The race to build the AI factory — massive data centers powering the generative AI boom — has become one of the most consequential storylines in technology. However, AI is placing a new set of infrastructural demands on the table, meaning that data centers need to be more performant than ever — while remaining efficient, compliant and sustainable.

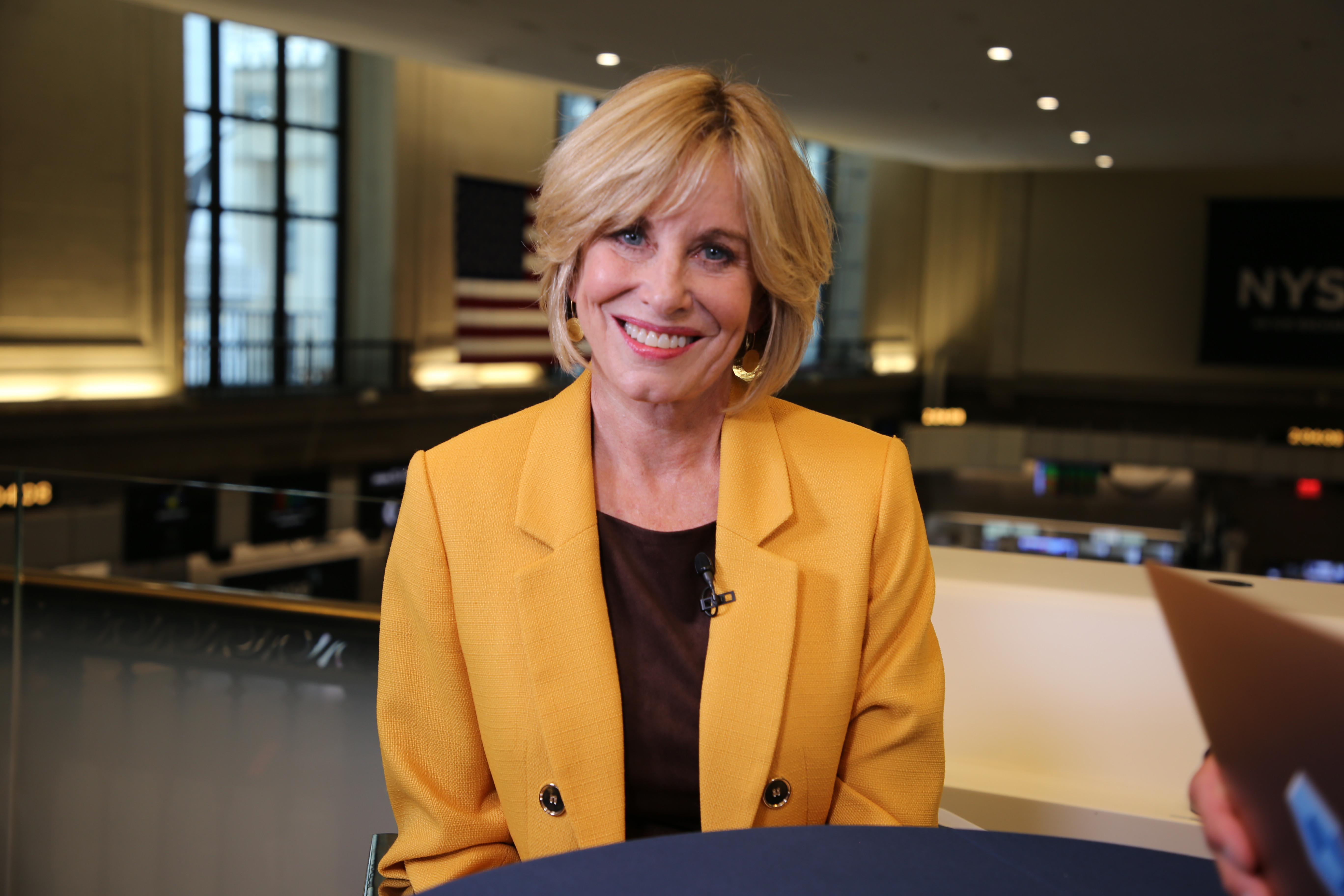

For its part, Intel Corp. has placed big bets on AI as the next frontier for tech innovation. Alongside partners like Nvidia Corp., the company has repositioned itself to redefine the data center with purpose-built chips and forward-leaning expertise, according to Diane Bryant (pictured), former head of Intel’s Data Center Division.

“When I was at Intel, we tried to start a foundry business literally five times and were never successful,” she said. “This is the sixth time to make it happen. Every time we created a foundry business, we went to Nvidia and asked them if we could build their product in our foundry. You have to have a robust, solid foundry to get someone like Nvidia’s business or anyone else. Again, the world would like an alternative to TSMC.”

Bryant spoke with theCUBE’s Dave Vellante at theCUBE + NYSE Wired: AI Factories – Data Centers of the Future event, during an exclusive broadcast on theCUBE, SiliconANGLE Media’s livestreaming studio. They discussed Intel’s turnaround, Nvidia’s strategic bets, the enterprise adoption curve for AI and how vertical integration is reshaping the industry.

Intel’s sixth attempt at claiming a stake in the AI factory space

Intel’s repeated attempts to establish a successful foundry business remain one of the company’s most significant challenges. Tthis sixth attempt carries existential weight, according to Bryant. A strong foundry alternative to TSMC is a matter of both market competition and national security, she added.

“TSMC is running 60% of all silicon in the world,” she said. “Someone needs to grab the other 40%. Intel has the opportunity to grab the other 40%. Everybody would like a second source in every area. Now Intel needs to go off and build a foundry. Again, if Intel fails, that opportunity is gone.”

In competing with TSMC, Intel has received a big boost — with considerable funding from Nvidia and the U.S. Government. Additionally, with Lip-Bu Tan at the helm, Intel has begun to leverage its rare combination of semiconductor expertise and business acumen to reimagine the AI factory, Bryant emphasized.

“The big difference is he’s a businessman, and you need a technologist to run a tech company like Intel,” she noted. “It’s very complicated, but it needs someone who actually knows how to run a business. Look what he did in his VC world. He knows semiconductors, but he also knows how to run and make deals and make things happen, and that’s what the company needed.”

The AI infrastructure boom is unlike anything the tech world has seen before. Projections estimate $500 billion in data center buildouts expected this year, potentially doubling to $1 trillion by 2030, according to Bryant. Yet, the industry must be cautious of speculative risk, drawing parallels to the telco overbuild of the 1990s.

“You’ve got to get more and more enterprises adopting AI solutions,” Bryant said. “That is generally a hurdle to get an enterprise to do anything. Enterprise IT moves very, very slowly. Also, the adoption of GenAI, or any other AI solution, is a behavioral change. It’s a workflow change. You’ve got to get people to change. The first way that an enterprise is going to get the advantage of AI is through the SaaS providers.”

Here’s the complete video interview, part of SiliconANGLE’s and theCUBE’s coverage of theCUBE + NYSE Wired: AI Factories – Data Centers of the Future event:

Photo: SiliconANGLE