continuation of universal free meals, after initial concern that the program’s funding would be eliminated from the budget, leaving only free and reduced meals for eligible low-income students through the U.S. Department of Agriculture.

In the latest spending plan for 2025-26, school meals would receive an appropriated $201.6 million.

Other notable priorities in the school spending plan:

$65 million in a grant program for districts to reduce class sizes, with the aim to help four districts in a pilot effort year keep class sizes in kindergarten through third grade at an average size of 17 to 19 students.

$258.7 million more for at-risk student supports, marking a 25% increase to $1.3 billion.

25% more for English-language learners, or $12.55 million more for $62.7 million total.

Retention of $70 million for career-technical education programs in “CTE deserts”

$100 million for school infrastructure grants.