By Aj Vinayak

Copyright thehindubusinessline

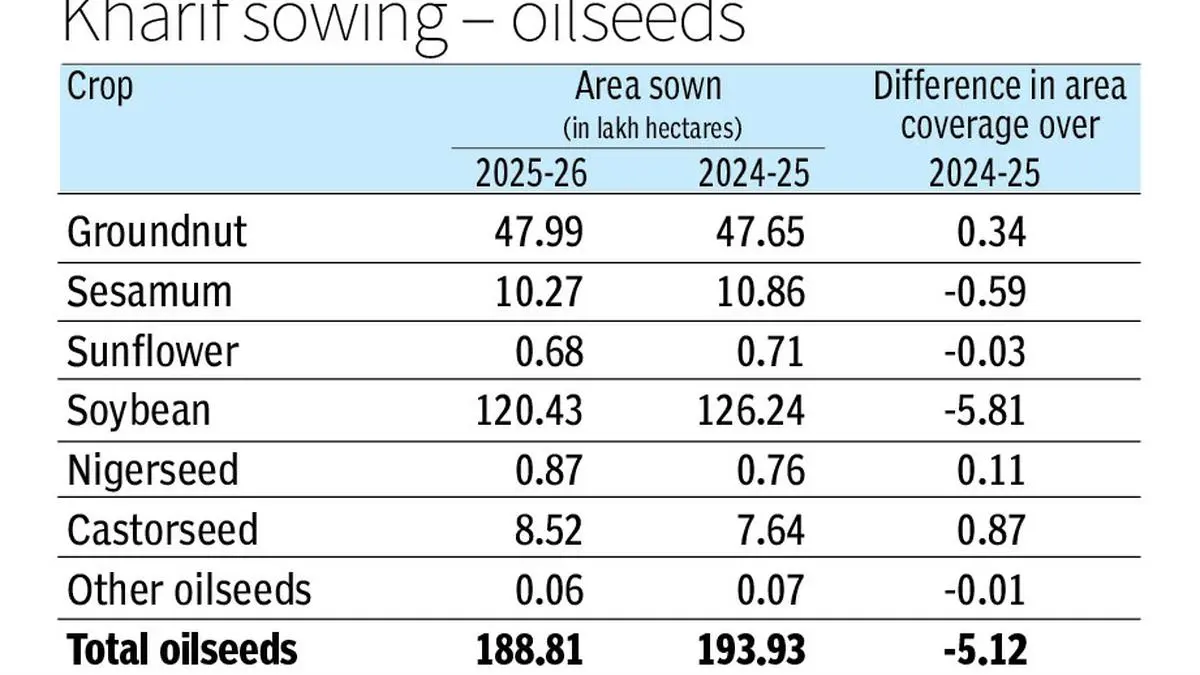

A shift in farmers’ preferences towards maize and rice crops driven by better economics has led to a decline in area under oilseed crops during the kharif 2025. This comes despite favourable rainfall in most parts of the country and the Government’s announcement of higher MSP (minimum support price) for oilseeds.

As of September 12, oilseeds were sown on an area of 188.81 lakh hectares (lh), down 5.12 lh from 193.93 lh during the year-ago period. The total oilseed sowing in Maharashtra declined to 51.25 lh (53.20 lh) during the current season, whereas sowing in Gujarat stood at 31.44 lh, an increase of 12 per cent, during the current season.

Ethanol factor

Soybean, which contributes a major share to the total oilseeds production in the country, has seen a sharp decline of 5.81 lh in area under its cultivation. As of September 12, the area under soybean declined to 120.43 lh (126.24 lh a year ago). Sowing data of the past five years shows that the area under soybean crop touched a maximum of 132.55 lh in 2023-24. Comparatively, the area under maize increased by 10.54 lh to 94.84 lh (84.30 lh), and rice by 8.45 lh to 438.51 lh (430.06 lh).

BV Mehta, Executive Director of the Solvent Extractors’ Association of India (SEA), told businessline that soybean acreage is down this season at the cost of maize and rice. Ethanol is used in the animal feed industry and biodiesel. Seeing better returns from maize, farmers are shifting to this crop, he said.

Sudhakar Rao Desai, President of Indian Vegetable Oil Producers’ Association (IVPA), said the ethanol impetus has made DDGS (distillers dried grains with solubles) cheaper for the poultry industry over soymeal. Being a cheaper alternative, DDGS is putting pressure on soymeal.

On the impact of reduction in soybean acreage on overall oilseed and edible oil production, Mehta said a 5 lh-plus reduction in area under soybean could yield around 1 lakh tonnes of oil. It is not going to affect much. However, total oilseed production will be lower than last year.

Soymeal exports may drop

Soybean is the dominant oilseed crop in Maharashtra. However, the cultivation area declined by 3.47 per cent to 49.73 lh (51.52 lh) during the current season. Crops of nearly 14.44 lh in Maharashtra reported damaged across 29 districts in the recent rains, with soybean being the worst affected in Marathwada region.

In Karnataka, soybean acreage was marginally up at 4.26 lh (4.22 lh). It is reported that the excess rains in recent weeks had impacted oilseed crops like soybean in northern Karnataka, but a clearer picture on the actual crop loss is yet to emerge.

Meanwhile, the US Department of Agriculture’s report ‘Oilseeds: World Market and Trade’ said Indian soybean production will be lower. However, global oilseeds production will be higher as Canadian rapeseed, Russian soybean, and Russia and Kazakhstan sunflower seed production will offset declines in India soybean and Ukraine and EU sunflower seed output.

It said India’s soymeal exports will likely drop to 9 lakh tonnes (lt) from 14 lt, while palm oil imports may rise to 89 lt from 87 lt.

Record high peanut output

While soybean sowing showed a sharp decline, other oilseeds showed a mixed trend. Groundnut is the next biggest contributor to the total oilseed production in the country after soybean. As of September 12, the area under groundnut cultivation increased by 0.34 lh to 47.99 lh.

Of the total area under oilseeds, groundnut has been sown in 22.01 lh in Gujarat, a growth of 15 per cent over last year. Gujarat expects groundnut production to reach 66 lt, a growth of 26 per cent, this season. However, production this year could be affected by incessant rains which flooded parts of groundnut growing areas in Banaskantha, Patan, Mehsana and Kutch districts last week.

In Maharashtra, the acreage under groundnut declined to 1.36 lh (1.48 lh) during this season.

Groundnut sowing in Karnataka saw a decline of 26 per cent at 2.39 lh (3.26 lh), while sunflower acreages were down marginally at 0.57 lh (0.58 lh). Most of the area’s decline in groundnut has been gained by maize this kharif.

Castorseed area up

Castorseed acreage in the country increased to 8.52 lh (7.64 lh), a jump of 0.87 lh, during the current season. The share of major producer Gujarat stood at 6.23 lh (5.47 lh), an increase of 14 per cent.

Acreage under sesamum declined by 0.59 lh to 10.27 lh as on September 12, and maintained three-year trend of staying within 10 lh range. Sesamum sowing had reached a maximum of 17.23 lh in 2020-21. Area under niger seeds increased by 0.11 lh to 0.87 lh, while sunflower seeds declined by 0.03 per cent to 0.68 lh.

MSP fails to encourage

Oilseed crops failed to attract the attention of farmers during this kharif season despite an increase in MSP prior to the beginning of the season. The Government had increased MSP for soybean (yellow) by ₹436 a quintal to ₹5,328 per quintal for the 2025-26 kharif marketing season.. For groundnut, MSP was increased by ₹480 per qunital to ₹7,263 per quintal.

Mehta said soybean farmers did not receive the MSP round the year in the last season. That has discouraged them to go for soybean, if they have a choice. That’s reflected in the lower area during the current year, he said.

Asked if MSP is no longer an effective tool to influence cropping choices of farmers, he said it should be used both as a way of encouraging and discouraging. Wondering the rationale behind increasing MSP for crops such as wheat and rice, which are produced in excess, he said: “If you have compulsion, increase only the minimum. Other than that, there is no need.”

Stating that oilseeds and pulses need the most support, he said MSP should be increased for them. It should be made sure that the declared MSP is defended.

7% higher rainfall

Rainfall pattern during the current season shows that the all-India cumulative rainfall was 7 per cent higher than the long period average (LPA) from June 1 to September 1. Rainfall was 30 per cent above LPA in Northwest India; and 10 per cent and 9 per cent above LPA in South Peninsula and Central India, respectively. However, it was 18 per cent below LPA in East and Northeast India.

IVPA’s Desai said overall rainfall across major oilseed crops growing regions remains comfortable. But unevenness especially in Rajasthan, Madhya Pradesh and Maharashtra was a concern.

Stating that acreage drop is not mainly due to monsoon reasons, he said: “I think it is for the reasons of shifting away to maize, paddy and sugarcane.”

NMEO PURPOSE IMPACTED?

Highlighting the Government’s focus on increasing oilseed production in the country through National Mission on Edible Oil (NMEO), SEA’s Mehta said its purpose is to reduce the import of edible oils. “If your own production is going down, then again you are dependent on heavy imports,” he said. While the Government’s mission wants to increase oilseed productivity, and area, the acreage is declining. Terming it as a cause of concern, he said: “If this continues, then we may have to depend heavily on imports.” This will defeat the purpose of NMEO to reduce imports.

RABI OUTLOOK BRIGHT?

Stating that oilseeds are mainly grown in Karnataka, Maharashtra, Gujarat, Rajasthan, Madhya Pradesh and Chattisgarh, Mehta said all water reserves and other water bodies are full in northern India. That will help the rabi crop. Northern and eastern India, which grow rabi oilseed crops, could perform better. Rabi could be better to compensate for the loss in kharif, he said.

(With inputs from Vishwanath Kulkarni in Bengaluru, Avinash Nair in Ahmedabad, Radheshyam Jadhav in Pune, and Subramani Ra Mancombu in Chennai)

Published on September 16, 2025