Copyright thecore

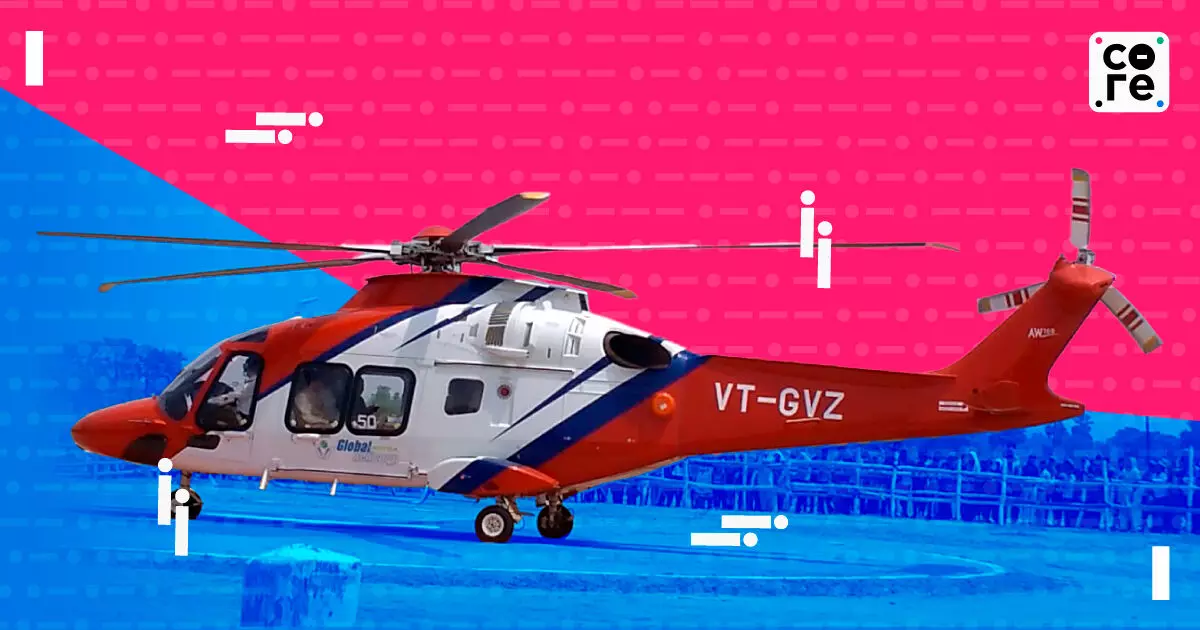

When India’s first private helicopter assembly line was launched this year in Karnataka’s Vemagal, it was more than just a milestone in manufacturing. It hinted at a new beginning for a sector that has long been mired down by regulatory turbulence. The joint initiative between Airbus and Tata Advanced Systems Ltd. (TASL) to manufacture H125 single-engine helicopters brings potential for growth amidst regulatory uncertainties. This comes as India gears up to manufacture civil helicopters for local, para-public, and international sales, with Mahindra Aerospace handling the production of fuselages.India’s civil helicopter industry has all the elements that it needs to take off — manufacturing ambition, urgent demand across tourism, energy, and medical services. The sector, however, remains weighed down by fragmented policy and skeletal infrastructure. After years of being stalled, will India’s helicopter segment truly have its moment? India’s Helicopter Leap Manufacturing helicopters in India has immediate and long-term gains such as lower acquisition costs, reduced import dependence and stronger supply chains through technology transfer. “This is a strategic extension of our aerospace capabilities,” said Sukaran Singh, CEO of Tata Advanced Systems Limited, had said. Meanwhile, Airbus India head Jürgen Westermeier had said, “India is an ideal helicopter country. A ‘Made in India’ helicopter will help develop this market and position helicopters as an essential tool for nation-building.” The first deliveries are expected by early 2027, with plans to scale production based on regional demand. Airbus has also signed an MoU with the Small Industries Development Bank of India to ease financing for civil helicopter operators — a hurdle that has existed for a long time in the capital-heavy business. From ferrying pilgrims to Kedarnath and Amarnath, to supporting offshore oil operations in Mumbai High and Krishna Godavari Basin, helicopters have quietly served a vital role in mobility. Operators like Pawan Hans, Global Vectra, and Heritage Aviation dominate this space, yet the sector’s vast potential remains untapped. Rohit Kapur, co-founder of The Jet Company and former president of the Business Aircraft Operators Association (BAOA), a key advocacy body for India's general and business aviation sector, had said during a recent conference, “Helipads and heliports are dependent on policy push, and infrastructure is the responsibility of the government. Helicopter operators can only push to a limited extent.”Even the Director General of Civil Aviation, Faiz Ahmed Kidwai, admitted at a recent BAOA conference, “A lot more could have been done. The potential has not been achieved. In a country where people use helicopters for weddings, we can do much more.”Helicopter Policy Needs Lift-OffDespite the DGCA’s launch of a Helicopter Directorate in June, India’s rotor-wing sector remains stalled by fragmented oversight, rigid regulations, and patchy infrastructure. Fragmented oversight among the Civil Aviation Ministry, DGCA, Airports Authority of India, Defence Ministry, and state governments delays every clearance—from helipad licensing to route permissions.The results are visible. Most helipads lie unused, and helicopters face restricted routing and landing options. Frequent accidents in mountainous regions driven by poor meteorological support and limited pilot training underscore systemic gaps. Public perception hasn’t helped either. Helicopters are still seen as for use by the elite or during emergencies rather than essential public infrastructure. while high capital costs and scarce leasing options deter operators.Rules also vary widely by cities and regions. Pune and Chhattisgarh permit take-offs from airports and private land, while Delhi and Mumbai impose tight restrictions due to security sensitivities. “We need rooftop helipads like Brazil and hospital-based landing zones for emergencies,” said Kapur, citing São Paulo’s 2,200 daily helicopter movements and 260 helipads, clocking a landing every 45 seconds. Landing at the busy Delhi airport is a bureaucratic marathon. Naveen Jindal, chairman of Jindal Steel and Power, suggested: “We have large polo fields where we can land. In Kurukshetra, we should be allowed night take-offs.”For all the talk of mobility, India’s promise of a “helicopter in every district” has faded, overshadowed by road-building priorities, said Kapur. With just 250 civilian helicopters serving 1.4 billion people, vertical mobility remains out of sync with the country’s topography. Remote Himalayan hamlets and flood-prone deltas remain stranded not by terrain but by policy inertia. Unlocking this potential will required a unified, single-window framework. For now, that remains a distant dream.India’s Lifesaving Link? The 2021 Heli-Disha guidelines identified 10 cities and 82 routes to streamline helicopter corridors and helipad approvals, but rollout has been bumpy. Four years later, progress...