By Oluwatobi Ojabello

Copyright businessday

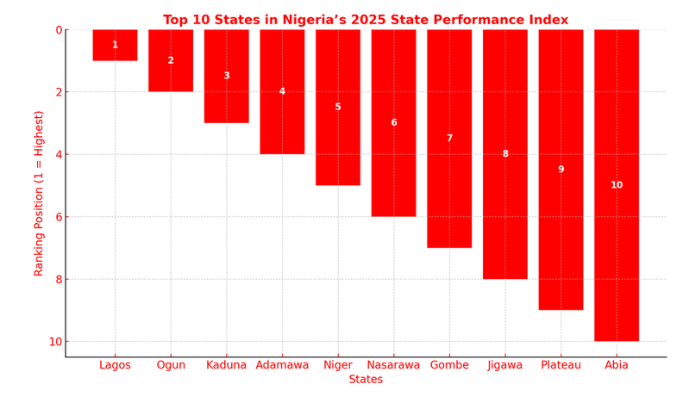

Lagos, Ogun, Kaduna and Adamawa have outperformed other states in internally generated revenue (IGR), investment in human capital and other indices.

These were revealed in the 2025 State Performance Index (pSPI), recently released by Phillips Consulting.

Now in its second year, the index blends hard numbers with citizen sentiment. Seventy percent of states’ scores are based on objective measures such as internally generated revenue (IGR), debt levels, audited accounts, and capital spending on health and education.

The remaining 30 percent reflects how residents experience daily life: whether water runs, schools function, taxes feel justified, and streets stay safe. States are then grouped into five tiers, from one-star ‘Fair’ to five-star ‘Exceptional.’

Read also: Kogi increases IGR from N750m to N3b in 4 years

On the metrics, Lagos comes first with a five-star rating. Its dominance rests on unrivalled revenue generation and economic density. The SPI shows Lagos generates about N51,840 in IGR per resident and more than N200 million per square kilometre – figures unmatched nationwide.

For investors, such density signals capacity to honour contracts and sustain infrastructure, reinforcing Lagos as Nigeria’s safest fiscal bet.

Lagos weaknesses

Yet, the report highlights weaknesses beneath the headline numbers. Poor outcomes in water and sanitation, a heavy debt burden per resident, and regulatory frictions constrain long-term growth. The message is clear: revenue scale provides resilience, but services must keep pace.

Ogun, Kaduna climb the table

Ogun and Kaduna take second and third, each earning four-star ratings. Ogun’s rise reflects its emergence as Lagos’s industrial neighbour, with estates and manufacturing corridors benefiting from proximity to Nigeria’s commercial capital.

Gains in account transparency and revenue collection have further strengthened investor confidence.

Kaduna ranks as the highest northern state, supported by visible investment in infrastructure and education. But residents still flag insecurity and inconsistent services, underlining that fiscal reform takes time to reflect realities on the ground.

Read also: Human capital development drive: Uniport @50 fishes out Emi Membere-Otaji

Reform-minded states move fast

The rest of the top 10 shows how smaller reform-oriented states can leap forward. Adamawa surged from 26th in 2024 to fifth this year, driven by higher capital spending and clearer financial disclosure.

Niger climbed from 29th to sixth, while Abia jumped from last place in 2024 to 10th, one of the index’s most dramatic reversals.

Nasarawa, Gombe, Jigawa, and Plateau also feature in the top tier, reflecting progress in fiscal management and transparency. Gombe, however, slipped from first in 2024 to seventh after heavier weighting of hard data exposed weaknesses masked by last year’s perception-led score.

Why the rankings matter

For investors, the rankings signal where state bonds, infrastructure concessions and public-private partnerships carry less risk. States with strong IGR bases, audited accounts and evidence of service delivery look better positioned to attract capital.

For policymakers, the lesson is starker: transparency and basic services build credibility more than political rhetoric. The exclusion of the Federal Capital Territory (FCT), which failed to publish audited accounts in 2025, underscores that opacity has costs.

A federation of contrasts

The results also underline Nigeria’s regional contrasts. The South-West dominates the upper tier, led by Lagos and Ogun. In the North, Kaduna, Nasarawa, Adamawa, Niger and Jigawa show reform momentum can pay off even in regions grappling with insecurity.

The South-East reflects mixed fortunes: Abia rebounded to 10th, but Anambra slid to 34th, exposing persistent governance and service delivery gaps.

At the bottom, states hampered by conflict, weak governance, and poor services continue to struggle. Katsina (32nd), Sokoto (33rd), Anambra (34th), Kogi (35th), and Borno (36th) occupy the lowest ranks, where both perception and hard numbers converge on poor performance.

Read also: Governments urged to increase investment in human capital development

The bottom line

By placing audited data at the heart of the methodology, the SPI has made fiscal independence and transparency the new currency of state performance. Lagos leads on scale, but the bigger story is that reform-driven states such as Adamawa, Niger and Abia can climb rapidly once services improve and accounts are credible.

In a federation where trust is often scarce, the conclusion is blunt: numbers now speak louder than promises, analysts say.