By Alice Li,Kandy Wong,Ralph Jennings

Copyright scmp

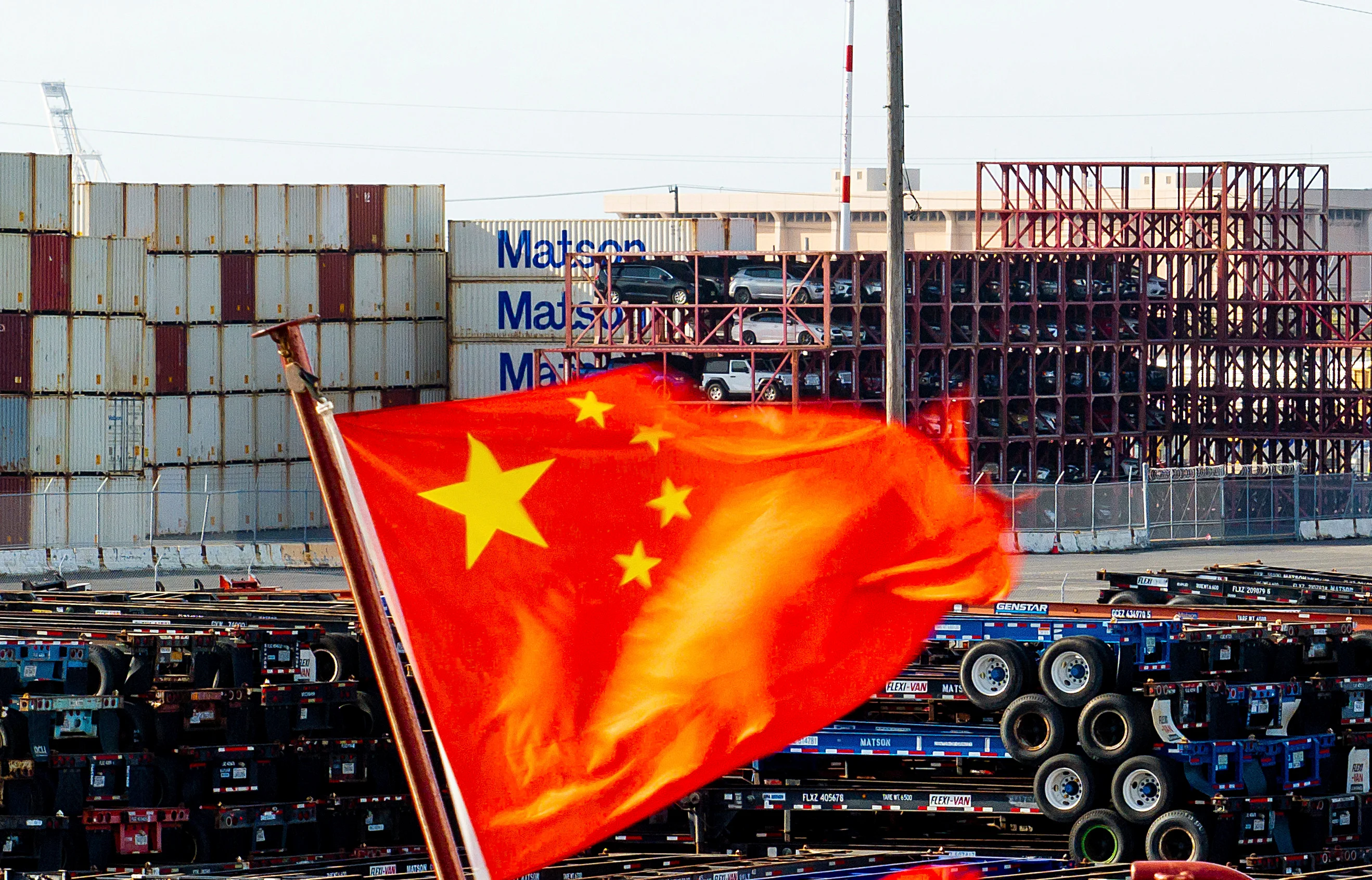

Washington’s decision to broaden its trade blacklist could put many overseas subsidiaries of Chinese firms under scrutiny, potentially disrupting their “going global” strategies and reigniting trade tensions between the two superpowers, analysts said.

The US Bureau of Industry and Security (BIS) announced on Monday that any company at least 50 per cent owned by firms already on the US Entity List or the Military End-User List – which target entities Washington deems a security threat – will now automatically face the same restrictions.

The US Department of Commerce said the new rules are effective immediately, with certain exceptions permitted for up to 60 days following their publication in the Federal Register on Tuesday.

The move came as China and the US weigh their next steps in trade talks.

“If companies on the blacklist have in fact been using subsidiaries to circumvent restrictions and these new rules are effective in closing that loophole, there will be pain,” said Stephen Olson, a visiting senior fellow at ISEAS-Yusof Ishak Institute and a former US trade negotiator.

He called the revision an “overdue corrective” to a gap that previously allowed blacklisted firms to maintain access via related companies. The impact “could be significant”, he added.

Washington did not explicitly single out any country in the announcement, but analysts said the revised export controls largely target China. The changes also came at a critical moment: the US and China have yet to reach a comprehensive trade deal, while their leaders are expected to meet at the Apec Forum in South Korea in late October.

A lot of people are going to get nervous because they think the Trump administration will willy-nilly apply these sanctions

Andrew Collier, Harvard Kennedy School’s Mossavar-Rahmani Centre for Business and Govern-ment

“This broader interpretation means a lot more Chinese companies could be put on that list. The net is definitely closing in on exports to China,” said Chen Zhiwu, chair professor of finance at the University of Hong Kong.

Beijing-based multinational law firm Zhong Lun warned in a note that Washington’s expanded blacklist could severely disrupt Chinese firms’ overseas expansion models, including those that establish subsidiaries or acquire local companies. It is “not an exaggeration” to suggest such strategies could “completely fail”, the firm said.

Andrew Collier, a senior fellow at the Harvard Kennedy School’s Mossavar-Rahmani Centre for Business and Govern-ment, also noted that the new rules could harm China’s global export ambitions.

“Obviously, a lot of people are going to get nervous because they think the Trump administration will willy-nilly apply these sanctions,” he said.

The US has used the list to target leading Chinese technology firms such as Huawei, DJI and SMIC for years, restricting their access to critical technologies and suppliers and complicating their overseas operations.

In September, the US added 32 entities to its trade blacklist, including 23 Chinese companies, mainly in the biotech, electronics and semiconductor industries.

About 1,100 Chinese entities are currently on the Entity List, according to the Center for New American Security. In total, more than 3,400 parties are covered, Los Angeles-based data firm Kharon said, adding that the new rules will sweep in thousands of additional subsidiaries.

China voiced “firm opposition” to the move on Monday night. “The rules represent another instance of the US broadly invoking national security to justify export controls,” the Ministry of Commerce said in a statement.

“It severely undermines the rights of affected companies, disrupts international trade and threatens the stability of global supply chains.”

A fifth round of China-US trade talks is expected soon, following September’s negotiations in Spain. Chim Lee, senior analyst at the Economist Intelligence Unit (EIU), said Washington’s latest move might be aimed at gaining leverage at the negotiating table.

“Any action on either side can be seen in the context of them wanting as many bargaining chips as possible during the ongoing trade negotiations,” Lee said.

“If the rules do pass, China can retaliate by re-escalating export controls on critical minerals.”

But despite the friction, Olson said both sides are still progressing towards a trade deal. “In terms of the timing, it could be intended as a signal that while the US doesn’t want to rock the boat too much before the Korea meeting, it will take action when it feels necessary to protect US interests,” he said.

“Both sides have thrown a few punches lately, but nothing sufficient to scuttle prospects for a deal or the meeting in Korea. China will simply add this to its list of grievances.”