It’s a relatively quiet week. According to DB’s Henry Allen, the data highlight this week will be Friday’s US core PCE deflator which should print softer than feared a few weeks ago given the recent inputs from other inflation releases. The main events outside of this will be a series of Fed speakers (at least 16 this week, with 4 on deck today) who can give their own spin on a complicated FOMC last week where the dots were a little all over the place. The global flash PMIs tomorrow will be the other main highlight but its not likely to be a major mover with most main economies seemingly fairly stable at the moment.

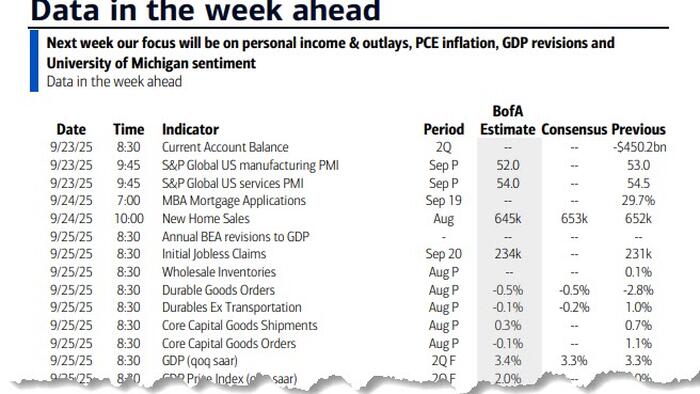

Friday’s personal income (+0.3% est. vs. +0.4% last) and consumption (+0.5% vs. +0.5%) data will include the all-important core PCE deflator which DB expects to come in at a relatively tame +0.22% vs. +0.27% last time. Thursday sees the final print on Q2 GDP (3.3% final vs. 3.3% prelim) and will also feature the annual update to the national accounts in which the BEA incorporates more complete and detailed source data covering the prior five years, allowing for revisions. So, another chance for history to be rewritten. Other notable US releases will include tomorrow’s existing home sales; Wednesday’s new home sales; Thursday’s durable goods orders, and the advanced trade balance; and Friday’s University of Michigan consumer sentiment index.

In terms of those Fed speakers this week, we’ll highlight the current voters. Today kicks off with Williams who should mirror the views of Powell last week. Musalem will also give an outlook speech later and new Governor Miran will be on the tapes with his thoughts likely to be fascinating to hear. Tomorrow, Chair Powell will give an outlook speech which will likely be similar to his FOMC rhetoric. Governor Bowman will also speak. Thursday sees Goolsbee, Williams, Governors Bowman and Barr, and Daly who votes next year. Governor Bowman also speaks on Friday. As DB’s economists point out, the Supreme Court has asked Governor Cook to respond by Thursday to President Trump’s appeal, which seeks to overturn lower court rulings preventing her immediate removal from office.

Trump will likely be in the news earlier in the week as he addresses the 80th UN General Assembly in New York tomorrow. We’ll also get a better idea of where we are with US exceptionalism on Friday with the Ryder Cup starting in New York. It will also be interesting to see the reaction from corporate America to Trump’s weekend plans to impose a $100,000 application fee for the widely used H-1B visa for foreign workers in speciality occupations. It’s caused a huge amount of uncertainty over the weekend for those that rely on it.

Outside of the US, Sweden (tomorrow) and Switzerland (Thursday) central banks are meeting with markets pricing in a 30% chance of a cut from the Riksbank, but with only a 4% chance for the SNB. A cut for the Swiss would lead the country back into negative rate territory if it did happen. Staying in Europe, sentiment gauges out include the Ifo survey in Germany on Wednesday as well as consumer confidence across major European economies, including Germany and France on Thursday.

Elsewhere, rounding out notable data releases, highlights include the Tokyo CPI for September in Japan and the July GDP report in Canada both on Friday, as well as the August CPI in Australia on Wednesday. For the Tokyo CPI, economists see an acceleration in core inflation ex. fresh food to 2.8% YoY (2.5% in August) and a slowdown in core-core inflation ex. fresh food and energy to 2.9% (3.0%).

Below is the day-by-day calendar for the full week ahead, courtesy of DB.

Monday September 22

Data: US August Chicago Fed national activity index, Eurozone September consumer confidence, Canada August industrial product price index, raw materials price index

Central banks: Fed’s Williams, Musalem, Hammack, Miran and Barkin speak, ECB’s Lane and Nagel speak, BoE’s Bailey and Pill speak, China 1-yr and 5-yr loan prime rates

Tuesday September 23

Data: US, UK, Germany, France and the Eurozone September PMIs, US September Philadelphia Fed non-manufacturing activity, Richmond Fed manufacturing index, business conditions, Q2 current account balance

Central banks: Fed’s Powell, Bowman and Bostic speak, ECB’s Muller, Kocher and Cipollone speak, BoE’s Pill speaks, Riksbank decision

Earnings: Micron

Auctions: US 2-year Notes ($69bn)

Wednesday September 24

Data: US August new home sales, Japan September PMIs, Germany September Ifo survey, Australia August CPI

Central banks: Fed’s Daly speaks, BoE’s Greene speaks

Auctions: US 2-year FRN (reopening, $28bn), 5-year Notes ($70bn)

Thursday September 25

Data: US August durable goods orders, advance goods trade balance, wholesale inventories, existing home sales, September Kansas City Fed manufacturing activity, initial jobless claims, Japan August PPI services, Germany October GfK consumer confidence, France September consumer confidence, EU27 August new car registrations, Eurozone August M3

Central banks: Fed’s Goolsbee, Williams, Bowman, Barr, Logan and Daly speak, ECB’s economic bulletin, BoJ’s minutes of the July meeting, SNB decision

Earnings: Costco, Accenture

Auctions: US 7-year Notes ($44bn)

Friday September 26

Data: US August PCE, personal income and spending, September Kansas City Fed services activity, Japan September Tokyo CPI, Italy September consumer confidence index, economic sentiment, manufacturing confidence, Canada July GDP

Central banks: Fed’s Barkin and Bowman speak, ECB’s August consumer expectations survey

Finally, looking at just the US, the key economic data releases this week are the durable goods report on Thursday and core PCE inflation on Friday. There are several speaking engagements by Fed officials this week, including events with Fed Chair Powell on Tuesday and New York Fed President Williams on Monday

Monday, September 22

There are no major economic data releases scheduled.

09:45 AM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will participate in a panel discussion on monetary policy frameworks organized by the European Money and Finance Forum. Q&A is expected. On September 4, Williams said, “The Federal Reserve’s monetary policy stance has been modestly restrictive…, [and] this policy stance is appropriate given that inflation has remained above our 2 percent target while the labor market has been generally consistent with maximum employment.”

10:00 AM St. Louis Fed President Musalem (FOMC voter) speaks: St. Louis Fed President Alberto Musalem will give remarks on the outlook for the US economy and monetary policy at an event hosted by Brookings Institution’s Hutchins Center on Fiscal and Monetary Policy. Following his remarks, he will be interviewed by David Wessel, director of the Hutchins Center. Q&A is expected. On September 3, Musalem said, “Recent data have further increased my perception of downside risks to the labor market…, [and] looking ahead, I expect the labor market to gradually cool and remain near full employment with risks tilted to the downside.”

12:00 PM Cleveland Fed President Hammack (FOMC non-voter) speaks: Cleveland Fed President Beth Hammack will host an event at the Cleveland Fed headquarters to discuss the functions of Federal Reserve Banks, the state of the economy, and ways Reserve Banks engage with the public. The event will be livestreamed. On August 22, Hammack said, “We are only very modestly restrictive, [and] we are at a very small distance to getting to a neutral rate.” She also noted, “We need to be cautious about removing that restriction.”

12:00 PM Richmond Fed President Barkin (FOMC non-voter) speaks: Richmond Fed President Tom Barkin will speak on the economy at the Howard County Chamber of Commerce in Maryland. Q&A is expected. On August 12, Barkin said, “Job gains have slowed recently, which is certainly worth watching. But I’m hopeful that even as businesses face cost and price pressure, they’ll largely avoid the type of large layoffs that would spike unemployment.”

12:00 PM Fed Governor Miran speaks: Fed Governor Stephen Miran will speak at a webinar hosted by the Economic Club of New York. Q&A is expected. On September 19, Miran said, “In my opinion, being so far above neutral means monetary policy is quite restrictive, and the longer it provides that level of restriction with the labor market having done what it did last year and the first half of this year, the greater the risks that we start to miss on the employment side of the mandate.”

Tuesday, September 23

09:00 AM Fed Vice Chair for Supervision Bowman speaks: Fed Vice Chair for Supervision Michelle Bowman will speak at the 134th Annual Kentucky Bankers Association Convention on the economic outlook. Speech text and Q&A are expected. On August 4, Bowman said, “I believe that beginning to move our policy rate at a gradual pace toward its neutral level will help maintain the labor market near full employment and ensure smooth progress toward achieving our dual mandate.” She also noted, “My Summary of Economic Projections includes three cuts for this year, which has been consistent with my forecast since last December, and the latest labor market data reinforce my view.”

09:45 AM S&P Global US manufacturing PMI, September preliminary (consensus 51.7, last 53.0)

09:45 AM S&P Global US services PMI, September preliminary (consensus 53.9, last 54.5)

10:00 AM Atlanta Fed President Bostic (FOMC non-voter) speaks: Atlanta Fed President Raphael Bostic will speak on the economic outlook on a Macro Musings podcast live recording. Q&A is expected. On September 3, Bostic said, “I continue to believe that the effects of tariffs on consumer prices won’t fade fast, and in fact will not fully materialize for some months.” He also noted, “These [inflation] numbers give me pause, [and] I will not be complacent and simply assume expectations will remain anchored and another inflation outbreak won’t happen.”

12:35 PM Fed Chair Powell speaks: Fed Chair Jerome Powell will speak on the economic outlook at the Greater Providence Chamber of Commerce Crowne Plaza Hotel in Rhode Island. Speech text and Q&A are expected. During the FOMC press conference on Wednesday, Powell said, “We see that the labor market is softening and we don’t need it to soften anymore, and we don’t want it to.” Powell characterized the policy decision at the September FOMC meeting as “a risk management cut” in response to downside risks in the labor market.

Wednesday, September 24

10:00 AM New home sales, August (GS -1.5%, consensus -0.3%, last -0.6%)

04:10 PM San Francisco Fed President Daly (FOMC non-voter) speaks: San Francisco Fed President Mary Daly will deliver keynote remarks on the outlook for the economy at the annual Spencer Fox Eccles Convocation at the University of Utah’s School of Business. After her remarks, she will join Kurt Dirks, Dean of the David Eccles School of Business, for a conversation. Speech text and Q&A are expected. On August 29, Daly said, “It will soon be time to recalibrate policy to better match our economy.” She also noted, “I think tariff-related price increases will be a one-off, [and] it will take time before we know that for certain, but we can’t wait for perfect certainty without risking harm to the market.”

Thursday, September 25

08:20 AM Chicago Fed President Goolsbee (FOMC voter) speaks: Chicago Fed President Austan Goolsbee will speak in a moderated discussion at Crain’s Power Breakfast about the Fed and the economy, focusing on trends for West Michigan. On September 5, Goolsbee said, “[Concerning] this slowdown in aggregate jobs numbers, we have to be extremely careful taking that as an indicator of the business cycle when things like immigration, labor supply, and labor force participation are moving behind the scenes.” He also noted, “We put a note of unease in the [July] CPI and PPI reports, with inflation kicking up in categories that are not obviously going to be transitory, which is to say services inflation.”

08:30 AM Advance goods trade balance, August (GS -$92.0bn, consensus -$96.0bn, last -$102.8bn) : We forecast that goods trade balance narrowed from -$102.8bn to -$92.0bn in August, reflecting declines in gold imports and imports from Southeast Asian countries.

08:30 AM Wholesale inventories, August preliminary (consensus +0.1%, last +0.1%)

08:30 AM GDP, Q2 third release (GS +3.4%, consensus +3.3%, last +3.3%); Personal consumption, Q2 third release (GS +1.9%, consensus +1.9%, last +1.6%): We estimate a 0.1pp upward revision to Q2 GDP growth to +3.4% (quarter-over-quarter annualized), reflecting upward revisions to consumer spending (+0.3pp to +1.9%), business fixed investment, and net exports. The third release of Q2 GDP will coincide with the 2025 annual update to the National Economic Accounts, which incorporates source data that are more complete than those previously available and methodological changes.

08:30 AM Durable goods orders, August preliminary (GS -1.5%, consensus -0.3%, last -2.8%); Durable goods orders ex-transportation, August preliminary (GS flat, consensus -0.2%, last +1.0%); Core capital goods orders, August preliminary (GS flat, consensus -0.1%, last +1.1%); Core capital goods shipments, August preliminary (GS +0.3%, consensus +0.2%, last +0.7%): We estimate that durable goods orders declined 1.5% in the preliminary August report (month-over-month, seasonally adjusted), reflecting a decline in commercial aircraft orders. We forecast unchanged core capital goods orders—reflecting an improvement in the new orders components of manufacturing surveys in August but potential payback for the outsized increase in the prior month—and a 0.3% increase in core capital goods shipments—reflecting the increase in orders in the prior month.

08:30 AM Initial jobless claims, week ended September 20 (GS 230k, consensus 235k, last 231k); Continuing jobless claims, week ended September 13 (consensus 1,938k, last 1,920k)

09:00 AM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will give welcoming remarks at the New York Fed’s Fourth Annual International Roles of the US Dollar Conference.

09:00 AM Kansas City Fed President Schmid (FOMC voter) speaks: Kansas City Fed President Jeff Schmid will speak about monetary policy and the economic and banking outlook at the Mid-Sized Bank Coalition of America in Dallas. On August 21, Schmid said, “I think we are in a good place [with policy] and we have to be careful with what lowering short-term rates would do to the inflation mentality if inflation is running closer to 3% than to 2%.” He also noted, “While it is true that payroll growth was weak over the summer, a broader set of indicators suggest a labor market that is in balance.”

10:00 AM Existing home sales, August (GS -2.5%, consensus -1.3%, last +2.0%)

10:00 AM Fed Vice Chair for Supervision Bowman speaks: Fed Vice Chair for Supervision Michelle Bowman will participate in a moderated discussion at the 2025 Financial Markets Quality Conference hosted by the Psaros Center for Financial Markets and Policy at Georgetown University. Q&A is expected.

01:00 PM Fed Governor Barr speaks: Fed Governor Michael Barr will speak at the Peterson Institute for International Economics on bank stress testing and potential reforms. Q&A is expected.

01:40 PM Dallas Fed President Logan (FOMC non-voter) speaks: Dallas Fed President Lorie Logan will speak at a panel organized by the Federal Reserve Bank of Richmond. Q&A is expected.

03:30 PM San Francisco Fed Daly (FOMC non-voter) speaks: San Francisco Fed Mary Daly will sit down with Mark Packard, President and CEO of the Central Bank of Utah, for a conservation on her economic outlook at the San Francisco Fed’s 2025 Western Bankers Forum. Q&A is expected.

Friday, September 26

08:30 AM Personal income, August (GS +0.4%, consensus +0.3%, last +0.4%); Personal spending, August (GS +0.4%, consensus +0.5%, last +0.5%); Core PCE price index, August (GS +0.21%, consensus +0.2%, last +0.3%); Core PCE price index (YoY), August (GS +2.92%, consensus +2.9%, last +2.9%); PCE price index, August (GS +0.25%, consensus +0.3%, last +0.2%); PCE price index (YoY), August (GS +2.72%, consensus +2.7%, last +2.6%): We estimate that both personal income and personal spending increased by 0.4% in August. We estimate that the core PCE price index rose 0.21% in August, corresponding to a year-over-year rate of +2.92%. Additionally, we expect that the headline PCE price index increased 0.25% in August, or increased 2.72% from a year earlier.

09:00 PM Richmond Fed President Barkin (FOMC non-voter) speaks: Richmond Fed President Tom Barkin will participate in a fireside chat to discuss the US economic outlook. Q&A is expected.

10:00 AM University of Michigan consumer sentiment, September final (GS 55.0, consensus 55.4, last 55.4): University of Michigan 5-10-year inflation expectations, September final (GS 3.8%, last 3.9%)

01:00 PM Fed Vice Chair for Supervision Bowman speaks: Fed Vice Chair for Supervision Michelle Bowman will give a speech on the approach to monetary policy decision-making at the Cornell Club of New York. Q&A is expected.

Source: DB, Goldman

Loading recommendations…