Intel Corporation (NASDAQ: ) shares surged dramatically in premarket trading on September 18, 2025, jumping an extraordinary 28.59% to $32.02 as of pre-market hours following a groundbreaking announcement. The catalyst behind this massive surge was Nvidia’s (NASDAQ: ) surprise decision to invest $5 billion in the struggling chipmaker, marking one of the most significant partnerships in semiconductor industry history.

This investment comes at a critical time for Intel, which has been battling declining market share and financial losses, while also following a controversial government bailout deal that gave the U.S. government a 10% stake in the company. The Nvidia partnership represents a potential lifeline for Intel’s turnaround efforts and signals renewed confidence in the company’s future prospects.

Nvidia Takes 4% Stake and Partners With Intel on AI Chips

Nvidia’s $5 billion investment will make it one of Intel’s largest shareholders, acquiring approximately 4% of the company at $23.28 per share – slightly below Intel’s Wednesday closing price of $24.90 but above the $20.47 per share the U.S. government paid for its 10% stake last month.

This strategic investment represents more than just financial backing; it establishes a comprehensive partnership that will see the two companies jointly develop PC and data center chips with enhanced AI capabilities. The collaboration is particularly significant given Nvidia’s dominant position in the AI chip market and Intel’s struggles to maintain relevance in the rapidly evolving semiconductor landscape.

The partnership will focus on creating custom data center processors that Nvidia will package with its AI chips, utilizing proprietary Nvidia technology to enable faster communication between chips – a crucial advantage in AI applications where multiple processors must work together.

For consumer markets, Nvidia will provide Intel with custom graphics chips that can be integrated with Intel’s PC processors using the same high-speed connection technology. This arrangement potentially gives Intel a competitive edge against rivals like AMD while allowing Nvidia to expand its ecosystem beyond its current chip manufacturing partnerships with Taiwan’s TSMC.

Importantly, the deal does not involve Intel’s struggling foundry business manufacturing chips for Nvidia, which many analysts believe would be necessary for Intel’s long-term survival in contract manufacturing.

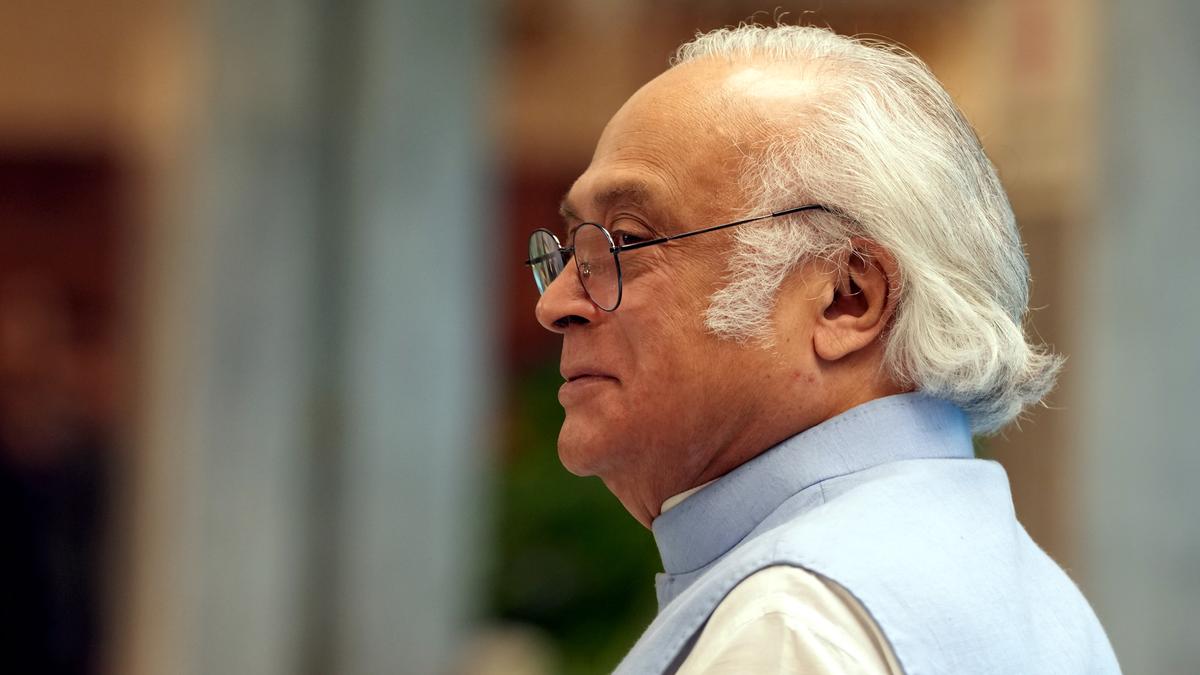

Instead, this appears to be a strategic move by Nvidia to diversify its U.S. investments while gaining favor with the U.S. government, which has been pushing for stronger domestic semiconductor capabilities. The collaboration represents a new chapter for Intel under CEO Lip-Bu Tan, who took over in March amid significant challenges, including political pressure and financial losses.

Intel Stock Jumps Despite Weak Margins and $20B Loss

Intel’s stock performance tells a story of a company in transition, with mixed results across different timeframes that reflect both recent struggles and emerging optimism. Year-to-date, Intel has actually outperformed the broader market with a 24.19% return compared to the S&P 500’s 12.22% gain, and over the past year, the stock has delivered a 15.98% return, though still lagging the S&P 500’s 17.14% performance.

However, the longer-term picture reveals significant challenges, with Intel posting a devastating 44.87% decline over five years compared to the S&P 500’s impressive 96.61% gain during the same period. These numbers underscore the company’s struggle to maintain its position in an industry that has been transformed by AI and mobile computing demands.

The company’s financial metrics paint a concerning picture of operational challenges, with Intel reporting a staggering profit margin of -38.64% and negative earnings per share of -$4.77 for the trailing twelve months. Despite generating $53.07 billion in revenue, the company posted a net loss of $20.5 billion, resulting in negative returns on both assets (-0.85%) and equity (-18.62%).

The company’s market capitalization stands at $116.29 billion, supported by $21.21 billion in cash but burdened by significant debt representing 48% of equity. These financial struggles explain why the Nvidia investment and partnership announcement triggered such a dramatic positive market reaction.

Intel’s recent capital raising efforts have provided some breathing room, with the company securing $2 billion from Softbank and $5.7 billion from the U.S. government in addition to the new $5 billion from Nvidia. According to Chief Financial Officer David Zinsner, the company is now in a “good cash position” and won’t require significant additional capital until there’s substantial demand for its next-generation 14A manufacturing process.

The premarket surge to $32.02 represents a critical psychological and financial milestone for Intel, suggesting that investors are beginning to see potential in the company’s turnaround strategy under new leadership and with powerful new partnerships.

***

Looking to start your trading day ahead of the curve?

Get up to speed before the bell with Bull Whisper—a sharp, daily premarket newsletter packed with key news, market-moving updates, and actionable insights for traders.