Copyright forbes

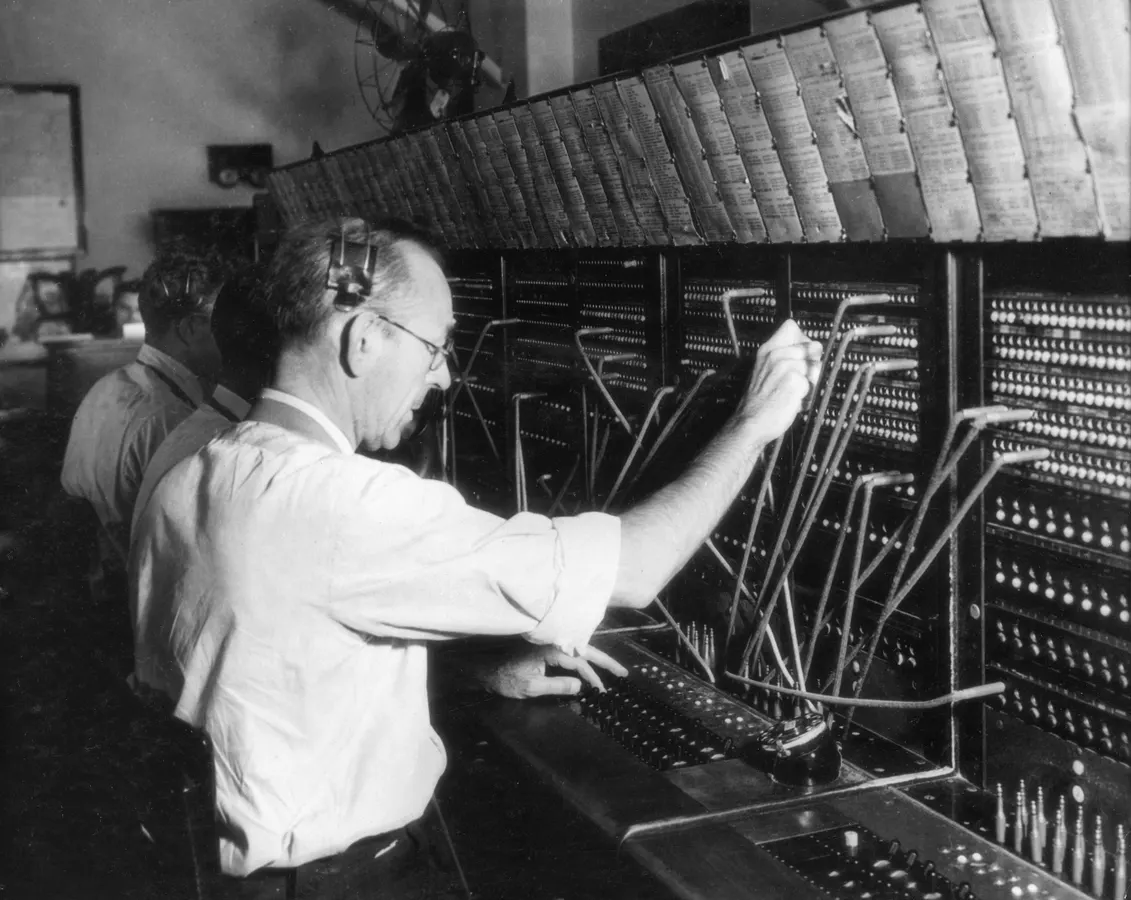

Once, every connection was made manually. Now, AI links the data and decisions that power modern family offices. Getty Images New data from the North America Family Office Report 2025 shows that artificial intelligence is moving from theory to practice and in a way reshaping how private wealth operations manage data, risk, and decision-making. Family offices have traditionally adopted new technology at a slow pace. Yet this latest report, published by Campden Wealth in partnership with RBC, paints a different picture. Artificial intelligence, automation, and data systems are becoming fundamental parts of how family offices operate. Nearly 70 percent of respondents now use automated investment reporting or wealth aggregation platforms, compared with 46 percent the year before. The jump reflects both necessity and opportunity. As portfolios span multiple asset classes, currencies, and jurisdictions, the administrative burden of reconciling information manually has become unsustainable. Offices are turning to digital infrastructure that can keep pace with their complexity. According to Adam Ratner, Director of Research at Campden Wealth, “Family offices are adopting Generative AI at a rapid pace. Today, we are seeing the technology being used for investment research, with aspirations of using it for reporting and administrative processes so teams can concentrate more on strategic work.” The report describes this transition as a move “from concept to practice.” The change is not driven by hype around generative AI, but by the need for greater precision and reliability in financial reporting. Many family offices are already applying AI tools to investment analysis, data collection, and media research. The next wave, according to the data, will focus on risk management and internal knowledge systems that give principals and executives faster access to context and insight. MORE FOR YOU How the family office is using, or would like to use, generative AI Campden Wealth / RBC, The North America Family Office Report, 2025 AI Moves From Concept to Practice The findings indicate that family offices, like all businesses, are crossing a threshold in AI adoption. What was once considered an experiment is now becoming a part of daily processes. Offices that previously relied on spreadsheets are transitioning to integrated systems that can automatically gather and interpret information. A significant share of respondents already use AI for investment reporting and securities analysis. These tools clean and structure data from multiple custodians and managers, a task that previously required manual entry and constant checking. As accuracy improves, so does decision speed. One family office director interviewed observed that even traditionally conservative organizations now recognize the pace of change: “Family offices tend to be late adopters of technology, but even the traditional ones recognize that large language models and generative AI will have a meaningful impact much faster than they realized.” — a director of a single family office, Florida Many expect large language models and other forms of AI to affect operations “much faster than they realized.” The first phase of adoption remains practical. Offices are using AI to reduce repetitive administrative work and to create reliable data foundations. Yet this groundwork is preparing them for more advanced applications. Many existing family office technology providers are also embedding AI capabilities directly into their platforms. Masttro just last week announced their agentic offering that allows family offices to query and reconcile wealth data in natural language. Eton Solutions launched AI tools to automate reconciliation, reporting, and administrative workflows across its platform. In Europe, Flanks recently raised new capital to expand its AI-driven data-aggregation engine, while Apex Group unveiled an AI-powered wealthtech platform designed to streamline investor onboarding and reporting. In the United States, Asseta has also doubled down on their AI features as they aim to replace fragmented accounting and reporting tools within family offices. The thesis across all these platforms would be that when information is structured correctly, AI systems can begin to analyze patterns across asset classes, track performance anomalies, and identify emerging risks. Rather than replacing analysts, these systems augment human judgment by improving visibility. Besides the traditional technology providers launching their AI features, there are also hundreds of new startups trying to enter this space with investment analysis-type solutions, many of them even vibecoded. All this additional noise could definitely make it more difficult to for clients to choose the right providers. Automating the Family Office From Spreadsheets to Systems Operational efficiency has become a strategic issue. The report identifies manual reporting as one of the top operational risks facing family offices. Inaccurate data or delayed reconciliations can distort investment oversight and governance. AI-enabled automation is starting to address this problem. Offices report faster reporting cycles, fewer reconciliation errors, and improved transparency across their structures. Many expect automation to reduce the need for large accounting or administrative teams, allowing resources to shift toward investment analysis and strategic planning. A chief financial officer interviewed for the study described the change as profound, noting that AI will “change the way we do almost everything.” The statement reflects a growing understanding that automation is not limited to data entry. It can also assist with document classification, compliance tracking, and performance attribution, reducing friction throughout the organization. Smaller offices often lack the scale to develop in-house solutions, so many rely on multi-family offices or outsourced providers that can distribute technology costs across multiple clients. This model has allowed sophisticated tools that were once reserved for large institutions to reach a broader segment of the market. Independent research underscores the scale of potential efficiency gains. A recent McKinsey analysis found that early implementations of AI agents accelerated project timelines by 40 to 50 percent and reduced costs by more than 40 percent. In one case, a universal bank built a “modernization agent factory” where a team of 100 AI agents, supervised by five humans, managed an entire software-modernization lifecycle—cutting time and labor costs by more than half. McKinsey estimates that early-stage use of agents can yield productivity improvements of three to five percent at the company level, rising toward ten percent as multi-agent workflows mature. As these systems mature, risk management is becoming a central application. Offices are beginning to use AI to flag inconsistencies, model scenarios, and stress-test portfolios against multiple outcomes. The technology is gradually transforming the family office into a connected information environment where reporting, risk, and governance are aligned within the same framework. Generative AI as a New Risk and Research Engine At present, the most common applications for Generative AI are investment reporting, research aggregation, and text analysis. Offices use AI tools to monitor media sentiment, summarize analyst commentary, and filter information relevant to specific holdings. Looking ahead, the most desired applications are risk management, manager selection, and internal knowledge management. Executives see potential for AI to consolidate fragmented information such as investment memos, contracts and correspondence into a single searchable environment. This would enable faster decision-making and reduce institutional memory loss when key staff change. Generative AI is also beginning to assist with drafting internal documents, preparing quarterly summaries, and identifying unusual activity in unstructured data. These functions save time but also improve consistency by applying the same analytical framework across large volumes of material. A complementary framework from McKinsey outlines three stages of progression: agents that assist individuals (“agentic labor”), agents that automate structured workflows, and agent-native systems that coordinate end-to-end processes under human oversight. The firm recommends that organizations establish an “agent factory” to codify standards, governance, and performance monitoring as these systems scale. For family offices, similar structures could ensure that data access, auditability, and accountability are built in from the outset, preventing uncontrolled tool sprawl as experimentation grows. Adoption patterns vary. Offices led by principals with backgrounds in technology or venture investing are moving fastest. Others are observing the early adopters before deciding how far to integrate AI into sensitive workflows. Across the sample, the direction is clear: AI is shifting from experimentation to embedded infrastructure. The report concludes that AI will likely reshape employment within the sector, not by replacing people outright but by changing the skills required. Data literacy, systems integration, and strategic interpretation are emerging as core competencies for the next generation of family office professionals. Could This Be The Early Signs Of a Big Shift? The North America Family Office Report 2025 captures a structural change in how private wealth operations use technology. Artificial intelligence and automation are no longer side projects; they are becoming essential to how information is processed and understood. For many offices, the challenge now is governance. This includes deciding who oversees AI-driven systems, how data integrity is maintained, and what safeguards are in place. The report suggests that transparency and auditability will become as important as performance when assessing new tools. Technology has always followed capital, but this year’s findings indicate that capital is now following technology too. As AI becomes more integrated into portfolio management and operational oversight, the family office model is evolving from a collection of discrete functions into a connected information network. The transformation is gradual but unmistakable. Artificial intelligence is no longer a future consideration. It is already part of how the modern family office sees its world. Editorial StandardsReprints & Permissions