By Shilpy Sinha

Copyright indiatimes

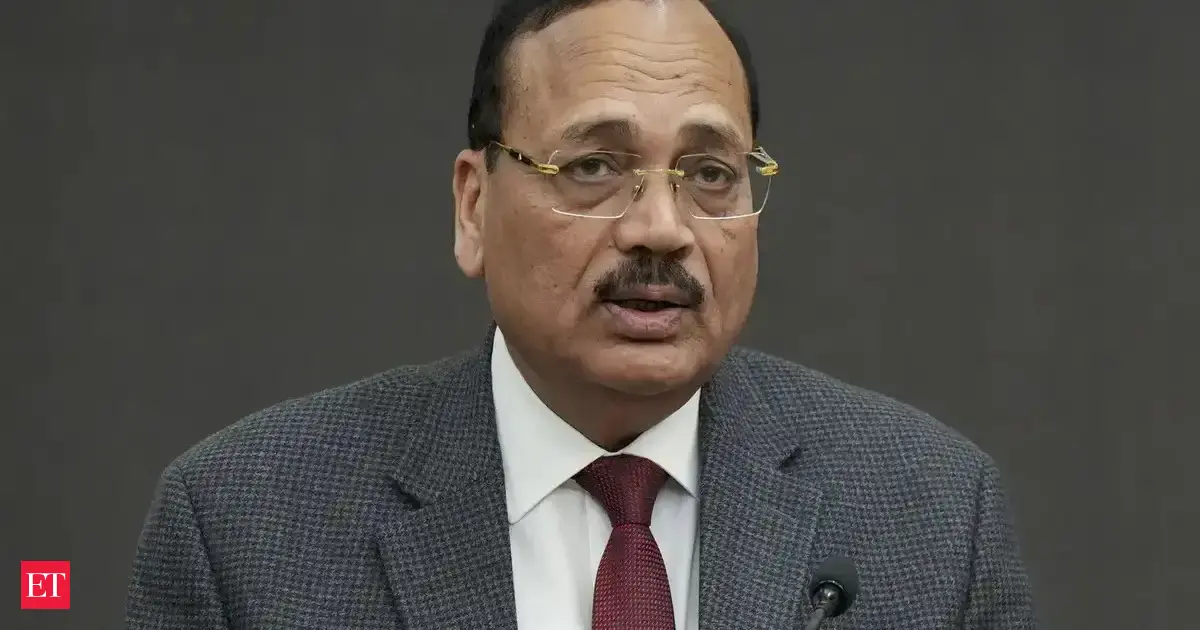

Mumbai: With electric vehicles (EVs) fast gaining traction, insurers are reworking motor insurance products to address a key risk, the battery, which accounts for the bulk of an EV’s cost. Unlike in the case of internal combustion engine (ICE) vehicles, where claims largely pertain to accidents or damages, performance-linked battery failures could soon be covered under insurance policies for EVs, according to industry executives.Motor insurance policies for EVs have already started covering battery warranties and extended warranties. But a performance-linked battery cover, where claims kick in if the battery underperforms within its guaranteed life, is in the works.”Today, in IC engines, we do not talk of a performance but in EVs, if battery performs below a certain threshold, then it can become a claim, which is generally not covered under motor insurance policies,” said Amit Ganorkar, managing director and CEO of Tata AIG General Insurance. “Normally a battery starts with 100% SOH (state of health) which degrades gradually overtime. But if battery starts underperforming after significantly shorter use beyond the average degradation of such battery, then it’s a loss. So there are some conversations that we are having around residual charging.”There are other options, he said, such as extended warranty on battery cover that people are buying while some covers come with the exclusion of the battery.Insurers are in talks with automakers to design specialised covers, including residual charging protection and performance guarantees. “These will become bigger covers in EVs, unlike ICE vehicles where the engine is rarely excluded or insured separately,” said an executive, who did not wish to be identified.Live EventsSome companies have launched EV-focused products, while others are studying global models, particularly from other Asian markets, before introducing them in India. Most general insurance companies in India cover mandatory third-party, own damage and comprehensive covers along with add-ons like battery protection.Extended warranties are being covered with insurers offering flexibility that was not seen in conventional auto products.Events such as urban flooding are also shaping product design. In case of a flood, hybrid and EV cars need full battery replacement after being submerged.Insurers are also looking at the ‘battery-as-a-service’ model that automakers are experimenting with, seeing it as a potential way to lower upfront costs for consumers.”These new-age covers will come in EVs. Battery-related products will become bigger, unlike ICE vehicles where the engine is rarely treated separately,” the executive said.Add as a Reliable and Trusted News Source Add Now!

(You can now subscribe to our Economic Times WhatsApp channel)

Read More News onelectric vehicles insuranceTata AIG General Insurancebattery warranties for EVsEV motor insurance productsresidual charging protectionextended warranty for EV batteriesEV battery performance claimsurban flooding insurance for EVs

(Catch all the Business News, Breaking News, Budget 2025 Events and Latest News Updates on The Economic Times.) Subscribe to The Economic Times Prime and read the ET ePaper online….moreless

(You can now subscribe to our Economic Times WhatsApp channel)Read More News onelectric vehicles insuranceTata AIG General Insurancebattery warranties for EVsEV motor insurance productsresidual charging protectionextended warranty for EV batteriesEV battery performance claimsurban flooding insurance for EVs(Catch all the Business News, Breaking News, Budget 2025 Events and Latest News Updates on The Economic Times.) Subscribe to The Economic Times Prime and read the ET ePaper online….moreless