Copyright SiliconANGLE News

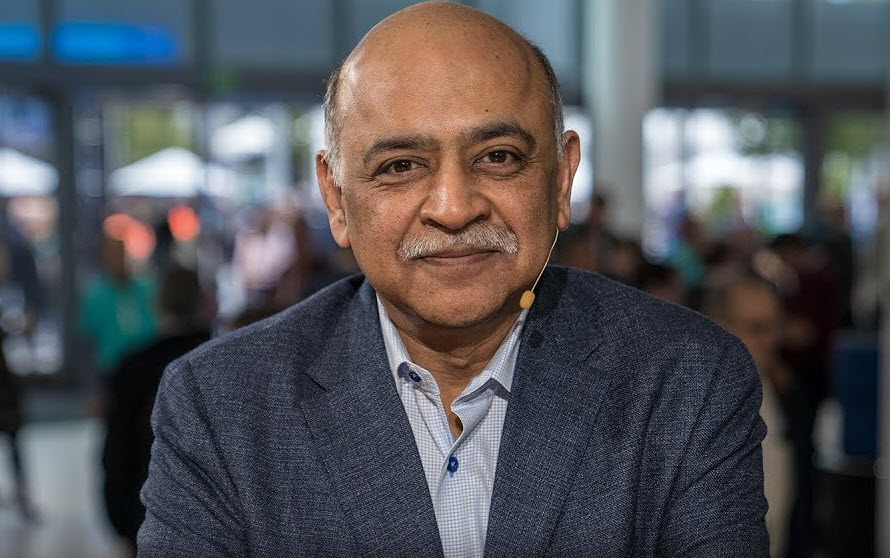

IBM Corp. delivered third-quarter financial results that surpassed Wall Street’s expectations and raised its guidance, citing tailwinds in artificial intelligence. However, investors were seemingly less than impressed with the company’s software revenue growth, and its stock moved lower after-hours. The company reported earnings before certain costs such as stock compensation of $2.65 per share, cruising past the analyst consensus estimate of $2.45 per share, while revenue for the period came to $16.33 billion, ahead of the $16.09 billion target. Net income for the quarter came to $1.74 billion, swinging from a loss of $330 million one year earlier. Last year’s results were impacted by a $2.7 billion pension settlement charge. IBM Chief Executive Arvind Krishna (pictured) said the company had a strong quarter, with accelerating performance across all major business segments helping it to exceed expectations for revenue, profit and free cash flow. “Clients continue to leverage our technology and domain expertise to drive productivity in their operations and deliver real business value with AI,” he said. On a conference call with analysts, Krishna revealed that the company’s AI book of business, which combines bookings with actual sales across various AI products and services, has now reached $9.5 million, up from $7.5 billion in the previous quarter. The company has made a big effort to attract enterprises to its AI offerings, including its emerging AI agents that can automate tasks on behalf of human workers with minimal supervision. Earlier this week, it announced it’s partnering with Groq Inc. to combine its watsonx Orchestrate platform with that company’s language processing unit and the GroqCloud inference infrastructure. By merging IBM’s governance, hybrid interoperability and workflow orchestration with Groq’s deterministic, compiler-driven speed, the companies say enterprise AI agents will be able to work with human-level responsiveness across regulated and hybrid cloud environments. A week earlier, IBM held its annual TechXchange 2025 event, where it announced a new generative AI tool called Project Bob that aims to accelerate developer productivity by automating the entire software lifecycle. It also announced a host of software and infrastructure updates aimed at helping enterprises put AI into operation across hybrid environments. While targeting enterprises, IBM has also leaned on AI itself to try and streamline its internal processes and increase productivity while reducing costs. In May, Krishna told reporters that the company had already replaced 200 human resource roles with AI systems, and was looking to do more along these lines. However, those investments have not yet sparked the kind of growth that some investors would like to see. IBM reported software revenue for the quarter of $7.2 billion, up 10% from a year ago but only in line with Wall Street’s consensus estimate. Elsewhere, hybrid cloud revenue, which includes sales from Red Hat, rose 14%, while automation revenue was up 24%, and data revenue rose 8%. Transaction processing revenue declined 1% from a year earlier. The company also revealed consulting revenue of $5.3 billion in the quarter, ahead of the Street’s $5.24 billion target, while infrastructure sales jumped 17% to $3.6 billion. The numbers apparently fell short of some investors’ expectations though, for the company’s stock fell fast, and was 6% in after-hours trading. Evercore ISI analyst Amit Daryanani told MarketWatch that the decelerating performance of Red Hat would likely be a concern for some investors. His sentiments matched those of Jeffries analyst Brent Thill, who said in a note to clients that the prospects of its software business are extremely dependent on Red Hat finding a way to reignite growth. “IBM’s software reacceleration over the next few quarters will depend on momentum in the Red Hat business,” he said. “Red Hat remains a cornerstone of IBM’s software growth strategy, with management reiterating confidence in sustaining midteens growth.” Looking ahead, IBM said it’s increasing its full-year revenue guidance slightly, and is now aiming for revenue growth of “more than 5%”. Three months earlier, it said it was hoping for growth of “at least 5%”. Executives are also targeting free cash flow for the year of $14 billion, topping the $13.5 billion estimate three months ago. Photo: SiliconANGLE