Copyright dailymail

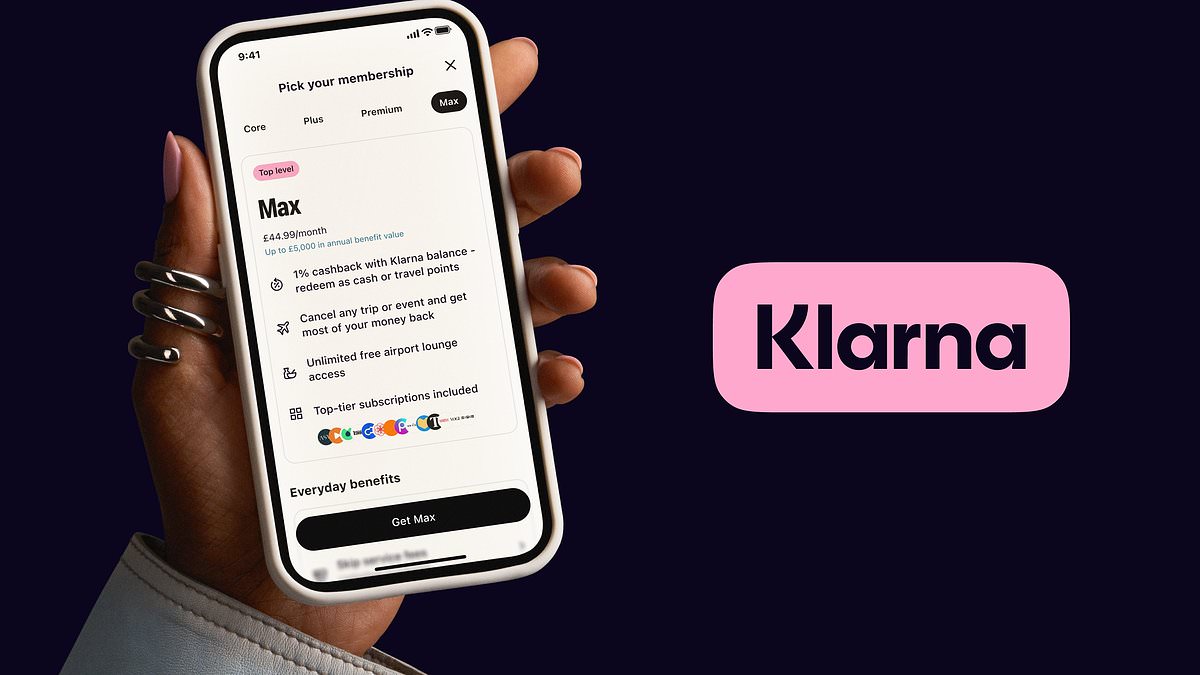

Klarna launches debit cards for British shoppers - and one costs £44.99 a month: What are the perks? By HELEN KIRRANE, REPORTER, THIS IS MONEY Updated: 14:37 GMT, 27 October 2025 Buy now, pay later firm Klarna is looking to take on Britain's high street banks with the launch of its debit card in Britain. The firm, which is best known for its credit service allowing shoppers to split the cost of online purchases, will now cater to customers wanting to spend their own money with the e-money account which will soon be rolled out in the UK. Customers will be able to sign up for paid-for accounts called Klarna Premium and Max, which given them perks including cashback, fitness classes, airport lounge access and a fertility app. However, the accounts come with a monthly fee of as much as £44.99 per month. When Klarna launched its debit card in the US, it attracted 1million sign-ups in a little under three months. Klarna was granted Electric Money Institution (EMI) status in June by financial watchdog the Financial Conduct Authority. New offering: Klarna is taking on high street banks with the roll out of premium e-money accounts which offer perks in exchange for a monthly fee EMIs are different to a current account. Electric money, or e-money, is stored electronically, usually in an online account or wallet, or on a prepaid card. You can use e-money to make payments, and EMIs can also provide non-bank current accounts. Looking ahead, Klarna has set its sights on obtaining a banking licence which David Sandström, chief marketing officer at Klarna tells This is Money would be 'a natural evolution of Klarna.' 'The launch of these products marks a major step in Klarna’s evolution into a full-scale digital bank,' he says. What do the Klarna accounts offer? Klarna's new membership accounts come with a range of accounts for a fee ranging from £17.99 to £44.99 a month. Their biggest competition will be high street banks such as Lloyds, HSBC and NatWest, which offer paid-for accounts with perks such as healthcare services, airport lounge passes and global travel insurance. These banks often require that customers have at least £100,000 or this amount in savings and investments. The Klarna card can be used anywhere Visa is accepted and has no foreign transaction fees, meaning it could also rival the likes of Revolut and Monzo. RELATED ARTICLES How much of a salary hike do YOU need to keep up with... Can I get a mortgage to buy a house without having a job? Share this article Klarna Premium costs £17.99 which would see customers paying £215.88 a year. It offers free subscriptions to the following: Blinkist, a book summarising service ClassPass, a fitness class app Clue, fertility app Vogue & GQ subscrptions Headspace, mental health app Laundryheap, online laundry delivery service MasterClass, online classes Picsart, a suite of free AI design tools Premium Customers get 0.5 per cent cashback on spending when using the Klarna balance account and global travel insurance. The account comes with a 2GB travel eSIM and a flashy 16g metal card in silver or black. Customers can also convert their Klarna-earned cashback and spend it directly with travel and hospitality partners including airlines such Air France–KLM, British Airways, United Airlines, and Turkish Airlines, and hotel groups like Accor, IHG Hotels & Resorts, Radisson, Global Hotel Alliance, and Wyndham. Almost HALF of money saved is put in a cash Isa, as Rachel Reeves mulls plan to slash allowance Klarna Max costs £44.99 a month which would see customers paying £539.88 a year in exchange for the perks. The account offers subscriptions to the following: ASmallWorld, a travel website Audiobooks.com, an audiobook site Blinkist, a book-summarising service ClassPass, a fitness class app Clue, fertility app Condé Nast (All titles, including New Yorker) Headspace, a mental health app Laundryheap, online laundry delivery service MasterClass, online classes Picsart, free AI design tools The Times and Sunday Times The cashback is upped to 1 per cent cashback on spending when using Klarna balance account. It includes travel insurance, rental car insurance and a 5GB travel eSIM. Customers who hold the max account will get unlimited airport lounge access worldwide via LoungeKey Pass, which has more than 1,600 lounges and can be found in London Gatwick, London Heathrow, London Luton and London Stanstead. The Max account also comes with a yet-flashier 16g rose gold metal card. Will the Klarna card appeal to Britons? When Klarna launched its debit card in the US, it attracted 1million sign-ups in 11 weeks. The UK is Klarna's second biggest market after the US. Most customers here are familiar with it for the buy now, pay later service it provides which allows customers to borrow to make a payment upfront and pay it back by installment over a payment plan. But Europe and the UK in general is a more debit-heavy market than the US, with US customers far more used to using credit. Asked if the card and accounts will have a similar uptake UK customers, Sandström says: 'The fact that we can offer debit and credit through the new Klarna accounts and card will make it more attractive so customers have choice. 'We have a very strong brand in the UK and hope that the UK could be an even bigger success than the US for the new products.' SAVE MONEY, MAKE MONEY Sipp cashback Sipp cashback £200 when you deposit or transfer £15,000 4.53% cash Isa 4.53% cash Isa Trading 212: 0.68% fixed 12-month bonus £20 off motoring £20 off motoring This is Money Motoring Club voucher Free shares bundle Free shares bundle Get free UK shares worth up to £200 4.45% Isa with bonus 4.45% Isa with bonus Now with no penalty for withdrawals Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence. Terms and conditions apply on all offers. Share or comment on this article: Klarna launches debit cards for British shoppers - and one costs £44.99 a month: What are the perks? Add comment